Credit cards today are not just about convenience—they also come with a wide range of rewards. Every time you swipe your card, your bank offers reward points that can later be redeemed in various ways. But not everyone uses them wisely. The key to maximizing these benefits lies in understanding how reward programs work and where you get the best value.

Here’s a complete guide on how to make the smartest use of your credit card reward points.

How Do Reward Points Work?

Every bank has its own system for rewarding transactions. For example, some cards may give you one reward point for every ₹100 spent, while others offer higher points on dining, travel, or online shopping. The value of these points also differs from bank to bank.

In many cases, banks set a conversion rate such as 4 points = ₹1. Understanding this redemption value is the first step in making the most of your rewards.

1. Redeem Points as Cashback

The simplest way to use reward points is through cashback. Here, your accumulated points are adjusted directly against your outstanding credit card bill. For instance, if 4 points equal ₹1, redeeming 4,000 points would reduce your bill by ₹1,000.

This option is straightforward and ensures you save money instantly.

2. Shop with Vouchers and Discounts

Many banks let you convert points into gift vouchers or directly purchase products from partner platforms like Amazon, Flipkart, or popular retail brands. During the festive season, banks often increase the value of points, giving you more shopping power for the same redemption.

Tip: Wait for festive sales to maximize the benefit of your points.

3. Use Points for Travel Bookings

Reward points can also be used to book flights, hotels, or complete holiday packages. Some banks even allow you to transfer points to airline loyalty programs, making them especially useful for frequent travelers.

If you travel often, this is one of the most valuable ways to redeem your points.

4. Pay Bills and EMIs with Reward Points

Several banks provide the option to use points for utility bills, mobile recharges, or even EMI payments. While this is convenient, the redemption value here is usually lower compared to shopping or travel.

Tip: Use this option only if you want hassle-free bill management rather than maximizing value.

Important Things to Remember

-

Expiry Period: Reward points generally remain valid for 2–3 years. If you don’t redeem them within this period, they expire and you lose the benefit.

-

Redemption Charges: Banks may charge a small fee (₹50–₹100) for processing redemptions. Always check these charges before using your points.

-

Best Value Options: Cashback and travel bookings typically offer the highest value, while bill payments and small vouchers may offer less.

How to Use Points Smartly

To get the most out of your reward points:

-

Track your accumulated points regularly through your bank’s app or statements.

-

Redeem them before the expiry date.

-

Save them for high-value transactions like travel bookings or festive shopping.

-

Compare redemption categories and choose the one offering the best conversion rate.

Final Thoughts

Reward points are essentially free money, but only if you use them smartly. Instead of letting them expire or redeeming them for low-value options, focus on cashback and travel benefits where the returns are higher.

With a little planning, your everyday spending can translate into significant savings and perks. So, the next time you swipe your card, remember—you’re not just spending, you’re also earning.

-

Saif Hassan's straight-bat success

-

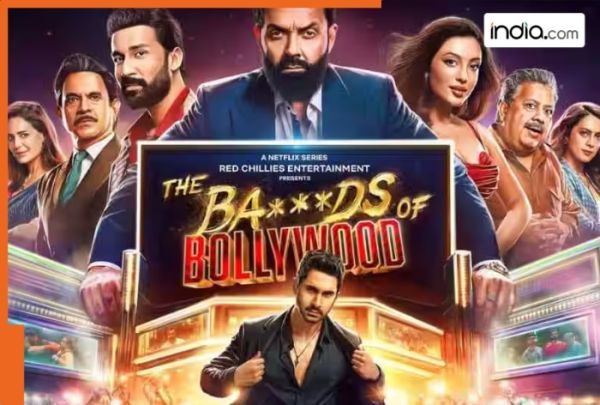

The Ba***ds Of Bollywood Full Cast Fees: Aryan Khan leads with highest fee; Lakshya Lalwani, Raghav Juyal, Mona Singh and others were paid just Rs…

-

Remember Anjali from Shah Rukh Khan’s Kuch Kuch Hota Hai? Where is she now? After 27 years, she looks like this, works in…, her name is…

-

Big update for GPay, PhonePe, Paytm users! new UPI transaction rules effective from…, check what will change for you

-

Bangladesh defeat Sri Lanka in Super Fours thriller at Asia Cup