OpenAI is holding preliminary discussions with Indian data centre companies Sify Technologies, Yotta Data Services, E2E Networks and CtrlS Datacenters, as the artificial intelligence giant firms up plans to bring its $500-billion global joint venture supercomputing project, Stargate, to India, said people in the know.

The ChatGPT developer has also been holding parallel conversations with oil-to-telecom conglomerate Reliance Industries for more than six months, they said. Reliance plans to build the world's largest data centre at Jamnagar, Gujarat.

Discussions have, so far, ranged from installed capacities of data centre companies to their location, spread and power availability, among others, as these are key considerations, the people said.

The government earlier requested OpenAI to bring the Stargate project to India and store citizens’ data locally. “The government has told OpenAI they should invest at least a few billions out of the $500-billion project in India,” an official said.

“India is becoming a key market for OpenAI and also has potential to become a large revenue generator. So, the company should invest a large percentage of the $500-billion Stargate project in India,” said the official. “It should start storing and processing data of residents within the country as well.”

“Others like Microsoft and Google already have large data centres in the country, and Meta and AWS are expanding,” the official said. “It will reduce their latency and improve their service.”

OpenAI, Reliance Industries and the data centre companies did not respond to ET’s request for comment till press time on Monday.

“Some initial conversations have started,” said one data centre company executive who did not wish to be named. However, nothing has reached the finalisation stage yet, he said, adding, “The question is not whether they will go ahead with a global or local partner, but actually who will be able to provide them with an uninterrupted energy supply.”

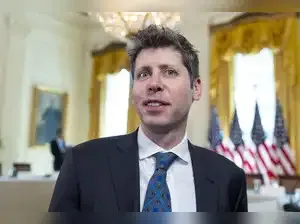

OpenAI chief executive Sam Altman last month said India was the company’s second-largest market after the US, and might become the largest as it was “incredibly fast-growing.” The company is doubling down on its India presence — it is setting up its first office in New Delhi, ramping up local hiring for sales leadership roles and has launched aggressive price offerings for subscribers in India.

“We are especially focused on bringing products to India, working with local partners to make AI work great for India, (making) it more affordable for people. We’ve been paying a lot of attention here, given the rate of growth,” Altman, who is visiting India later this month, had said.

In May, OpenAI enabled local data residency in key Asian countries including India, Japan, Singapore and South Korea. The feature allows ‘data at rest’ such as prompts, uploaded files and chat interactions to be stored within the country of origin. But models still reside in foreign servers and processing enterprise information at inference time (run-time) will need exchange outside India servers.

OpenAI announced the Stargate project in January as a joint venture company that intends to invest $500 billion over four years to build new AI infrastructure in the US. The initial equity funders in Stargate are SoftBank, OpenAI, Oracle and MGX, with SoftBank’s Masayoshi Son as its chairman. Arm, Microsoft, Nvidia, Oracle and OpenAI are the key initial technology partners.

Without guaranteed demand from tech service providers, domestic players have so far hesitated to invest in large clusters of graphics processing units to build computing capacity. OpenAI, as the world’s leading AI model developer, could provide that anchor tenancy and catalyse India’s slow-moving infra buildout.

Availability of chips and advanced cooling technologies are some of the bottlenecks that local companies will need to resolve to cater to OpenAI’s requirements, experts said.

“India’s data centre industry meets most AI workload requirements, including competitive power, skilled talent and strong local market demand,” said Jitesh Karlekar, director, research, Asia Pacific and India data centres, at JLL. “However, supply chain constraints for specialised AI hardware persists. Strategic partnerships and targeted infrastructure investments will enable operators to overcome these bottlenecks and capitalise on India's expanding AI market.”

“It also remains to be seen whether OpenAI would target India for model-training or inferencing needs,” another executive said. “In terms of costs, India would be a lucrative region for training because of cheaper energy and land costs. But when it comes to enterprise needs, Indian businesses’ core requirement over the next decade would be inference. Local regulations on data storage will also play a big part for OpenAI to strategise.”

India accounts for less than 1% of the world’s AI compute capacity, a stark gap at a time when nations are racing to secure GPUs and build sovereign AI stacks. For instance, under the government’s IndiaAI Mission, only 38,000 GPUs have been empanelled so far.

In contrast, the scale OpenAI requires is staggering. A 1GW hyperscale data centre would need nearly 135,000 of Nvidia’s most advanced B100 Blackwell chips deployed over four to five years, along with 1.3GW of round-the-clock power supply, according to estimates by market research firm Morgan Stanley.

Currently, India’s combined data centre capacity (non-AI cloud) is less than 1 GW, underscoring the challenge.

