Withdrawing cash from an ATM using a debit card is easy, but most people rarely do so with a credit card. But do you know how much money can be withdrawn from a credit card in a day? Most banks allow withdrawals up to 20-40% of the credit limit, which can range from ₹20,000 to ₹1 lakh. However, this facility is expensive due to interest and fees. So, let's understand how credit card cash withdrawals work, what the limits are, what the charges are, and why they should be avoided.

What is a credit card cash withdrawal?

Withdrawing cash from a credit card can be considered a small loan. Essentially, you withdraw money from an ATM or bank, but it's part of your credit limit. Unlike a debit card, it's not directly deducted from your account, but is added to your bill. However, unlike a debit card, interest and fees apply from the first day. However, most banks allow this up to 20-40% of the credit limit.

How much money can you withdraw per day?

Credit card cash withdrawal limits depend on the bank and card.

Daily limit: 20-40% of your credit limit. So, if your limit is ₹1 lakh, you can withdraw ₹20,000-₹40,000.

Bank-wise examples:

HDFC: 20-40% limit, daily maximum around ₹50,000-₹1 lakh (depending on the card).

ICICI: 20-40% limit, daily around ₹20,000-₹50,000.

SBI: 20-40% limit, daily around ₹15,000-₹50,000.

Bank of India RuPay: Around ₹15,000 per day.

Other banks: Like Canara Bank or Axis, around ₹20,000-₹1 lakh.

Transaction Limit: Around ₹10,000-₹20,000 at a time.

This limit can be checked through the bank app or customer care, but remember, this feature is for emergencies, not for daily use.

What are the charges for cash transactions?

Cash Advance Fee:

2.5-3.5% of the withdrawal amount, or a minimum of around ₹300-₹500.

Interest:

2.5-3.9% per month (30-45% per annum) from the first day of withdrawal, with no grace period.

Rest:

ATM fee ₹20-₹50 if the ATM is from another bank. Example: Withdrawing ₹20,000 would cost ₹500 + interest ₹500-₹800 (per month) = total around ₹21,000-₹21,300.

These charges are added to the bill, and late payments incur additional interest.

Advantages of credit card withdrawals

Instant cash: Cash can be withdrawn from an ATM or bank in case of an emergency.

No documentation: Instant use if you have a credit card.

Rewards: Some cards earn reward points (but fewer for cash).

Disadvantages of credit card withdrawals

Expensive: Interest and fees can eat into your money.

Credit score impact: Excessive cash withdrawals can hurt your score.

No grace period: Not as free as debit cards.

No rewards: Reduced or no points for cash.

Cautions to keep in mind:

Emergencies only: Avoid daily use.

Repay immediately: Return the full amount as soon as the bill arrives.

Limit check: Check your cash advance limit through your bank app.

Options: Use a debit card or UPI.

Hacking: Keep your PIN safe.

You can withdraw up to 20-40% of your daily limit (₹20,000-₹1 lakh) with a credit card, but it's expensive. Fees range from 2.5-3.5% and interest is 30-45% per annum. Use it only in emergencies, or it could lead to a debt trap. It's better than a debit card or savings. (Note: This news is based on general information only.)

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Is SAIC pulling out of India? Here’s what we know

-

‘Jis bowler ko Sehwag ne mara…’: Abhishek Sharma trolls Shaheen Afridi and Haris Rauf after India vs Pakistan Asia Cup 2025 match

-

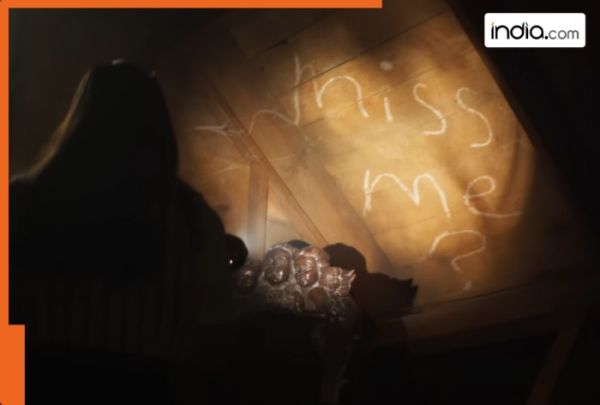

This horror thriller film will send chills down you spine, in just 16 days turned out blockbuster, earned Rs 3140 crore, movie is…, lead stars are…

-

Tragic Leopard Attack Claims Life of Young Girl in Madhya Pradesh

-

Minor Earthquake Hits Upper Siang, Arunachal Pradesh