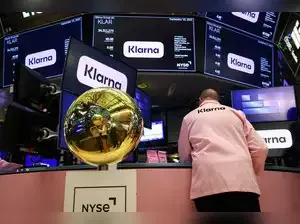

Klarna, the Swedish buy-now-pay-later giant, has officially gone public in one of 2025’s most anticipated market debuts. Trading under the ticker KLAR on the New York Stock Exchange, the company priced its IPO at $40 per share, well above the expected $35–$37 range.

Klarna shares signaled a strong Wall Street debut on Wednesday, with indications of opening up to 25% above the IPO price, giving the Swedish fintech a potential valuation of $18.9 billion.

The listing, priced at $40 a share, ends years of anticipation and positions Klarna at the center of a rebound in the U.S. IPO market.

Early trading ranges suggested KLAR stock could open between $48 and $50, underscoring heavy investor demand for the buy-now-pay-later (BNPL) pioneer.

The debut also leads a busy IPO week in New York, with seven companies — including the Winklevoss twins’ crypto exchange Gemini — set to go public, marking the biggest wave of listings on Wall Street in years.

The strong opening signals investor appetite not only for Klarna but also for the broader buy now, pay later (BNPL) sector, which has been reshaping consumer credit habits worldwide.

ALSO READ: Larry Ellison dumps Elon Musk, becomes world’s richest person overnight— largest single-day gain ever, what is his net worth?

Over time, the company expanded into longer-term financing, charging interest on extended payment plans.

Today, Klarna claims over 111 million active users globally, with strong traction in the U.S. since entering the market in 2015 through a partnership with Macy’s.

Its recent tie-up with Walmart underlines its strategy: to embed Klarna not just in e-commerce checkouts, but also directly into browsers and digital wallets, competing head-on with credit cards.

Investors are betting that companies like Klarna and Affirm could eat into traditional banks’ and credit cards’ market share as younger consumers increasingly turn to installment plans.

However, Klarna faces pressure on profitability and rising loan defaults, risks that analysts are watching closely.

The company’s second-quarter report showed $823 million in revenue and an adjusted profit of $29 million — signs of progress, but not yet the kind of robust profitability that long-term investors want to see.

BNPL is booming, yet regulatory scrutiny is increasing, competition is intensifying, and the model’s reliance on consumer credit health makes it sensitive to economic downturns.

Still, Klarna’s U.S.-focused strategy suggests management sees American shoppers as the company’s future growth engine.

If the firm can balance growth with sustainable profits, KLAR may carve out a lasting place on Wall Street.

Klarna’s valuation puts it at the heart of the fintech growth story — but whether KLAR stock can maintain momentum depends on how well it executes in the crowded U.S. market and how resilient its customers remain if borrowing costs rise.

Klarna priced its IPO at $40 per share, above the expected $35–$37 range.

What is Klarna’s market valuation after the IPO?

At $40 per share, Klarna debuted with a valuation of about $15.1 billion.

What is Klarna’s stock ticker symbol?

Klarna trades on the New York Stock Exchange (NYSE) under the ticker KLAR.

How much did Klarna stock gain on its first day?

KLAR shares were indicated to open as much as 25% above the IPO price on debut.

What type of company is Klarna?

Klarna is a buy now, pay later (BNPL) fintech company, founded in Sweden in 2005.

How many users does Klarna have worldwide?

Klarna reported having 111 million active consumers globally as of 2025.

How much revenue did Klarna generate recently?

In Q2 2025, Klarna reported $823 million in revenue and $29 million in adjusted profit.

Who are Klarna’s main competitors?

Klarna’s biggest public rival is Affirm, currently valued around $28 billion. Other competitors include Afterpay and PayPal’s BNPL services.

Is Klarna stock a good buy now?

Klarna’s IPO shows strong demand, but investors should weigh risks like profitability challenges, rising defaults, and stiff competition before buying KLAR.

Klarna shares signaled a strong Wall Street debut on Wednesday, with indications of opening up to 25% above the IPO price, giving the Swedish fintech a potential valuation of $18.9 billion.

The listing, priced at $40 a share, ends years of anticipation and positions Klarna at the center of a rebound in the U.S. IPO market.

