Chat and Pay: NPCI Teams Up with OpenAI and Razorpay for AI-Powered UPI Payments

India’s digital payments and online shopping experience is about to take a major leap. The National Payments Corporation of India (NPCI) — the organization behind UPI (Unified Payments Interface) — has partnered with OpenAI and Razorpay to launch a revolutionary feature that will allow users to shop and make payments directly through AI chatbots like ChatGPT.

Here’s everything you need to know about this new integration and how it’s set to transform the way Indians shop and pay online.

🔍 What Is the New Feature?

Until now, users chatting with a virtual assistant or chatbot for product information had to leave the chat to make a purchase or complete a payment.

With this new AI-integrated payment system, users will be able to complete the entire transaction without leaving the chat window.

Razorpay has named this feature “Agentic Payments”, which is currently in its beta (testing) phase, accessible to a limited number of users.

💡 How It Works — Backed by New UPI Innovations

This new capability will use two of UPI’s latest features: Reserve Pay and UPI Circle.

-

Reserve Pay: Allows users to pre-allocate a certain amount in their bank account for specific merchants or purposes.

-

UPI Circle: Enables payments to be made without switching apps, directly from within chat interfaces.

For example, a user chatting with ChatGPT about a product will be able to browse, decide, and pay — all within the same chat.

🤝 Key Partners in the Project

This pilot initiative includes Airtel Payments Bank and Axis Bank as banking partners.

In the early rollout, companies like Tata Group’s BigBasket and Vodafone Idea are expected to adopt the feature.

According to a report by TechCrunch, Razorpay CEO Harshil Mathur confirmed that the new Agentic AI payment technology has also been successfully tested with other chatbots, including Google’s Gemini and Anthropic’s Claude.

However, the final rollout across all platforms may still take a few more weeks.

🔐 Security and Data Privacy

NPCI has assured users that the system will be fully secure. Each transaction will require Two-Factor Authentication (2FA), ensuring user consent and preventing unauthorized access.

Importantly, AI companies will not have access to users’ financial or payment data, maintaining full data privacy and user control.

While a revenue-sharing model between NPCI, Razorpay, and OpenAI hasn’t been finalized yet, this collaboration is expected to boost user engagement and retention for AI platforms and payment providers alike.

🚀 The Future of Digital Payments in India

This marks a major step toward making India’s digital ecosystem smarter and more conversational.

Soon, users won’t just chat with AI for information — they’ll shop, pay bills, and complete UPI transactions seamlessly within the chat itself.

With OpenAI, NPCI, and Razorpay leading the charge, the future of digital payments in India looks more interactive, intelligent, and instant.

-

Increase sleeping time with these vitamins and foods – Obnews

-

Fashion is not danger! Deafness is increasing among youth due to earphones, prolonged use can cause depression

-

See wild animals in Rajasthan’s Jawai National Park

-

Ways couples try to save money on wedding day

-

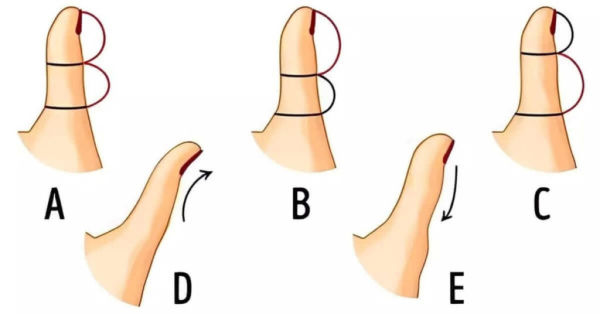

Personality Test: Which way does your thumb bend? The method will reveal the secrets of the heart