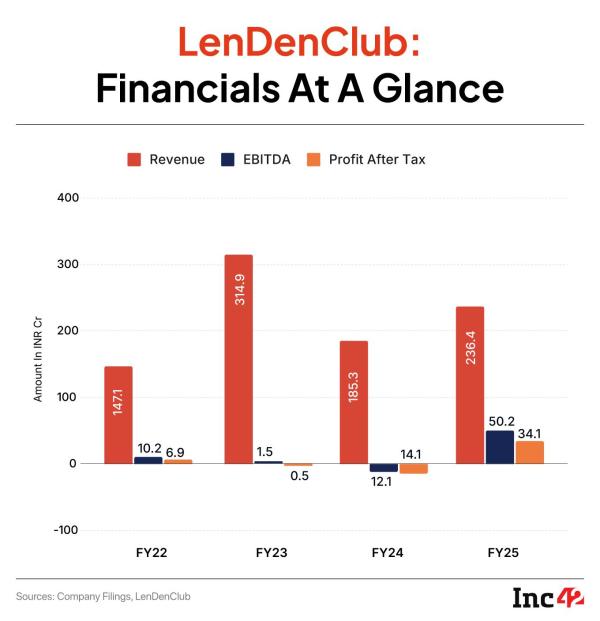

In 2024, LenDenClub, a Mumbai-based peer-to-peer (P2P) lender, plunged into the red, posting a double-digit loss of INR 14.17 Cr, as its operations were hit hard under a strict regulatory regime. The slide at the end of FY24 was staggering. The company had been profitable two years ago, reporting an INR 6.98 Cr profit after tax and achieving a 1,000% YOY surge in loan disbursement volume.

How did the regulatory landscape change? By August 2024, the RBI had finalised its stringent guidelines that hit the P2P lending ecosystem like a sledgehammer. Once a freewheeling alternative to traditional credit, regulatory tightening has made it a closely watched space where compliance determines survival, a shift that mirrors the global fintech trend.

In India, it is now governed by lending and borrowing caps, T+1 escrow settlements (requires funds in escrow accounts to be transferred within one business day of receipt to prevent pooling funds and park-now-withdraw-later offers), fixed platform fees and zero cross-selling of unrelated products.

The platforms (now NBFC-P2P companies) can no longer promote P2P lending as an investment product and only act as facilitators (the model resembles online marketplaces). No lender-borrower matching is allowed within closed user groups, and P2P lenders cannot provide or arrange any form of credit enhancement or guarantees.

These measures improved transparency and safeguards but also strained P2P operations and revenues. Platforms that had once effortlessly connected India’s credit-hungry borrowers with yield-seeking investors were compelled to overhaul processes, invest heavily in compliance and manage credit risk more cautiously.

For LenDenClub, a platform built on easy-to-access small-ticket loans for underserved borrowers, the journey was fraught with existential challenges.

“The shift began around June or July 2023, when we first received the RBI’s notice, almost 18-20 months before the final regulations came into effect. Under the central bank’s guidance, we implemented all required changes wherever the guidelines were clear. We also took a lot of tough calls along the way,” cofounder Bhavin Patel told Inc42.

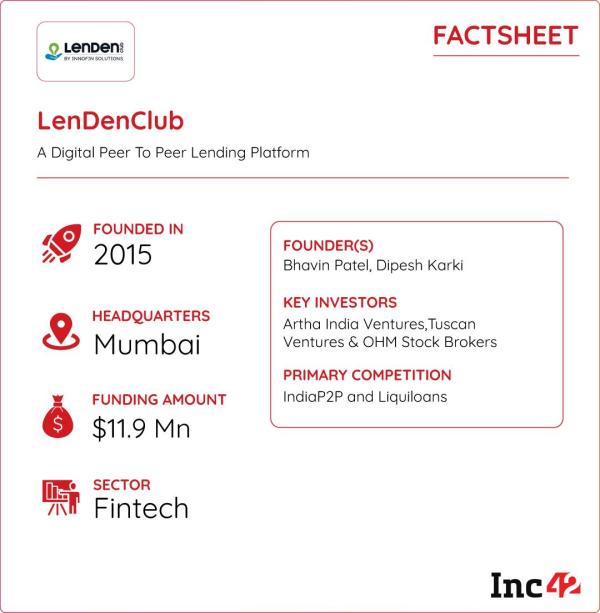

Inspired by global P2P platforms, Patel and Dipesh Karki launched LenDenClub in 2014, only to encounter deep scepticism. But by then, the founders had identified a critical flaw in traditional credit assessment. Lenders often judged borrowers by postal codes — the more affluent the neighbourhood, the higher the chance of approval — rather than by individual merit. The approach excluded millions of creditworthy borrowers from the system.

