The Adani Group’s Navi Mumbai International Airport (NMIA), the second aviation facility serving India’s commercial capital, would focus on in-house retail as part of a wider strategy to lift non-aeronautical revenue.

Around 65–70% of the airport’s 113 stores would be operated under the group’s own brands, with the remaining space open to external partners, executives in charge of the facility said.

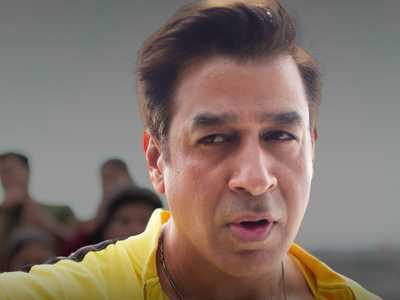

Adani Airports Chief Executive Arun Bansal said the group’s focus is on creating a long-term, demand-driven ecosystem rather than build revenue streams with short-term incentives.

“We don't need to talk about incentives per se because there is enough demand. For international airlines, we have given some concessions where we will not charge partners for the first year,” Bansal said.

By 2030, Adani Airports expects non-aeronautical businesses — including retail, F&B, and city-side developments — to contribute about 70% of total revenue, up from the current 50%.

“Right now, our revenue is about 50% aero and 50% non-aero. By 2030, I expect aero revenue to drop below 30%,” Bansal told ET in August.

The retail plan at Navi Mumbai airport follows a “passenger-to-product” model aimed at filling gaps in airport shopping and catering to Gen Z travellers, who are projected to make up 64% of the airport’s passenger base. Terminal 1 will feature about 110 retail and F&B outlets, including an artisanal tea brand, Bombay Bond, casual dining, a food hall serving Indian and international cuisines, chef-led concepts, bars, breweries, and a street food zone at the arrival forecourt.

Duty-Free Shopping

The duty-free area will cover about 1,800 sq m, with total retail space of 5,000 sq m. Duty-free outlets will operate at both departures and arrivals. Commercial services — including retail, food and beverage, baggage, lounge check-ins, and duty-free shopping — will be integrated through the Adani OneApp.

According to Adani Airports Holdings’ FY25 report, the company aims to turn its airports into “vibrant destinations that go beyond traditional aviation services,” leveraging data analytics, technology, and partnerships to boost passenger engagement.

In FY25, Adani Airports’ total revenue stood at Rs 9,276.42 crore, with non-aeronautical income contributing 54%. In June, the group raised $750 million through external commercial borrowings to refinance debt and fund expansion of retail, F&B, and duty-free operations across its six airports. Across all its operational airports, AAHL aims to have 310 stores with its own concepts or franchisees.

Passenger operations are slated to begin in December, with both domestic and short-haul international flights starting from day one. Talks are underway with airlines for initial overseas routes. The 45–60 day commissioning process involves completing trials and deploying customs and immigration staff.

Built over 1,160 hectares, the two-runway, four-terminal airport will open with a single runway and an integrated terminal capable of handling 20 million passengers annually and half a million tonnes of cargo. Sources said the airport would start with around 60 aircraft movements per day.

Around 65–70% of the airport’s 113 stores would be operated under the group’s own brands, with the remaining space open to external partners, executives in charge of the facility said.

Adani Airports Chief Executive Arun Bansal said the group’s focus is on creating a long-term, demand-driven ecosystem rather than build revenue streams with short-term incentives.

“We don't need to talk about incentives per se because there is enough demand. For international airlines, we have given some concessions where we will not charge partners for the first year,” Bansal said.

By 2030, Adani Airports expects non-aeronautical businesses — including retail, F&B, and city-side developments — to contribute about 70% of total revenue, up from the current 50%.

“Right now, our revenue is about 50% aero and 50% non-aero. By 2030, I expect aero revenue to drop below 30%,” Bansal told ET in August.

The retail plan at Navi Mumbai airport follows a “passenger-to-product” model aimed at filling gaps in airport shopping and catering to Gen Z travellers, who are projected to make up 64% of the airport’s passenger base. Terminal 1 will feature about 110 retail and F&B outlets, including an artisanal tea brand, Bombay Bond, casual dining, a food hall serving Indian and international cuisines, chef-led concepts, bars, breweries, and a street food zone at the arrival forecourt.

Duty-Free Shopping

The duty-free area will cover about 1,800 sq m, with total retail space of 5,000 sq m. Duty-free outlets will operate at both departures and arrivals. Commercial services — including retail, food and beverage, baggage, lounge check-ins, and duty-free shopping — will be integrated through the Adani OneApp.

According to Adani Airports Holdings’ FY25 report, the company aims to turn its airports into “vibrant destinations that go beyond traditional aviation services,” leveraging data analytics, technology, and partnerships to boost passenger engagement.

In FY25, Adani Airports’ total revenue stood at Rs 9,276.42 crore, with non-aeronautical income contributing 54%. In June, the group raised $750 million through external commercial borrowings to refinance debt and fund expansion of retail, F&B, and duty-free operations across its six airports. Across all its operational airports, AAHL aims to have 310 stores with its own concepts or franchisees.

Passenger operations are slated to begin in December, with both domestic and short-haul international flights starting from day one. Talks are underway with airlines for initial overseas routes. The 45–60 day commissioning process involves completing trials and deploying customs and immigration staff.

Built over 1,160 hectares, the two-runway, four-terminal airport will open with a single runway and an integrated terminal capable of handling 20 million passengers annually and half a million tonnes of cargo. Sources said the airport would start with around 60 aircraft movements per day.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!