Lakhlu. Chief Minister Yogi Adityanath has said that the basis of deployment in the State Tax Department will only be ‘performance’. He gave clear instructions that the same officers should be deployed in the field who are committed to achieving the target and whose image is completely clear. The Chief Minister was reviewing the updated status of the revenue receipts of the state tax department on Sunday. During this, he interacted directly with zonal officials through video conferencing. The Chief Minister said that after the ‘Next Generation Reform’ of GST, the market is seeing a boom and its positive results will definitely be seen in the coming months. He directed that unnecessary investigation or raid should be avoided on the occasions of Dhanteras and Deepawali. The complaint of harassment of traders and entrepreneurs should not come from anywhere.

Read:- Weather Update: The weather again changed its mood, hail can fall with strong rain

During the meeting, it was informed in the Zone -wise review that zones like Bareilly (64.2%), Saharanpur (63.7%), Meerut (63.0%), Gorakhpur (62.5%) and Jhansi (62.1%) have been relatively better. In some zones, the target supply was between 55 and 58 percent, where improvement is required. The Chief Minister reviewed Varanasi I and Second, Gorakhpur, Prayagraj, Ayodhya, Lucknow I and Second, Kanpur I and Second, Etawah, Jhansi, Agra, Aligarh, Moradabad, Meerut, Ghaziabad I and Second, Gautambuddha Nagar and Saharanpur, division wise and block -wise reviews of all zones. He asked all the zonal officials to clarify the reason for the status of sections with revenue collection less than 50 percent and prepare an action plan for improvement immediately. The Chief Minister also mentioned that no section in Bareilly, Jhansi and Kanpur first zones is less than 50 percent, which is satisfactory. At the same time, instructions were given to decide the accountability of unsatisfactory performances.

The Chief Minister said that revenue growth is the main basis of the state’s economic progress. He called upon all the officers to work with a resolve to achieve 100 percent of the prescribed goals. He said that senior officials should do market mapping themselves, go to the market in general, meet traders and understand their expectations. Giving examples, the Chief Minister said that due to reduction in mandi fee, farmers have increased both relief and revenue. This is proof that transparent and simple tax system is always beneficial. Stressing on maintaining dialogue with traders, he said that concrete efforts should be made to increase GST registration and file returns on time.

The Chief Minister was informed that in the financial year 2025-26, the State Tax Department has received a total of ₹ 55,000 crore till September. In this, ₹ 40,000 crore GST and ₹ 15,000 crore have been received from VAT/Non-GST. In the same period of the last financial year, ₹ 55,136.29 crore was received. The state tax department has been set a target of ₹ 1.75 lakh crore for the current financial year, which is about ₹ 18,700 crore more than the previous year’s ₹ 1,56,982 crore. The Chief Minister said that Uttar Pradesh should make a leading contribution in the national GST collection and planned efforts should be made for this.

Special discussions were held on bogus firms and fake input tax credit (ITC) cases in the meeting. So far, fake ITC of ₹ 873.48 crore has been identified by the department in 104 firms, which are being investigated and strict punitive action. The Chief Minister said that transparency, responsibility and honesty in revenue collection are paramount. Where the deficiency is seen, corrective steps should be taken immediately after reviewing the reasons. He laid special emphasis on recovery of arrears, prevention of fake ITC and speedy disposal of pending GST/VAT cases.

Read:-VIDEO- Former SP MLA Manoj Singh Walking on the WHC officials, said-If you do not listen, then this thing happened…

The Chief Minister said that the convenience and trust of taxpayers is the basis of permanent revenue growth. He asked the officials to further strengthen the e-governance system by creating a taxpayer-friendly environment. The Chief Minister said that “Revenue growth is the basis for speeding up the state’s economy. The role of the State Tax Department is very important towards the target of developed Uttar Pradesh and developed India. He instructed the departmental officers to pay equal attention to both the speed and transparency of revenue creation and increase the taxpayer.

-

Dead skin on the face will disappear in 5 minutes! Mix in the lentils pulses ” foods will come to the face, glow like parlor

-

Malti Chahar surrounds Tanya Mittal, home drama and tension – Obnews

-

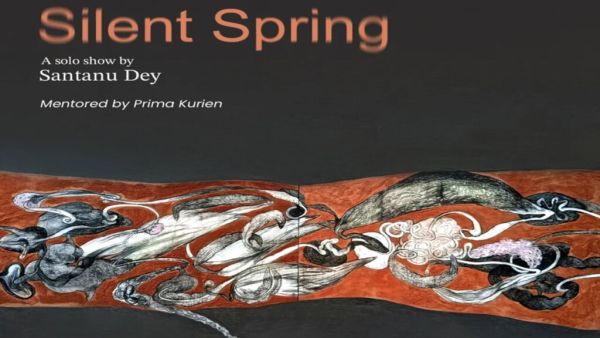

‘Silent Spring’ depicts nature’s retaliation in Santanu Dey’s stark new works

-

The secret of the beauty of every skin hidden in neem, apply these three types of face packs daily

-

Vivo V60: DSLR Lost 200MP camera and a strong battery equipped with a strong battery… will be amazed to hear the features of the new smartphone!