The government has made some changes to the registration process for the Atal Pension Yojana. It has also released a new, updated application form. Let's find out who can apply for this scheme.

Atal Pension Yojana: A new update has been announced for the Atal Pension Yojana. The government recently made some changes to the registration process to improve pension-related services under the Atal Pension Yojana. In an official notification, the Postal Department stated that the old form for the Atal Pension Yojana will no longer be accepted from October 1, 2025.

The updated form will also be required to open a new account under this scheme. These changes are in accordance with the guidelines of the Pension Fund Regulatory and Development Authority (PFRDA). Let's learn about the changes to the APY form and who can apply.

What is the Atal Pension Yojana?

The Atal Pension Yojana (APY) is a pension scheme of the Government of India. Launched in 2015, this scheme aims to provide pension benefits to people working in the unorganized sector. Under this scheme, the government guarantees a minimum monthly pension of ₹1,000 to ₹5,000 upon reaching the age of 60. The pension amount depends on the customer's age at entry and the monthly installment rate paid during the savings period. Currently, approximately 80 million people are benefiting from this scheme.

What changes have been made to the form?

Now, to avail the Atal Pension Yojana benefits, people will have to fill out a new, updated form. The most significant change in this form is the FATCA/CRS declaration form, which helps obtain information about foreign citizens and taxpayers. Consequently, applicants will now also be required to provide their citizenship information, confirming whether they are citizens of another country. The government says this step will allow Indian citizens to directly benefit from the scheme.

Who can apply?

Any Indian citizen between the ages of 18 and 40 can apply under APY. They must also have a savings account or a post office account. They must not be an income tax payer after October 1, 2022. To receive regular updates and details about the scheme, you must link your Aadhaar number and mobile number to your APY account.

-

MP News: 'Love And Friendship Has No Gender,' Bhind Youth Dresses As Bride To Observe Karwa Chauth Fast For Friend

-

Mumbai Police Housing Crisis: Maharashtra Govt To Redevelop 75 Plots, Build 40,000 New Residential Units

-

CM Mohan Yadav to inaugurate three-day MP Travel Mart in Bhopal today

-

Pathological Demand Avoidance signs as McFly star's child gets news

-

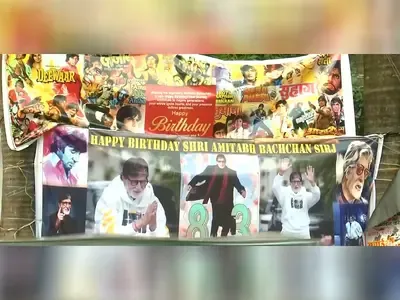

Amitabh Bachchan turns 83, fans gather outside Mumbai home to celebrate his birthday