Patel and Karki saw an opportunity to build a model around India’s vast but underserved demand for small-ticket loans. Momentum gathered pace after the RBI’s 2017 P2P lending regulations lent credibility to the sector, allowing platforms like LenDenClub to win over wary users. The company steadily expanded its reach by adopting a mobile-first approach and forging industry partnerships.

The first wave of Covid-19 further accelerated activity on both the borrower and lender sides, pushing disbursements to new highs. By FY21, its loan volume had surged 1,000% year over year to INR 600 Cr from INR 60 Cr in FY20, turning LenDenClub profitable for the first time.

That trajectory, however, would soon be tested by the RBI’s next set of P2P regulations, which illustrated a broader transition within India’s $16.7 Bn P2P lending industry. Compliance standards are reshaping the sector as it moves towards a projected $38.18 Bn by 2031, rising at a CAGR of 14.8%.

As Patel mentioned, a company-wide transformation started mid-2023 to ensure a disciplined adaptation to regulatory changes. However, it required a strategic and operational overhaul, forcing the platform to rein in its rapid growth and rework its model to meet compliance standards. While those efforts were underway, the central bank slapped a penalty of nearly INR 2 Cr on Innofin Solutions, LenDenClub’s parent company, citing a series of compliance lapses.

Meanwhile, the founders staked everything on early compliance rather than resisting the regulatory tide.

“We felt those corrective steps were essential. The business could not regain its loan volume and revenue without those,” said Patel.

At first, it felt like death by a thousand compliance cuts. Painful decisions followed almost immediately, and the harshest was cutting ties with as many as eight fintech partners, including its largest, BharatPe (more on that later). Earlier, most P2P lenders tied up with them for ready access to a vast user base, comprising potential lenders and creditworthy borrowers. This not only reduced customer acquisition cost but also enhanced efficiency and user experience

The fallout was swift. Revenue, loan disbursals and overall volumes plunged. Within six months, origination volume had collapsed to just 15-20% of earlier levels.

Compliance costs also mounted when the platform revamped its systems and operational workflows. Tasks, which once required just one person, needed three.

The T+1 settlement rule proved challenging, as technical glitches often plagued transfers between lenders’ and borrowers’ escrow accounts. For example, when a customer reported making two payments but only one was recorded, the missing transaction had to be traced within the payment system. It could take up to seven days, while the platform waited before processing repayments or returning funds to lenders.

“That increased pressure on the operations team to reconcile daily, just like any payment gateway, which wasn’t the case earlier,” explained Patel. “We had to deploy additional resources to handle compliance and operational requirements, which drove our costs.”

Earlier, there was no strict timeline for transfers, and platforms often held on to the money for an extended period or used it for immediate requirements. For example, a borrower’s repayment could have been utilised to fund a new loan, or the funds pooled could have been used for fast liquidation.

The financial toll of these measures was particularly distressing. After turning profitable in FY22, LenDenClub’s PAT swung into the red for two consecutive years (see Financials At A Glance).

Nevertheless, its early compliance push paid off. Around 90% of its operations were aligned with the new rules when the RBI issued its final guidelines, and the business was back on track within eight to 10 months.

In FY25, the P2P lender posted a net profit of more than INR 34 Cr, its strongest performance yet. Founders also claimed that loan originations recovered and exceeded volumes recorded before the August 2024 regulatory shift. The sharp turnaround reflects a recalibration of operations and the company’s ability to adapt to a sector where regulatory discipline has become as important as expansion.

