When it comes to taking out a personal loan, people often say that if you have a good CIBIL score, you'll get one. But the truth is, banks don't just look at your CIBIL score; they also check three different ratios. These are used to determine whether you'll be able to repay your loan installments on time. Let's explore three ratios that banks consider, in addition to your CIBIL score.

1- Debt-to-Income (DTI) Ratio

Before granting a loan, banks must consider the debt-to-income ratio. This is calculated by comparing your monthly salary and monthly loan repayments. If this ratio is low, the chances of getting a loan are higher. This helps banks understand how much debt you already have and how much money you have left. VIDEO - Upcoming IPOs: 7 major IPOs to launch in the last week of September, see details

2- EMI/NMI Ratio

Banks use this ratio to assess how much of your net monthly income will be spent on existing EMIs and new loan EMIs. If the ratio is between 50-55%, it's fine, but if it's higher, banks hesitate to grant loans. Even if they do, they charge higher interest rates.

3- Loan-to-Value (LTV) Ratio

This ratio is especially important for housing loans. It helps banks understand how the loan amount compares to the value of the property or mortgage. Based on this, banks determine the terms and conditions of the loan. VIDEO - Starting September 22nd, these 'special' items will attract 40% GST!

CIBIL Score is also important

The CIBIL score is a 3-digit number, ranging from 300 to 900. It reflects your ability to secure a loan. Previous loans, credit card bills, and your habit of making timely payments determine this score. Timely payments improve your score, while defaulting lowers it. VIDEO - From Shampoo to Coffee... GST to be reduced from September 22nd, 15 items to become cheaper!

Advantages and Disadvantages of a CIBIL Score

A good CIBIL score makes it easier to obtain loans at lower interest rates. Pre-approved loan offers are often available, and instant loans are credited to your account within minutes. However, a poor CIBIL score can make it difficult to obtain a loan, resulting in higher interest rates and delays in disbursing the loan. Let's explore five disadvantages of a poor CIBIL score.

1- Difficulty in obtaining a loan

With a poor score, banks and NBFCs hesitate to grant you loans because they fear default.

2- Higher Interest Rates

Even if you get a loan, banks will charge you a higher interest rate to reduce their risk. VIDEO- 8 Tata cars at this discount!

3- Higher Insurance Premiums

Sometimes, due to a poor score, insurance companies demand higher premiums or even refuse to provide insurance.

4- Problems with Home and Car Loans

Like personal loans, home and car loans also face increased complications and can result in higher interest rates.

5- Delays in Loan Approval

Even if banks are willing to provide a loan, it will take longer to verify documents and paperwork. Sometimes, banks may also demand additional collateral.

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Is SAIC pulling out of India? Here’s what we know

-

‘Jis bowler ko Sehwag ne mara…’: Abhishek Sharma trolls Shaheen Afridi and Haris Rauf after India vs Pakistan Asia Cup 2025 match

-

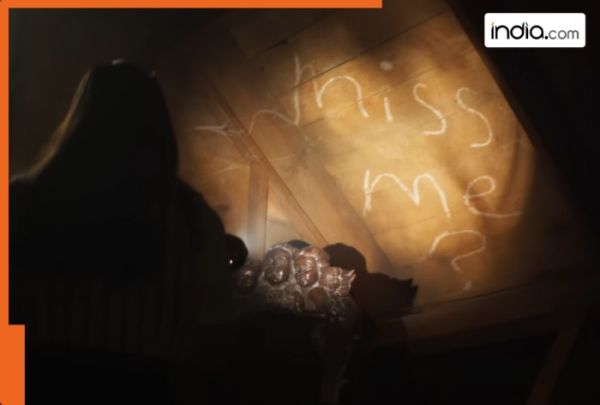

This horror thriller film will send chills down you spine, in just 16 days turned out blockbuster, earned Rs 3140 crore, movie is…, lead stars are…

-

Tragic Leopard Attack Claims Life of Young Girl in Madhya Pradesh

-

Minor Earthquake Hits Upper Siang, Arunachal Pradesh