The Brisbane-based RPM provides enterprise-wide software for everything from planning and scheduling to asset management for miners.

Caterpillar Inc. (CAT) has agreed to buy Australia’s RPMGlobal for A$1.1 billion ($732 million) in a bid to bolster its mining solutions offering.

The U.S. industrial major has agreed to pay A$5 per share for RPM, representing a premium of nearly 33% compared to its closing price on Aug. 28 before Caterpillar came out with a non-binding merger proposal.

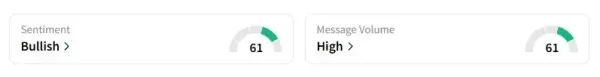

Retail sentiment on Stocktwits about Caterpillar was in the ‘bullish’ territory at the time of writing.

“Caterpillar’s global reach and resources will provide an enhanced platform for RPM’s products, customers, and employees to continue to thrive,” RPM Global Chair Stephen Baldwin said in a statement.

The Brisbane-based RPM provides enterprise-wide software for everything from planning and scheduling to asset management for miners. In fiscal 2025, RPM generated A$76.7 million in revenue. The move comes at a time when mining firms are increasingly leaning toward automation to trim costs amid a shortage of skilled workers in the industry.

The deal, which will likely attract scrutiny from Australia’s foreign investment regulator, is expected to close in the first quarter of 2026.

Caterpillar’s stock has gained 34.3% this year, outperforming the benchmark S&P 500 and Nasdaq indices. The world's largest mining and construction equipment maker is scheduled to post third-quarter earnings in the coming weeks.

According to Fiscal.ai data, the industrial heavyweight is expected to post earnings of $4.54 per share for the quarter ended Sept. 30. Last week, Truist analysts wrote in a broader sector note that machinery is facing risk to margins in the second half relative to the first half, as tariff impact will likely show up fully.

The company projected a net impact of between $1.3 billion and $1.5 billion from tariffs in August.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Bank Jobs 2025: Opportunity to become a manager in Bank of Baroda, new recruitment out, salary up to Rs 1.20 lakh..

-

ECIL Vacancy: Recruitment of ITI, Diploma and B.Tech candidates in Government of India company, interview starts from October 15..

-

NHIDCL Vacancy 2025: Become a Deputy Manager in a Government of India company, opportunity for GATE candidates..

-

Railway Rule: Can you carry firecrackers and sparklers with you in the train? know here...

-

Emergency Fund: A small savings that can be a big support in tough times..