Share Market Today : The first trading day of the week, the Indian stock market on Monday 6 October (Share Market Today) Started with a slight edge. The Sensex is trading up a 615 points to a level of 81,840, while the NIFTY ran out 180 points to 25,072. However, despite the initial growth, many sector of the market remain under pressure, so that the atmosphere for investors cannot be said to be completely stable.

In the initial stages, 13 of the 30 shares of the Sensex were trading in green mark and 17 in red mark. Axis Bank and Bajaj Finance showed a strength of more than 1%, while Tata Motors and Tata Steel fell by more than 1%. Out of 50 shares of Nifty, 23 climbed and fell 27. Looking at the sector -wise trend, banking and healthcare were strengthened, while auto, FMCG, Pharma and metal sector remained under pressure.

Impact of global market

Mixed business was seen in Asian markets today. Japan’s Nikkei index reached 47,835 with a big gain of 4.51%. On the other hand, Hong Kong’s Hangseng fell 0.73% to 26,943. Korea’s Cospie remained closed due to holiday, while Shanghai Composite will be closed till 8 October due to the mid -automatic festival in China.

Talking about American markets, on October 3, Dow Jones climbed 0.51% to close at 46,758, Nasdaq Composite 0.28% broken and S&P 500 flat closed.

Investors’ move

On October 03, Foreign Investors (FIIs) sold shares worth Rs 1,583.37 crore in the cash segment. In contrast, domestic investors (DIIs) supported the market by purchasing nets of Rs 489.76 crore. In September, FIIS sold shares worth ₹ 35,301.36 crore, while DIIS made a purchase of ₹ 65,343.59 crore. The same trend continued in August, when Fiis sold ₹ 46,902.92 crore and DIIS purchased ₹ 94,828.55 crore.

Last week’s trend

On Friday, October 3, the market closed firmly. The Sensex climbed 223 points to 81,207 and the Nifty closed at 24,894 with 57 points. In the day -long business, the Sensex showed 600 points from the lower level and the Nifty had shown a recovery of 150 points.

On that day, the NSE metal sector rose by about 2% and PSU bank sector 1%. Private banks, consumer durables, media, financial services, FMCG, IT, Pharma and Oil and Gas sector were also strengthened. However, the decline in auto and realty sectors increased the concern of investors.

In today’s business, the banking and healthcare sector has drawn the market up, but the pressure of big sectors like metal, auto and FMCG is affecting the pockets of investors. Constant selling of foreign investors is still making the market unstable, while domestic investors remain strong support. In the coming days, global signs and FII activities will decide the direction of the market.

-

Dead skin on the face will disappear in 5 minutes! Mix in the lentils pulses ” foods will come to the face, glow like parlor

-

Malti Chahar surrounds Tanya Mittal, home drama and tension – Obnews

-

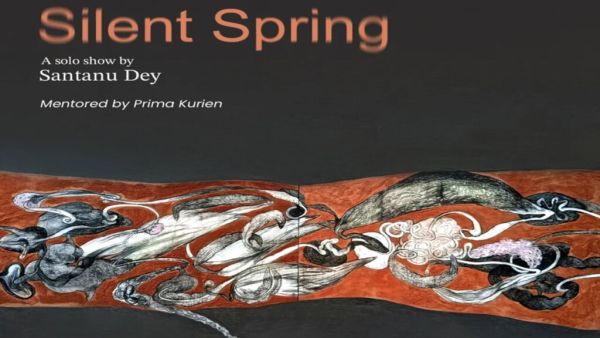

‘Silent Spring’ depicts nature’s retaliation in Santanu Dey’s stark new works

-

The secret of the beauty of every skin hidden in neem, apply these three types of face packs daily

-

Vivo V60: DSLR Lost 200MP camera and a strong battery equipped with a strong battery… will be amazed to hear the features of the new smartphone!