Mumbai|New Delhi: Container freight rates are expected to stay subdued for the remainder of this financial year amid widespread uncertainty in global trade due to US President Donald Trump's volatile tariff policies.

Industry experts say exporters accelerated shipments to the US to save costs before the August 27 deadline for levy of steep 50% tariff on Indian goods. They expect the unpredictable trade scenario to further weigh on India's export shipments especially to North America.

"We saw higher exports to the US with companies targeting the Christmas holiday season early," said a shipping industry representative.

India's exports to the US climbed 18% from a year earlier to $40.39 billion during April-August 2025. It far surpassed a modest 2.5% rise in the country's overall exports to $184.13 billion during the period. Notably, China's exports to India also rose more than 10% to $51.57 billion in the same period, outpacing the broader import growth of 2.14%.

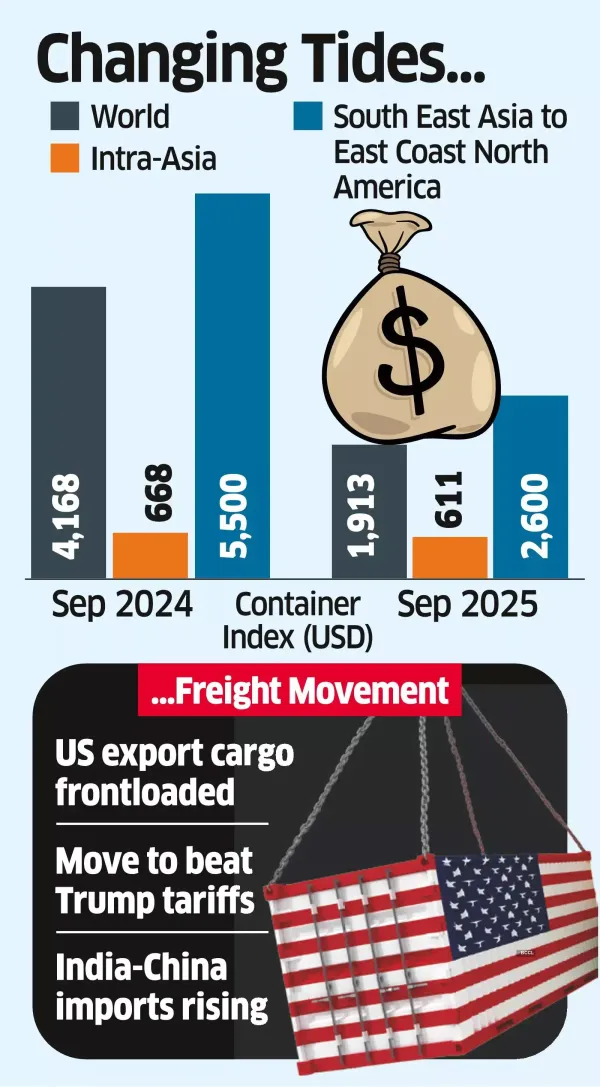

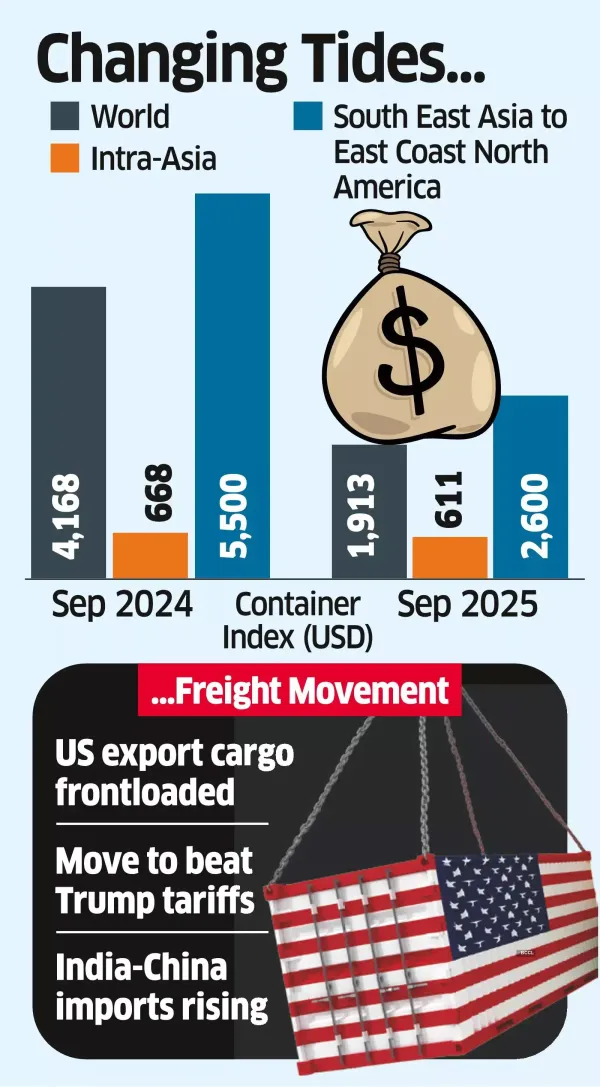

Ajay Sahai, director general and CEO of the Federation of Indian Export Organisations (FIEO) said sea freight rates are likely to see a 10-15% correction. "This is being driven by an oversupply of capacity at a time when global demand is weakening," he said, noting that the US and European economies are clearly showing signs of a slowdown. "Inflationary pressures are persistent, and the risk of recession in advanced markets could deal a major blow to world trade," said Sahai. The Drewry's Container Forecaster also expects the supply-demand balance to weaken in the second half of 2025, leading to a contraction in spot container rates. Its World Container Index dropped 6% sequentially this week to $1,913 per 40ft container. The index was at more than $4,000 per 40ft container a year ago.

