More than £116 billion in fixed-rate savings accounts will come to an end by the end of the year, with over 3.5 million accounts facing a significant drop in earnings unless they take action. To avoid losing out experts are advising savers to check their accounts and look for better interest rates before their deals finish.

When a fixed-rate deal ends, many banks automatically move your money into a lower-interest account which could mean much lower returns for some savers. The average interest rate people are getting on these maturing accounts is around 4.5%. If they do nothing, their money will likely be moved to a variable-rate account, which currently pays only about 2.4% (for non-ISA accounts) or 2.7% (for ISAs).

The analysis was carried out by Skipton Building Society, which also commissioned research of 2,000 adults which revealed 39 per cent rarely or never move their money around.

Of these, 21 per cent find the process too complicated, while 18 per cent prefer to keep their money in one place. But 12 per cent worry about losing access to their funds if they were to transfer them - with 31 per cent suffering from 'money moving paralysis'.

Alex Sitaras, head of savings and partnerships at the building society, said: "Too many savers are missing out on money simply by standing still - letting their savings sit in accounts with low interest rates, especially when their fixed-rate deals come to an end.

"When a fixed-rate account matures, many providers automatically switch customers to a default variable rate, which is often significantly lower. The difference between 4.5% and 2.5% might not sound dramatic, but for the average saver, it could mean losing hundreds of pounds a year.

"These findings show just how vital it is to protect savers from rate shocks at the end of their term. We believe in fairness - so where possible, we aim to transfer the majority of our customers onto another fixed-rate option at the end of the fixed rate period.

"However, when the fixed term comes to an end, we are mindful that this may be a lower rate than they started with, so we encourage all our members to come and have a conversation with us to see what option is right for them.

"It is crucial to stay alert when your fixed-rate savings mature - better rates options are worth shopping around for and can make a real difference to your savings."

It emerged that nearly one in 10 never check the interest rates on their savings accounts. Additionally, 18 per cent said they lack awareness of better rates available.

In fact, 16 per cent have not opened a new savings account in the last five years, with 22 per cent believing it's too much effort to switch. And 19 per cent are concerned they might make the wrong choice if they did.

For 62 per cent they have opened an account only to see the interest rate drop after a certain period leaving them disappointed and annoyed.

According to the research, when their account reaches 'maturity' 59 per cent moved their money to a new account. But 10 per cent left the money where it was.

Of those who do move their money, 62 per cent choose the provider offering the highest rate, while 35 per cent prioritise access to their funds.

Alex Sitaras from Skipton Building Society added: "Far too often, savings accounts that began with competitive interest rates end up quietly drifting onto low variable rates and many savers don't even realise it.

"That means they could be missing out on the opportunity to earn more from their money.While it's encouraging to see some people actively managing their savings, not everyone feels confident navigating their options.

"That's why guidance matters - and we why offer a free money advice service to help people plan ahead and make smarter decisions about their finances.

"But for those with savings of £20,000 or more, moving money into a pension or investment could be a better long-term option, provided they are happy to take some risk with their money.

"So being able to also provide face-to-face regulated financial advice on the high street, can present longer-term solutions like pensions or investments, which can offer the chance for stronger returns and greater financial security."

-

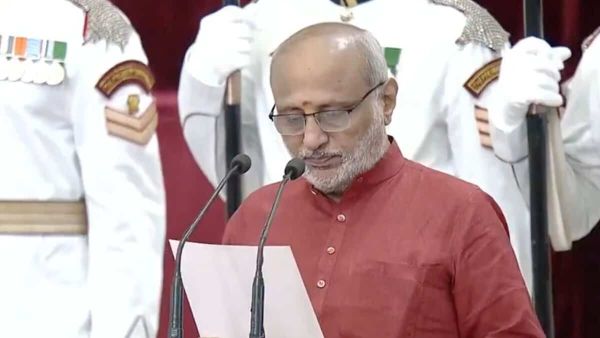

C P Radhakrishnan takes oath as 15th Vice President of India

-

India pulls up Switzerland, Pakistan at UN meet in Geneva

-

Oracle's blockbuster surge shows AI trade's growing influence on market

-

India vs Pakistan, Playing XI: Star Bowler At Risk Of Being Benched

-

Shahid Afridi Revives ‘Rotten Egg’ Remark, Appears Directed At Shikhar Dhawan