Most of Sahara Group’s major properties are set to be bought by the Adani Group. According to media reports Sahara submitted a term sheet to the Supreme Court on September 6 2025 under which Adani will take over more than 88 properties including the Aamby Valley township in Maharashtra the Sahara Star hotel near Mumbai airport and various commercial and residential assets across multiple states.. The deal still requires the Supreme Court’s approval. Because the transaction is highly sensitive financial details have been kept secret and will only be shared with the court in a sealed envelope. Documents reviewed by India Today show that the Adani Group will have to deposit the agreed payment into the SEBI-Sahara refund account or another account specified by the court. As per the court filing more than 88 properties will be handed over to Adani Properties in a single large deal not in separate parts. The most important among them are Aamby Valley Township and Sahara Star Hotel. The money from the sale would go into the SEBI–Sahara refund account. The matter will come up again before the Supreme Court on October 14 where the court may order that the sale proceeds be deposited directly into the SEBI–Sahara refund account. Which Sahara properties are being sold? The deal includes Aamby Valley City in Maharashtra spread over 8810 acres. Along with it the Sahara Star Hotel near Mumbai Airport is also part of the sale. In addition Sahara’s properties in several states: Maharashtra Uttar Pradesh Haryana Rajasthan Gujarat West Bengal Jharkhand Madhya Pradesh Karnataka and Uttarakhand are also being considered for transfer. Currently there is no court-appointed receiver managing these assets. The application in the Supreme Court was filed by Sahara India Commercial Corporation Limited (SICCL) on behalf of Sahara’s entities with the Sahara management itself leading the negotiations for the sale. In its petition Sahara Group asked the Supreme Court to use its special powers under Article 142 of the Constitution to ensure “complete justice” and provide broad protection during the sale process. The company has requested the court to: Protect the properties being sold from any regulatory or criminal investigations. Ensure that all claims and liabilities related to these properties are handled only by the Supreme Court and not by any other court tribunal or government authority. Immediately lift existing seizure orders restrictions or attachments placed on these properties by different authorities. Proposal to form a high-level committee To manage the funds Sahara has proposed the formation of a high-level committee under the chairmanship of a former Supreme Court judge. This committee would oversee the entire sale process resolve objections or competing bids and also identify assess and settle Sahara’s remaining liabilities. According to documents reviewed by India Today earlier attempts to sell these assets had failed due to poor market conditions lack of reliable buyers and multiple ongoing lawsuits which weakened investor confidence. Sahara has also pointed out that despite repeated attempts and hiring advisors SEBI was unable to sell or liquidate any of Sahara’s assets leading to further delays. Decision to sell all properties to a single buyer Sahara said that the situation was made even more complicated after multiple investigative agencies launched separate probes against the group and its officials. This directly affected the company’s ability to sell its assets on its own. Given these ongoing challenges the management concluded that selling each property separately would take many years. To avoid further delays and to secure maximum value within the shortest possible time Sahara decided to sell almost all of its remaining properties in one block deal to a single buyer i.e. the Adani Group. So far however the Adani Group has not commented on the matter. What is the Sahara Case about? The long-running Sahara dispute centers on the money it raised from millions of small investors which has still not been fully refunded. In 2012 India’s capital markets regulator SEBI ruled that two Sahara companies had illegally raised funds by selling optionally fully convertible debentures (OFCDs) without proper approval. SEBI ordered Sahara to return the money with interest. The matter went to the Supreme Court which upheld SEBI’s order. In 2014 Sahara’s founder Subrata Roy was jailed for failing to comply with the repayment order. He was later released on parole but delays in asset sales and repayments have kept the case unresolved. Over the years several Sahara assets were seized under court and regulatory actions and a special SEBI–Sahara refund account was created to repay investors. The group continues to face investigations and court cases even today. At its peak Sahara owned a vast empire that included an airline sports teams hotels in London and New York financial services mutual funds life insurance businesses the Aamby Valley township and nearly 36000 acres of land. Most of these assets however have since been seized or sold off.

-

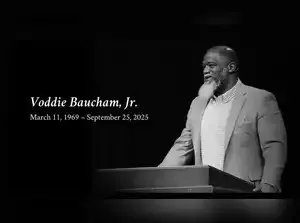

Voddie Baucham death cause: Emergency medical incident sparks heart failure battle speculation

-

Horoscope Today, 26th September 2025: Aries, Taurus, Gemini, and Scorpio Navigate Focus, Emotional Depth, and Strategic Growth Today

-

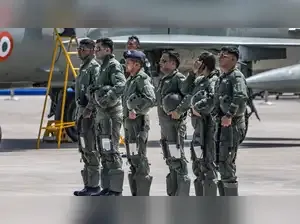

Of men and their flying machines: Pilots hail legacy as MiG-21 prepares for swansong

-

Defence Minister Rajnath Singh to attend MiG-21 decommissioning ceremony in Chandigarh today

-

Centre yet to release Rs 1500 cr relief package: Himachal Minister Jagat Negi slams BJP for 'misleading' claims