LenDenClub’s compliance playbook relied on speed. Rather than waiting for final guidelines, the team implemented changes based on the regulator’s draft revisions. This early action gave them nearly a year to adapt, minimising disruptions and keeping the platform ahead of competitors.

But the strategic response went beyond compliance. From the outset, the platform chose to run two verticals: LenDenClub for lenders and InstaMoney for borrowers, which later evolved into a lending service provider (LSP). The split simplified compliance and allowed the company to speak to each side in a way that resonated, especially when dealing with sensitive issues such as loan defaults. What started as an operational convenience became a strategic advantage years later.

The company also built a TSP platform to handle niche use cases such as merchant loans with daily repayments. It had long been a pain point for NBFCs and LSPs, but an in-house technology service provider helped resolve many issues. This unit-level focus, supported by the TSP, gave the firm tighter control over revenue and costs and made a meaningful contribution to profitability.

Next came the difficult decision around partnerships with fintechs. Every lender was required to strictly adhere to the prescribed workflows and operational guidelines. For example, P2P lenders had to clearly define the type of borrowers they intended to serve, refrain from cross-selling any product other than loan-specific insurance, and ensure full compliance with all applicable legal requirements. However, several fintech partners — who had been key distribution enablers for P2P lenders — were either unwilling or unable to meet these compliance standards.

As a result, many of these partnerships had to be discontinued, even though unwinding the deep integrations proved to be a significant operational challenge. The platform currently works with two fintech partners, Google Pay and PhonePe.

Finally, LenDenClub restructured its escrow mechanism. Under the new framework, borrowers’ repayments flow directly to lenders’ accounts, while funds in lenders’ escrow accounts are disbursed only to borrowers or returned to lenders if the T+1 settlement fails. This overhaul streamlines cash flows, ensures compliance and maintains trust.

The Tech Stack That Builds A Competitive Moat“The discussion around escrow accounts began in January 2024, and we immediately started working on system changes. From February onwards, implementation was underway,” said Patel.

“It couldn’t be applied to the entire portfolio, but many workflows incorporated the new process. By the time the final guidelines were released in August, repayments were already flowing directly into lenders’ accounts.”

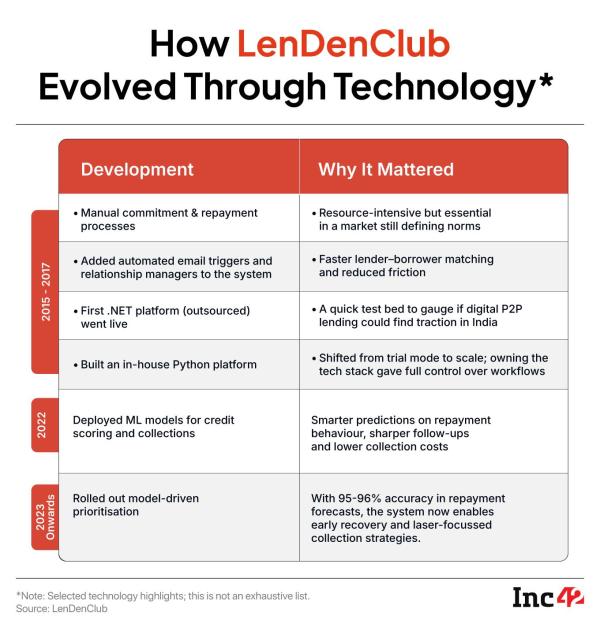

LenDenClub’s resilience was not built in a day. Since its launch in 2014, Patel and Karki have been steadily developing technological capabilities that proved crucial during and after the regulatory storm.

From outsourcing the first version of the platform on .NET to building an in-house system on Python, and now developing AI-ML models and automation tools, the company’s technological evolution has been steady. Of course, the core workflow remains. Lenders review borrower details, choose whom to fund, and decide the amounts. But around that constant, technology, scale and speed have improved significantly over time.

Here are the three core functions managed by its tech stack:

Manages Demand & SupplyThe customer base was small in the early years, and loan volumes were limited. So, the system relied on automatically triggered email messages with customised links sent to all registered lenders. This allowed them to commit funds without logging in. Because the platform lacked advanced filtering, lenders shared their criteria with relationship managers, who matched those with suitable borrowers. Once the matching was done and approved, lenders went online, confirmed the amount and manually transferred funds.

