Balaji Telefilms Shares Jump 50 Percent: The shares of Balaji Telefilms Ltd. have witnessed a major surge this week providing good returns to investors. The stock has increased from Rs 92.08 to Rs 139.59 recently. In the last six months the shares of Balaji Telefilms have increased 136 percent from Rs 57.78 to Rs 139.59 on BSE. On Wednesday the stock touched its 52-week high of Rs 139.59 on BSE but all the gains faded at around 2.25 pm an hour before the closing time. The shares were trading at Rs 136.27 increasing the market cap of the company to Rs 1629 crore. At the time of writing this article the shares were still trading nearly 177 percent above their 52-week low of Rs 49.18. Why The Sudden Surge? It is worth noting that Balaji Telefilms is one of the leading television content producers in the country. The company which is promoted by Ekta Kapoor has major backing of Reliance Industries. Notably Ekta has 21.8 million shares which is 18.27 percent stake. On the other hand the Mukesh Ambani company has 25.2 million shares of Balaji Telefilms representing a 21.07 percent stake. Talking about other investors Sanjeev Dhireshbhai Shah has 50.43 lakh shares (4.22 percent stake). The company is famous for producing Hindi daily soaps but now it has expanded to films live events and digital content. HIGHLIGHTS Balaji Telefilms’ stock surged 50 percent this week jumping from Rs 92.08 to Rs 139.59. In the last six months shares soared 136 percent from Rs 57.78 to Rs 139.59 increasing market cap to Rs 1629 crore. Ekta Kapoor holds 21.8 million shares (18.27 percent) while Reliance Industries owns 25.2 million shares (21.07 percent). Apart from TV shows Balaji produces films live events digital content and OTT platform. Does Balaji Telefilms Has An OTT platform? Balaji Telefilms operates its own subscription-based OTT platform targeting the youngsters and binge watchers. The company made its entry in the stock market in 2000 with a cash IPO at a premium of Rs 120/share. With the recent surge people are considering investing in the stock again. INSIGHTS The stocks 14-day RSI is at 82.2 which indicates overbought conditions. MFI of 83.1 suggests positive market sentiment. The stock has a one-year beta of 1.4 which means significant volatility. The shares are trading above key averages surpassing its 50-day SMA of Rs 101.4. It also exceeds its 200-day simple moving average (SMA) of Rs 81.0.

-

Pilot's high-flying drug smuggling operation lands £2.4m haul

-

"Will add vigour to India's Research and Development ecosystem": PM Modi lauds Union Cabinet's approval to DSIR scheme

-

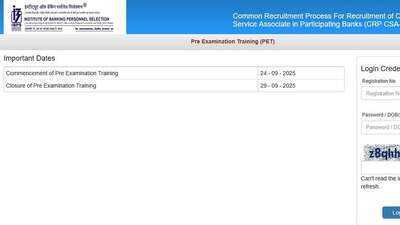

IBPS Clerk PET 2025 Admit Card Out For Over 10,000 Vacancies; Download Link Active At ibps.in

-

3 pretty pink pussybow blouses that channel Princess Kate's latest look

-

UK drivers who pay by phone at car parks urged to use cash instead