Bitcoin prices slipped to $121,336.94 after hitting an all-time high of $126,198.07 earlier this week. Ethereum prices dropped sharply to $4,439.67, while XRP found support at $2.85.

Major cryptocurrencies edged lower on Wednesday, following strong gains this week amid a rise in the U.S. dollar.

Bitcoin prices slipped to $121,336.94 after hitting an all-time high of $126,198.07 earlier this week. Ethereum prices dropped sharply to $4,439.67, while XRP found support at $2.85. Among other tokens, Solana and Cardano edged lower. Binance Coin (BNB), which replaced XRP as the third-most valuable cryptocurrency, pulled back toward $1,283.

Bitcoin’s relative strength index, a key financial momentum indicator based on price changes, remained at approximately 72. A reading over 70 usually implies overbought conditions. Previously, Bitcoin prices have usually pulled back when RSI is elevated, primarily due to profit-taking. According to SoSoValue data, spot Bitcoin ETFs logged outflows of $23.8 million on Tuesday, following six consecutive days of inflows.

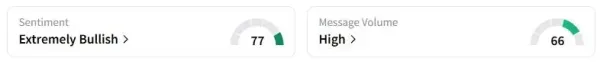

Michael Saylor’s Strategy, which pioneered the concept of crypto treasuries, also fell 8.7%, tracking a decline of the apex cryptocurrency. Retail sentiment on Stocktwits about Strategy was still in the ‘bullish’ territory at the time of writing, while traders were ‘extremely bullish’ about Bitcoin.

While cryptocurrencies took a pause, spot gold prices surpassed the $4,000 per ounce mark for the first time, despite the U.S. dollar's advances on Wednesday. Over the past week, both digital assets and precious metals have advanced, driven by the so-called ‘debasement trade,’ where investors flock to alternative investments amid uncertainty over state bonds and currencies.

External Fundamentals Still Supportive

Mark Moss, Chief Bitcoin strategist at Satsuma Technology, noted that Bitcoin might still have room to run.

“Bitcoin is breaking out to new ATHs, and yet it's not looking anywhere near cycle peaks while external fundamentals are looking hot. Unlike 2021, the Fed is not tightening; they are loosening, ETFs and BTCTCs (Bitcoin Treasury Companies) are creating the greatest demand shock, and the world has woken up to the debasement trade,” Moss said.

Earlier this week, U.S. Senator Cynthia Lummis said that acquiring funds for the US Strategic Bitcoin Reserve (SBR) can “start anytime” now, signalling continued support at the federal level.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

How poor sleep makes the brain grow older faster

-

NPCI Announces Four New UPI Launches During GFF Day 2

-

Jammu & Kashmir News: Massive Search Operation Launched In Kokernag To Trace 2 Missing Soldiers

-

Amit Shah congratulates Maharashtra on Navi Mumbai Airport, metro line inauguration

-

CBI conducts nationwide searches in digital arrest case under Operation Chakra-V