The founders first outsourced the development of a .NET-based platform while building their in-house system on Python. After seven to eight months, the in-house version went live in June 2016, onboarding borrowers and lenders and setting the stage for scale.

Automates The Commitment ProcessBefore the RBI’s 2017 regulations, the commitment process was slow and manual. If a borrower needed INR 1 Lakh and 20 lenders each committed INR 5K, the platform had to prepare 20 separate agreements, run security checks, upload scanned documents and process repayments to each lender individually.

About seven months before the central bank finalised its framework, LenDenClub worked with IDFC Bank to build an automated escrow solution. (It later shifted from IDFC to ICICI Bank, drawn by the latter’s enhanced technology suite.) The founders engaged closely with the regulator, addressed its concerns and launched the system in March 2017. The same approach was later incorporated into the RBI’s final guidelines.

Lenders today can spread INR 1 Lakh across 25 borrowers in a single step, guided by in-app notifications, custom filters and preference settings. The once manual, relationship-driven process has given way to one that is faster, more transparent and built for scale.

ML Models Improve Credit & Collections ManagementA key technology leap came in 2022, when it began integrating machine learning models to improve credit and collections management. Earlier, credit assessments relied on simple, rule-based systems with eight to 10 hard-coded rules. But after its Series A funding in 2021, LenDenClub set up a data science team of 10 engineers.

It took six to nine months to develop the first ML models, and by the second half of 2023, their predictions were used to drive operations. These models can forecast repayment behaviour with 95-96% accuracy, identifying which borrowers are likely to default or delay payments. For instance, if 100 borrowers are due for repayments on a given day, the system may predict that 80 will pay on time and 20 will require follow-ups. This allows the platform to focus on high-risk cases, reduce costs and improve early recovery rates.

Customers receive pre-due reminders via WhatsApp, email, SMS and automated calls in local languages. If payments are missed, follow-ups escalate from automated messages to telecallers. Collection agencies come in after 30 days, and legal notices are issued after 90 days. This structured approach ensures efficient loan recovery and minimal manual intervention.

Reflecting on the journey, Patel said, “From the beginning, we knew technology would be essential to solving mass-market lending challenges. Every step, from automation to ML models, is about making lending faster, smarter and more reliable for borrowers and lenders.”

Patel emphasised that LenDenClub’s success was not driven by technology alone. He praised the team’s resilience, noting how they treated challenges as constraints to navigate and focussed on winning solutions. That mindset and careful decision-making helped the company overcome regulatory hurdles and build for the long term.

Besides, the company’s strong balance sheet and early profitability gave it financial independence, allowing the team to make strategic decisions without constant pressure to raise funding or chase growth. That stability made it possible to prioritise compliance, product integrity and sustainability during regulatory changes.

The cofounder highlighted three additional strengths that stand out. These include:

Lending caps to limit NPA risk: LenDenClub enforces regulatory and internal loan caps to ensure responsible lending. Currently, borrowers are capped at INR 10 Lakh, lenders at INR 50 Lakh, while a lender can lend a maximum of INR 50K to a single borrower. Over time, the platform has found that smaller, diversified loans, around INR 2K per borrower, deliver better returns while reducing risk.

Internal caps offer further guidance to lenders. As high returns can encourage risky behaviour, the platform adjusts lending limits based on total exposure. For example, a lender with INR 50 Lakh may lend INR 10K to each borrower, while one with INR 5 Lakh is limited to INR 5K.

Diversified portfolios for risk management: According to Patel, a 2017 incident underscored the importance of diversified portfolios. One lender ignored the platform’s guidelines and lent INR 75K to a single borrower, who later defaulted. Such cases show that people do not always make informed decisions, as they see only a tiny fraction — perhaps less than 1% — of the platform’s 50-60 Lakh-strong loan universe. Monitoring and risk management are, therefore, essential. LenDenClub combines its internal measures with regulatory guidelines to minimise risk.

Strong loan underwriting mechanisms: The same meticulousness in risk management extends to loan underwriting. LenDenClub now evaluates more than 600 borrower-specific data points such as bank statements, mobile usage and third-party digital footprints (data collected by trackers across websites, apps, services and more) to assess those without traditional credit history.