But there have been some green shoots. Google Cloud is expected to build and operate a 1GW data centre and power infrastructure by itself and invest $6 billion in Andhra Pradesh, news reports suggest. Reliance has also stated plans to build a 1GW facility in Jamnagar, along with world’s largest new energy giga complex at an investment of $10 billion (₹75,000 crore).

The ChatGPT developer has also been holding parallel conversations with oil-to-telecom conglomerate Reliance Industries for more than six months, they said. Reliance plans to build the world's largest data centre at Jamnagar, Gujarat.

Discussions have, so far, ranged from installed capacities of data centre companies to their location, spread and power availability, among others, as these are key considerations, the people said.

The government earlier requested OpenAI to bring the Stargate project to India and store citizens’ data locally. “The government has told OpenAI they should invest at least a few billions out of the $500-billion project in India,” an official said.

“India is becoming a key market for OpenAI and also has potential to become a large revenue generator. So, the company should invest a large percentage of the $500-billion Stargate project in India,” said the official. “It should start storing and processing data of residents within the country as well.”

“Others like Microsoft and Google already have large data centres in the country, and Meta and AWS are expanding,” the official said. “It will reduce their latency and improve their service.”

OpenAI, Reliance Industries and the data centre companies did not respond to ET’s request for comment till press time on Monday.

“Some initial conversations have started,” said one data centre company executive who did not wish to be named. However, nothing has reached the finalisation stage yet, he said, adding, “The question is not whether they will go ahead with a global or local partner, but actually who will be able to provide them with an uninterrupted energy supply.”

OpenAI chief executive Sam Altman last month said India was the company’s second-largest market after the US, and might become the largest as it was “incredibly fast-growing.” The company is doubling down on its India presence — it is setting up its first office in New Delhi, ramping up local hiring for sales leadership roles and has launched aggressive price offerings for subscribers in India.

“We are especially focused on bringing products to India, working with local partners to make AI work great for India, (making) it more affordable for people. We’ve been paying a lot of attention here, given the rate of growth,” Altman, who is visiting India later this month, had said.

In May, OpenAI enabled local data residency in key Asian countries including India, Japan, Singapore and South Korea. The feature allows ‘data at rest’ such as prompts, uploaded files and chat interactions to be stored within the country of origin. But models still reside in foreign servers and processing enterprise information at inference time (run-time) will need exchange outside India servers.

OpenAI announced the Stargate project in January as a joint venture company that intends to invest $500 billion over four years to build new AI infrastructure in the US. The initial equity funders in Stargate are SoftBank, OpenAI, Oracle and MGX, with SoftBank’s Masayoshi Son as its chairman. Arm, Microsoft, Nvidia, Oracle and OpenAI are the key initial technology partners.

Without guaranteed demand from tech service providers, domestic players have so far hesitated to invest in large clusters of graphics processing units to build computing capacity. OpenAI, as the world’s leading AI model developer, could provide that anchor tenancy and catalyse India’s slow-moving infra buildout.

Availability of chips and advanced cooling technologies are some of the bottlenecks that local companies will need to resolve to cater to OpenAI’s requirements, experts said.

“India’s data centre industry meets most AI workload requirements, including competitive power, skilled talent and strong local market demand,” said Jitesh Karlekar, director, research, Asia Pacific and India data centres, at JLL. “However, supply chain constraints for specialised AI hardware persists. Strategic partnerships and targeted infrastructure investments will enable operators to overcome these bottlenecks and capitalise on India's expanding AI market.”

“It also remains to be seen whether OpenAI would target India for model-training or inferencing needs,” another executive said. “In terms of costs, India would be a lucrative region for training because of cheaper energy and land costs. But when it comes to enterprise needs, Indian businesses’ core requirement over the next decade would be inference. Local regulations on data storage will also play a big part for OpenAI to strategise.”

India accounts for less than 1% of the world’s AI compute capacity, a stark gap at a time when nations are racing to secure GPUs and build sovereign AI stacks. For instance, under the government’s IndiaAI Mission, only 38,000 GPUs have been empanelled so far.

In contrast, the scale OpenAI requires is staggering. A 1GW hyperscale data centre would need nearly 135,000 of Nvidia’s most advanced B100 Blackwell chips deployed over four to five years, along with 1.3GW of round-the-clock power supply, according to estimates by market research firm Morgan Stanley.

Currently, India’s combined data centre capacity (non-AI cloud) is less than 1 GW, underscoring the challenge.

But there have been some green shoots. Google Cloud is expected to build and operate a 1GW data centre and power infrastructure by itself and invest $6 billion in Andhra Pradesh, news reports suggest. Reliance has also stated plans to build a 1GW facility in Jamnagar, along with world’s largest new energy giga complex at an investment of $10 billion (₹75,000 crore).

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!