Analyst highlights breakout potential above ₹375 and long-term upside of 20–25%.

Rail Vikas Nigam (RVNL) shares fell over 2% on Wednesday, a day after the government approved four major multitracking and rail expansion projects worth ₹24,634 crore, marking another strong push towards modernizing and decongesting India’s railway network.

On the technical front, RVNL shares are emerging from a prolonged correction phase that began in mid-June 2025. SEBI-registered analyst Deepak Pal said that the stock has formed a strong bullish candle, indicating renewed investor confidence.

He identified immediate support at ₹340-₹345, with resistance at ₹365–₹375. Pal flagged a breakout zone at ₹375 and higher. If the stock crossed this level with strong volumes, it could likely test ₹395–₹410.

Strong Fundamentals

Pal added that this miniratna PSU with an order book of over ₹90,000 crore has a solid revenue visibility over the next 4-5 years. Its expanding role in metro and high-speed rail projects positions it as a key beneficiary of India’s ongoing infrastructure growth.

The railway company’s Q2 FY26 results, expected in late October, are likely to show stable earnings and margin improvement, which could trigger a short-term breakout if numbers beat estimates.

Additionally, the FY26 Union Budget may raise railway capex to ₹2.9 lakh crore, directly benefiting the company. Pal highlighted that its new agreements with BHEL and RITES for green energy and metro projects, along with potential international contracts in Bangladesh and the UAE, can strengthen long-term growth visibility.

What Should Investors Do?

Over the short term (1–3 months), Pal noted that RVNL stock has regained strength after forming a strong base around ₹330–₹340. The breakout above ₹350 suggests renewed momentum. If the stock sustains above this level, it may move toward ₹375–₹390 in the short term. Positive earnings expectations and improving volume activity support a bullish outlook for the short term. However, any dip below ₹340 could lead to mild profit booking.

From a long-term (6-12 months) perspective, the company remains fundamentally strong with a robust order book, improving profitability, and steady execution. Pal advised long-term investors to accumulate on dips near ₹345 with a 12-month target range of ₹430–₹450. Overall, the outlook remains positive, with potential for a 20–25% upside.

What Is The Retail Mood?

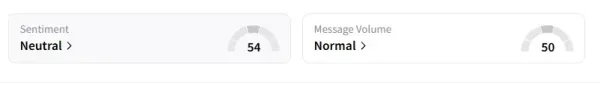

However, data on Stocktwits shows that retail sentiment has been ‘neutral’ for a month.

RVNL shares have declined 18% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

How poor sleep makes the brain grow older faster

-

NPCI Announces Four New UPI Launches During GFF Day 2

-

Jammu & Kashmir News: Massive Search Operation Launched In Kokernag To Trace 2 Missing Soldiers

-

Amit Shah congratulates Maharashtra on Navi Mumbai Airport, metro line inauguration

-

CBI conducts nationwide searches in digital arrest case under Operation Chakra-V