STAAR Surgical’s Long-Term Shareholder Says Proposed Deal With Alcon Undervalues The Company

admin | October 8, 2025 1:22 AM CST

Defender Capital, which owns 1.5% of STAAR’s common stock, highlighted STAAR’s board of directors' rejection of Alcon's previous offer of $58 per share in cash.

Defender Capital, a long-term shareholder of STAAR Surgical Company, on Tuesday expressed opposition to the firm’s proposed acquisition by Alcon Inc.

Add Asianet Newsable as a Preferred Source

Defender Capital owns 1.5% of STAAR’s common stock. “The proposed sale of STAAR to Alcon for $28 per share significantly undervalues the company, especially when considering the STAAR board of directors' rejection of Alcon's previous offer for $58 per share in cash only sixteen months ago,” the shareholder said.

Shares of STAAR Surgical Company traded nearly 2% lower on Tuesday.

Get updates to this developing story <directly on Stocktwits.<

READ NEXT

-

Jack Wilshere 'close' to first managerial role after ex-Premier League club sack boss

-

EU makes major threat to UK in Brexit revenge plot - it's a disaster for Starmer

-

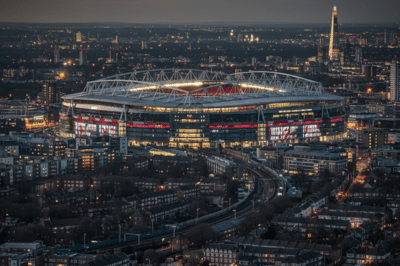

Emirates Stadium upgrade imagined by AI as stunning new pictures of Arsenal ground emerge

-

Prince Harry and Meghan Markle to step out for rare joint appearance in less than 48 hours

-

Encounter Breaks Out Between Terrorists & Security Forces In Jammu & Kashmir's Rajouri