Mumbai: From September 15, the National Payments Corporation of India (NPCI) has increased the daily limit for Person-to-Merchant (P2M) transactions to Rs 10 lakh.

This decision was taken to help sectors where lower limits earlier created difficulties.

Insurance and Investments

- Limit for capital market investments and insurance premium payments raised from Rs 2 lakh to Rs 5 lakh.

- However, total daily transactions cannot exceed Rs 10 lakh.

UPI New Rule: UPI Payments May Soon Change, New Biometric System Likely To Replace PINGovernment Payments and GEM Portal

- On the Government e-Marketplace (GEM) portal, the limit has increased from Rs 1 lakh to Rs 5 lakh per transaction.

- This includes tax payments and earnest money deposits.

Travel Sector

- Travel-related transactions now have a higher limit of Rs 5 lakh (earlier Rs 1 lakh).

- The overall daily cap remains Rs 10 lakh.

Credit Card Bills and Loan EMIs

- Credit card bill payments through UPI allowed up to Rs 5 lakh per transaction, but capped at Rs 6 lakh per day.

- Loan EMI collections raised to Rs 5 lakh per transaction and ₹10 lakh per day.

New UPI Rules From August 1, Big Changes Coming To Payments & PricesJewellery and Banking Services

- Jewellery purchase limit via UPI raised to Rs 2 lakh per transaction (earlier Rs 1 lakh), with a Rs 6 lakh daily cap.

- For banking services like fixed deposits through digital onboarding, the limit is Rs 5 lakh per transaction per day.

No Change in Person-to-Person (P2P) Payments

The daily limit for P2P payments remains the same at Rs 1 lakh per day.

-

Will RBI’s Rate Cut Push 10-Year Bond Yields Below 6.4%? Expert Analysis Ahead of December Policy

-

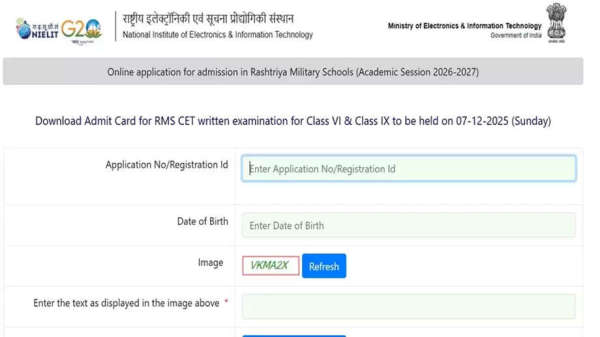

RMS Admit Card 2025: Admit card for Rashtriya Military School Common Entrance Test released, download from the direct link given here..

-

IBPS PO Mains Result 2025: Probationary Officer Main Exam result released, download with these steps..

-

UPPSC PCS Result 2025 Link: UP PCS Prelims result released on uppsc.up.nic, check results in 1 click..

-

UPMSP Center List 2026: Center list released for UP Board High School, Intermediate exams, exams will be held at 7448 centers..