According to industry estimates for the South East Asia to East Coast North America route, container freight rate fell to $2,600 per 40ft container this week from $2,900 10 days ago. It has nearly halved from a year ago when freight on this route stood at $5,500 per 40ft container. Container lines are already feeling the pinch with logistics companies flagging mixed trends across sectors.

Bhavik Mota, director, head of markets (Intra Gulf & Far East, West & Central Asia) at AP Moller - Maersk said automotive shipments have declined sharply while shrimp export volumes are vulnerable too. "With prices climbing for end-consumers (due to Trump's tariffs), this could eventually translate into a larger drop," he said. Mota said FMCG exports are currently steady though it could change in the long-term. "Exports of pharmaceuticals are holding firm, and we expect them to stay resilient," he said, highlighting that shipments to North America are slowing down due to the prevailing uncertainty.

Smaller exporters from India are facing the brunt of the impact with some even cancelling export orders amid the high US tariffs, said senior officials at a shipping company. "The end consumer will be impacted and it's going to hurt demand. The large ones are sustaining, but smaller shippers are having problems," one of the officials said. "Around 20% of our volumes go to the US, the rest elsewhere, but the US side is definitely getting impacted."

However, not all export markets appear bleak. According to representatives from freight forwarders, improved relations with China are reflecting in Indian imports ahead of the Diwali festive season. Drewry's Intra-Asia Container Index (IACI), a weighted average of Asian spot container freight rates, rose 5% sequentially in the September 15 fortnight, reaching $611 per 40ft container, an indication of firmer regional trade. Industry officials caution that unless Trump moves to ease the tariffs on India and other countries, the long-term fallout will worsen pressures on global supply chains. "End consumers will shoulder those additional costs," an industry representative said.

Industry experts say exporters accelerated shipments to the US to save costs before the August 27 deadline for levy of steep 50% tariff on Indian goods. They expect the unpredictable trade scenario to further weigh on India's export shipments especially to North America.

"We saw higher exports to the US with companies targeting the Christmas holiday season early," said a shipping industry representative.

India's exports to the US climbed 18% from a year earlier to $40.39 billion during April-August 2025. It far surpassed a modest 2.5% rise in the country's overall exports to $184.13 billion during the period. Notably, China's exports to India also rose more than 10% to $51.57 billion in the same period, outpacing the broader import growth of 2.14%.

Ajay Sahai, director general and CEO of the Federation of Indian Export Organisations (FIEO) said sea freight rates are likely to see a 10-15% correction. "This is being driven by an oversupply of capacity at a time when global demand is weakening," he said, noting that the US and European economies are clearly showing signs of a slowdown. "Inflationary pressures are persistent, and the risk of recession in advanced markets could deal a major blow to world trade," said Sahai. The Drewry's Container Forecaster also expects the supply-demand balance to weaken in the second half of 2025, leading to a contraction in spot container rates. Its World Container Index dropped 6% sequentially this week to $1,913 per 40ft container. The index was at more than $4,000 per 40ft container a year ago.

According to industry estimates for the South East Asia to East Coast North America route, container freight rate fell to $2,600 per 40ft container this week from $2,900 10 days ago. It has nearly halved from a year ago when freight on this route stood at $5,500 per 40ft container. Container lines are already feeling the pinch with logistics companies flagging mixed trends across sectors.

Bhavik Mota, director, head of markets (Intra Gulf & Far East, West & Central Asia) at AP Moller - Maersk said automotive shipments have declined sharply while shrimp export volumes are vulnerable too. "With prices climbing for end-consumers (due to Trump's tariffs), this could eventually translate into a larger drop," he said. Mota said FMCG exports are currently steady though it could change in the long-term. "Exports of pharmaceuticals are holding firm, and we expect them to stay resilient," he said, highlighting that shipments to North America are slowing down due to the prevailing uncertainty.

Smaller exporters from India are facing the brunt of the impact with some even cancelling export orders amid the high US tariffs, said senior officials at a shipping company. "The end consumer will be impacted and it's going to hurt demand. The large ones are sustaining, but smaller shippers are having problems," one of the officials said. "Around 20% of our volumes go to the US, the rest elsewhere, but the US side is definitely getting impacted."

However, not all export markets appear bleak. According to representatives from freight forwarders, improved relations with China are reflecting in Indian imports ahead of the Diwali festive season. Drewry's Intra-Asia Container Index (IACI), a weighted average of Asian spot container freight rates, rose 5% sequentially in the September 15 fortnight, reaching $611 per 40ft container, an indication of firmer regional trade. Industry officials caution that unless Trump moves to ease the tariffs on India and other countries, the long-term fallout will worsen pressures on global supply chains. "End consumers will shoulder those additional costs," an industry representative said.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!