Shares have shown a mixed response since the sportswear giant's better-than-expected earnings last week.

Short interest in Nike's stock has fallen to a seven-month low, according to Koyfin data as of Monday — a notable indicator suggesting that investors anticipate potential medium-term gains.

Short interest was 2.4% as of the last reading, the same as in March this year. The figure peaked at 3.4% in May. Short interest refers to the total number of shares that investors have borrowed and sold short, betting that the stock's price will decline.

Although Nike reported better-than-expected quarterly results last week, winning praises from analysts, the stock move has been mixed. It initially rose by more than 7% in the two sessions following the earnings, and then fell by 5% in the subsequent two sessions.

Meanwhile, Nike CEO Elliott Hill said in an interview on Monday that the sportswear giant's turnaround plan, which he has been overseeing since taking over as chief executive exactly a year ago, will "take a while" to bear fruit, and the company's recovery will not be linear.

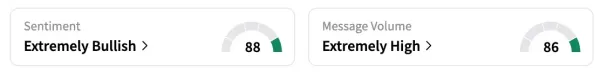

Although Stocktwits sentiment for NKE has remained mostly in the 'extremely bullish' zone since the earnings release, some users are unimpressed with Hill.

"$NKE Good interview with Elliott Hill by CNBC's Sarah Eisen. He's making progress, but many investors will be disappointed that he's basically a marketing guy who talks a lot about segmentation, product, competition, distribution and organizational structure," said one user.

"He doesn't seemed to be focused on shareholders (not even a mention) and that's a problem. Maybe he needs a much stronger CFO who knows how to better address investor concerns. He was naive to leave the interview with the message that ‘the turnaround will take a while’, particularly after being CEO for a year,” they said.

Given the stock's weakness (down 4.4% year-to-date), management's growth initiatives, and Nike's global brand recognition, Wall Street has a largely positive outlook.

Twenty-three of the 39 analysts covering Nike have a 'Buy' or higher rating of the company’s shares, while 14 recommend 'Hold,' according to Koyfin. Their average price target of $82.46 implies a 16% upside for the stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Helicopter rides from Hyderabad to Srisailam soon: What to expect

-

Monitoring situation in landslide-affected north Bengal: Mamata

-

Delhi court gives bail to man accused in 2020 murder case

-

Actor-politician Vijay reaches out to families of Karur stampede victims

-

Coldrif cough syrup deaths: MP govt to bear treatment costs