Urban Company Pops The Champagne

Urban Company Pops The Champagne

Urban Company has scripted the most spectacular startup IPO of 2025 so far. Shares of the hyperlocal services unicorn opened at INR 161 on the BSE, commanding a 56.3% premium over its issue price of INR 103. The NSE debut was equally strong, opening at INR 162.25, with a premium of 57.5%.

A Stellar Debut: The momentum continued throughout the day as its shares touched an intraday high of INR 179. However, it lost some of the gains to close the day at INR 167.05, still 62.2% above its issue price, and a market cap of INR 23,986 Cr.

The performance validated massive investor appetite for its IPO, which comprised a fresh issue of INR 472 Cr and an OFS component of INR 1,428 Cr.

Early Backers Strike Gold: Accel raked in at least INR 390 Cr from the public issue, a 27X return, while Elevation Capital sold shares worth INR 346 Cr, translating to about 19X gains. Bessemer India clocked 14X returns while Vy Capital and Tiger Global earned 5X and 1.4X gains, respectively.

Sustainability Test Ahead: Several factors came together to fuel Urban Company’s listing euphoria — its profitable performance and rising revenues in FY25, diversified revenue streams, and leadership in the organised home and beauty services segment. However, what lies ahead is a litmus test from the profitability point of view.

That’s because Urban Company was still in the red until FY24 – posting losses of INR 92.7 Cr in FY24 and INR 312.5 Cr in FY23. Profitability only came at the end of March 2025. On average, the company has been loss-making over the last three years. So there’s a lot that UC has to prove in terms of profitable growth.

While the company has bucked the trend of lacklustre startup IPOs this year, the fundamental question hovers around its long-term value creation. But for now, here’s how Urban Company popped the champagne with a blockbuster IPO.

From The Editor’s DeskDevX’s Muted IPO: In contrast to Urban Company, shares of the coworking space provider listed at INR 61.30 on the BSE, marginally above its issue price of INR 61. On the NSE, DevX shares listed flat at INR 61. The stock eventually closed the day at INR 64.36.

INR 40 Cr Fraud At MobiKwik: The fintech major said that some merchants and users colluded to claim unauthorised settlements from the company. The company has lodged an FIR and has also recovered INR 14 Cr from the lost amount.

Singularity Closes INR 2,000 Cr Fund: The PE firm has marked the close of its second fund, which saw participation from domestic DFIs, banks and family offices. Focussed on cleantech, D2C, fintech and healthcare, more than half of the fund has already been committed.

FinBox Nets $40 Mn: The fintech SaaS startup has raised the funds in its Series B round led by WestBridge Capital. While $35 Mn was raised via equity, $5 Mn came from a secondary share sale. FinBox offers B2B credit infrastructure and risk intelligence solutions for banks.

Paytm Relaunches BNPL: The fintech major has relaunched its buy-now-pay-later offering in partnership with Suryodaya Small Finance Bank. The offering is being rolled out selectively, with broader expansion planned soon. It offers up to 30 days of short-term credit.

Amazon India’s FY25 Show: The ecommerce major’s marketplace arm slashed its losses by 89% to INR 374.3 Cr in FY25 from 3,469.5 Cr in the year-ago period. Meanwhile, the company’s top line zoomed 30% YoY to INR 30,138.6 Cr in FY25.

Meta Vs CCI: The big tech major has told the NCLT that the watchdog failed to establish any evidence of its abuse of dominance. At the heart of the matter is the INR 213.14 Cr penalty imposed by the CCI on Meta over alleged unfair practices linked to WhatsApp.

EcoSoul Nets $20 Mn: The D2C sustainable home essentials brand has raised around INR 175 Cr, in a mix of equity and debt, from Accel, StartupXseed Ventures, SIDBI and others. EcoSoul claims to sell eco-friendly goods like tableware, drinkware, kitchenware, and others.

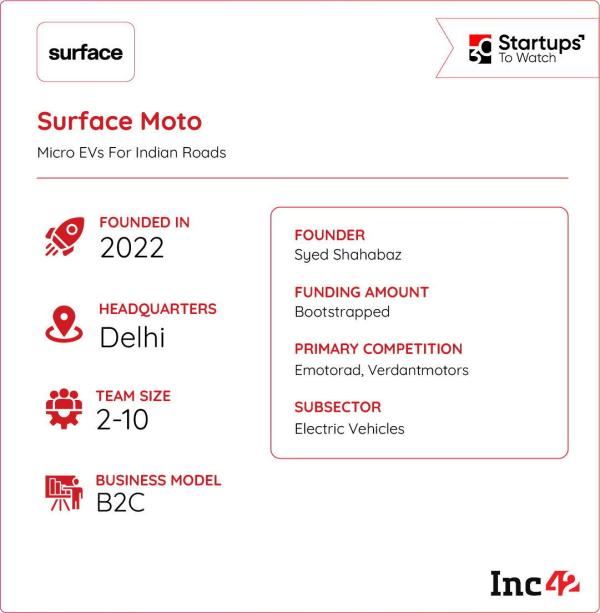

Inc42 Startup Spotlight Will Surface Moto’s Micro EVs Rule Indian Streets?Existing electric vehicle (EV) models, especially two-wheelers, are either too expensive or require extensive licensing and registration. Realising this created barriers for personal use, Surface Moto came up with a solution – micro EVs.

Building Customised EBikes: Founded in 2022, the startup’s flagship product, Surface C1, is a custom-designed electric bike. The ebike comes with a top speed of 25 kmph, a range of 35 km and can carry a load of up to 160 kg. Priced at INR 65,000, the electric bike is easy on people’s pockets and is built for practicality.

Market Positioning: Surface Moto’s strategy addresses two critical barriers to EV adoption – cost and complexity. By eliminating licensing and registration hassles and maintaining affordability, the startup positions itself for India’s expanding urban commuter segment seeking green, hassle-free daily transportation.

Buoyed by the government’s push for electric vehicles and growing adoption, can Surface Moto’s affordability moat help it rule Indian streets?

The post Urban Company’s Stellar Debut, Fraud At MobiKwik & More appeared first on Inc42 Media.

-

Desi Style Tawa Burger Now make it at home, the children will be big in the house. Note recipe

-

Drinking on empty stomach daily will get surprising benefits – Obnews

-

Oppo launches new phone, equipped with 7000mAh battery; Price can also afford pockets, extreme features

-

Opportunity to earn more profits than pension funds… NPS has a big change from October 1

-

A beneficial business opportunity for youth and women – Obnews