The platform operates five credit models — three that assess borrowers sequentially and two independent models that evaluate them regardless of the sequential outcomes. For context, sequential credit assessment is a process where credit risk is determined by evaluating a series of financial and behavioural data points in a specific order over time, instead of a single snapshot of one’s financial status.

Refined over the past two to three years and tested on millions of small-ticket loan transactions, LenDenClub’s models have outperformed bureau benchmarks such as CRIF’s ST1/ST2 and CIBIL’s first-EMI predictor. The company reports a 98% repayment rate on loans up to INR 50K, compared to CIBIL’s 97%. In fact, its investment in data science in 2022 continues to pay off, as growing transaction volumes provide larger datasets, enhancing the models’ predictive accuracy.

Lenders also undergo regulatory and risk checks. KYC verification is mandatory for anyone lending more than INR 10 lakh, and each must have a net-owned fund (NOF) of at least INR 50 Lakh to prove financial strength. Fund sources are also verified to prevent fraud and money laundering. Together, these measures help mitigate ‘default’ risks and ensure only qualified lenders join the platform.

What’s Next On The Cards“By combining rigorous borrower data analysis with stringent lender verification, we have built a system that predicts repayment behaviour accurately and protects both parties effectively,” explained Patel.

Despite the RBI’s cautious stance and tight regulations, India’s P2P lending sector has grown at a fast clip. The country is now home to around 26 licensed NBFC-P2Ps (as of June 2024). Platforms like LenDenClub, Lendbox, Finzy, Fello, IndiaP2P, iLend, and Faircent have attracted substantial funding to scale operations and roll out new products. It signals investor interest and a growing demand for alternative credit in a market dominated by banks.

Yet bottlenecks remain. LenDenClub, for instance, continues to wrestle with the perennial P2P challenge of balancing demand and supply (borrowers and lenders). The issue has persisted even after decade-long operations, limiting scalability and consistent returns.

“In some months, like May, June and mid-July, we see too much money chasing too few borrowers. At other times, it’s the reverse,” said Patel. “When we have a lender surplus, we sometimes have to return funds to comply with T+1 regulations.”

Patel likened it to running a stock exchange, never knowing whether buyers or sellers would show up. That equilibrium, he notes, is crucial. Without it, markets will wobble. Similarly, LenDenClub’s transaction volumes may suffer when the lender-borrower balance is off.

Even when mismatches persist for weeks, the platform completes 99% of loan disbursements within 24 hours. With a base of 2.5 Cr borrowers and 60-65 Lakh lenders, maintaining the demand-supply balance remains a daily operational imperative. However, scaled processes now manage these fluctuations effectively.

The platform is also extending its GenAI capabilities beyond borrower support to help lenders with customised summaries and insights. For example, a lender can access a comprehensive report on loans worth INR 1 Lakh, including deployment patterns, repayment trends, and transaction timelines. Eventually, upgraded models will be designed to automate reconciliation, detect issues early, and improve customer experience while remaining within regulatory boundaries.

To realise its AI ambitions, LenDenClub’s technology roadmap leverages strategic collaborations with global giants Amazon and Google. Internal testing is underway, and a user rollout is expected shortly.

“All these processes, which are largely related to reconciliation and compliance, can be fully automated using these AI models. This is only the beginning, but it promises to reduce manual effort significantly,” observed Patel.

By strengthening its core business lines, LenDenClub will prioritise revenue growth and profitability in the current fiscal year. But for a company that has weathered regulatory upheaval and bounced back stronger, an essential question looms. Can it sustain its momentum as competition intensifies and the market matures? The next chapter may prove equally transformative, or even more challenging.

The post How LenDenClub Cracked The P2P Lending Code Amid The RBI Crackdown appeared first on Inc42 Media.

-

After child deaths, pharmacists told to stop dispensing cough syrups to kids under 2

-

Two Gujarat cos under lens for DEG-laden cough syrup; FDA issues alert

-

Year-end travel boom: The early bird gets the suite; the late one pays the price

-

Delhiites home in on community living, rentals scale new high

-

Investments in offices make a strong comeback