Early trading ranges suggested KLAR stock could open between $48 and $50, underscoring heavy investor demand for the buy-now-pay-later (BNPL) pioneer.

The debut also leads a busy IPO week in New York, with seven companies — including the Winklevoss twins’ crypto exchange Gemini — set to go public, marking the biggest wave of listings on Wall Street in years.

The strong opening signals investor appetite not only for Klarna but also for the broader buy now, pay later (BNPL) sector, which has been reshaping consumer credit habits worldwide.

Klarna’s business model

Founded in 2005, Klarna first made waves by letting shoppers split payments into interest-free installments — a “pay-in-4” system that has since become its flagship product.ALSO READ: Larry Ellison dumps Elon Musk, becomes world’s richest person overnight— largest single-day gain ever, what is his net worth?

Over time, the company expanded into longer-term financing, charging interest on extended payment plans.

Today, Klarna claims over 111 million active users globally, with strong traction in the U.S. since entering the market in 2015 through a partnership with Macy’s.

Its recent tie-up with Walmart underlines its strategy: to embed Klarna not just in e-commerce checkouts, but also directly into browsers and digital wallets, competing head-on with credit cards.

How does Klarna compare with its rivals?

With its IPO, Klarna becomes the second-largest publicly traded BNPL player in the U.S., sitting behind Affirm, which is currently valued around $28 billion after a 40% surge this year.Investors are betting that companies like Klarna and Affirm could eat into traditional banks’ and credit cards’ market share as younger consumers increasingly turn to installment plans.

However, Klarna faces pressure on profitability and rising loan defaults, risks that analysts are watching closely.

The company’s second-quarter report showed $823 million in revenue and an adjusted profit of $29 million — signs of progress, but not yet the kind of robust profitability that long-term investors want to see.

Market outlook for KLAR stock

Klarna’s shares were indicated to open up to 25% above IPO price on debut day, showing strong investor enthusiasm. But the road ahead won’t be simple.BNPL is booming, yet regulatory scrutiny is increasing, competition is intensifying, and the model’s reliance on consumer credit health makes it sensitive to economic downturns.

Still, Klarna’s U.S.-focused strategy suggests management sees American shoppers as the company’s future growth engine.

If the firm can balance growth with sustainable profits, KLAR may carve out a lasting place on Wall Street.

Klarna’s IPO

For investors eyeing the stock, Klarna’s IPO offers a rare chance to buy into a global fintech brand at scale. It also marks one of the largest listings of 2025, alongside Figma and Circle, with more big names like StubHub and Gemini still to come.Klarna’s valuation puts it at the heart of the fintech growth story — but whether KLAR stock can maintain momentum depends on how well it executes in the crowded U.S. market and how resilient its customers remain if borrowing costs rise.

Klarna IPO key facts

- IPO Date: September 10, 2025

- Ticker Symbol: KLAR (NYSE)

- IPO Price: $40 per share

- Valuation: ~$15.1 billion

- First-day trading: Indicated up to +25% vs. IPO price

FAQs:

How much was Klarna’s IPO priced at?Klarna priced its IPO at $40 per share, above the expected $35–$37 range.

What is Klarna’s market valuation after the IPO?

At $40 per share, Klarna debuted with a valuation of about $15.1 billion.

What is Klarna’s stock ticker symbol?

Klarna trades on the New York Stock Exchange (NYSE) under the ticker KLAR.

How much did Klarna stock gain on its first day?

KLAR shares were indicated to open as much as 25% above the IPO price on debut.

What type of company is Klarna?

Klarna is a buy now, pay later (BNPL) fintech company, founded in Sweden in 2005.

How many users does Klarna have worldwide?

Klarna reported having 111 million active consumers globally as of 2025.

How much revenue did Klarna generate recently?

In Q2 2025, Klarna reported $823 million in revenue and $29 million in adjusted profit.

Who are Klarna’s main competitors?

Klarna’s biggest public rival is Affirm, currently valued around $28 billion. Other competitors include Afterpay and PayPal’s BNPL services.

Is Klarna stock a good buy now?

Klarna’s IPO shows strong demand, but investors should weigh risks like profitability challenges, rising defaults, and stiff competition before buying KLAR.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!