Desk: Big news has come for crores of users using UPI. The National Payments Corporation of India (NPCI) has changed the rules of UPI. From 1 October 2025, UPI’s P2P ‘Collect Request’ feature will be discontinued. This means that now you will not be able to send ‘Collect request’ to someone like PhonePe, GPAY or Paytm to ask for money. This step has been taken to prevent online fraud and strengthen the safety of users.

NPCI has instructed all banks and payment apps to turn off the P2P Collect Request System from 1 October 2025. This simply means that after this date, no user will be able to send or receive a collect request on UPI. Now only direct transfer will be possible, which will make the payment process more secure.

-

Also read HC expressed concern over the addiction to social media and reel among policemen, given these instructions

The Collect request feature was being misused by the fraudsters. Many times the users used to approve the collection request by mistake or in deception, due to which the money was deducted from their account. NPCI has taken this step and ensured that now the process of sending money should be done only by the user’s initiative, which will reduce the possibility of fraud.

Users who had a habit of sending collect request, now they have to use the option to transfer Push Transaction directly. Payments will continue as before through QR code, UPI ID and bank account number. Also, NPCI has advised that users should keep their UPI and banking apps updated and never approve the request from an unknown person.

This change will only affect the Collect request feature. Sending and receiving normal money will continue as before. Banks and payment apps have been instructed to make changes in their system so that users can easily transact according to the new rules. This step has been taken completely keeping in mind the user security.

-

School holidays: Multiple states announce day-off for students. Is yours on the list?

-

Bengaluru weather update: Why Bangalore feels like Shimla and will the city see more chilly days ahead? Check IMD prediction

-

Hybrid funds emerge as a low volatility alternative to equity

-

Mizoram Agriculture board thanks NITI Aayog for declaring state as 'Ginger Capital of India'

-

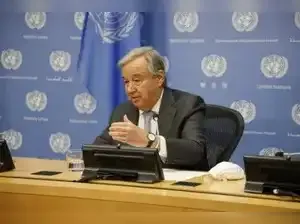

UN chief proposes slashing 2026 budget by $577 million, cutting 18% of jobs