Another analyst slaps a ‘Hold’ rating on the sportswear company’s stock.

Lululemon shares ticked 0.6% lower in the premarket on Tuesday, after investment research firm Baird issued a downgrade.

Investors continue to speculate when the stock will recover amid a sharp decline in recent months. In all, LULU stock is down 55% year-to-date and currently trades around its lowest level since March 2020.

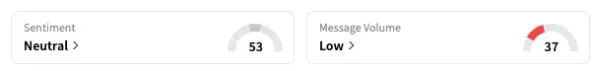

Baird became the latest brokerage to downgrade the stock to 'Neutral' from 'Overweight,' joining the consensus view among Wall Street analysts. The firm also lowered its price target by $30 to $195, which still implies an 18% upside from the last close.

In an investor note, Baird analysts expressed low near-term confidence in the company's growth and margin trajectory. A high degree of earnings uncertainty has overshadowed the company's "compelling valuation multiples," making it difficult to recommend.

Recent results indicate that Lululemon's trendy sportswear is losing appeal among consumers, particularly in the U.S., amid broadly weak spending trends and rising competition from challenger brands such as Alo Yoga and Vuori.

Meanwhile, U.S. tariffs under President Donald Trump have become a substantial headwind for the company, as it manufactures the bulk of its products in Asia.

Currently, 24 of the 34 analysts covering the stock have a 'Hold' rating, seven rate it 'Buy' or higher, and three rate it 'Sell' or below, according to Koyfin data. The average price target is $199.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Credit Push: NPCI Exploring EMI On UPI Payments

-

Assam Achieves Significant Reduction in Total Fertility Rate

-

Trump's Return Sparks Crisis: International Student Numbers in US Hit Four-Year Low, Universities Face Billions in Losses

-

Speciality Chemicals Startup Distil Raises $7.7 Mn To Scale R&D

-

Mumbai: Suspected Scooter Thief In Virar Made To Smoke, Eat Food Before Cops Take Custody; Video Viral