New Delhi: Bank FDs tend to remain a preferred investment option not only for senior citizens that are seeking a steady income but also for investors with a low risk appetite. However, investment consultants do not recommend excessive reliance on FDs, as it is important to evaluate your financial goals and overall asset allocation before deciding how much to invest in them.

For example, using FDs to save for your child’s higher education 15 years from now may not be effective, as the post-tax returns often fail to outpace inflation. On the other hand, if you are saving for a short-term goal, such as a holiday in two years, an FD can be a suitable choice. Therefore, before investing, it is wise to compare the interest rates offered by different banks. Below is a list of banks providing the most competitive FD rates for deposits up to Rs 1 crore across various tenures.

| Bank | 6 months to <1 year | 1 to <2 years | 2 to <3 years | 3 to <5 years | 5 years and above |

| DCB Bank | 6-6.5 | 6.90-7 | 6.90-7.20 | 7 | 7-7.20 |

| RBL Bank | 4.75-6.05 | 7 | 7-7.20 | 7-7.20 | 6.7 |

| Axis Bank | 5.50-5.75 | 6.25-6.60 | 6.6 | 6.6 | 6.6 |

| ICICI Bank | 4.50-5.50 | 6.25-6.40 | 6.40-6.60 | 6.6 | 6.6 |

| Central Bank of India | 5.5 | 6.5-6.6 | 6.7 | 6.5 | 6.5 |

| Dhanlaxmi Bank | 5.25 | 6.25-6.90 | 6.25-6.50 | 6.5 | 6.50-6.60 |

| Federal Bank | 4.5-6.0 | 6.40-6.60 | 6.50-6.70 | 6.5 | 6.5 |

| IndusInd Bank | 5-6.5 | 6.75-7 | 6.75-7 | 6.65-6.75 | 6.50-6.65 |

| Jammu & Kashmir Bank | 5.25-6.25 | 6.6 | 6.75-7.10 | 6.75 | 6.5 |

| Union Bank of India | 4.9-6.15 | 6.40-6.50 | 6.30-6.50 | 6.40-6.60 | 6.4 |

| Kotak Mahindra Bank | 5.75-6 | 6.25-6.60 | 6.4 | 6.4 | 6.25 |

| Canara Bank | 5.50-5.75 | 6.25-6.5 | 6.25 | 6.25 | 6.25 |

-

US team likely to visit India next week for trade talks: Sources

-

CBIC, Russian customs agree to exchange pre-arrival info on goods & vehicles

-

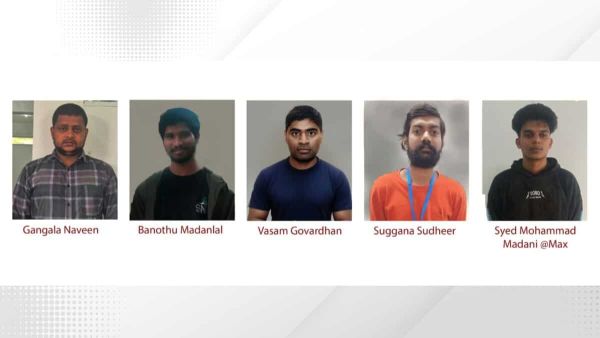

TGCSB busts fake job racket with Myanmar cybercrime link; five held

-

Fiction: The lives of five Indian doctors intersect in an American hospital as each tries to belong

-

Madhya Pradesh: Man Cuts Off Leopard's Paws After It Died in Snare Meant for Pigs, Arrested