State-run Oil and Natural Gas Corporation (ONGC) with a market value of around Rs 3.10 lakh crore now trails food delivery major Zomato despite its subsidiaries and minority investments accounting for over one-third of its valuation shows that India’s largest oil and gas producer may be undervalued. As per BSE data ONGC’s market capitalisation was at Rs 3.097 lakh crore at Friday’s close lower than Eternal Ltd (formerly Zomato) at Rs 3.36 lakh crore Hindustan Aeronautics Ltd (HAL) at Rs 3.23 lakh crore and Titan Company at Rs 3.13 lakh crore. Back in 2012 ONGC was India’s most valuable firm with a market cap of Rs 2.44 lakh crore surpassing both TCS and Reliance Industries. However while its valuation has increased by just 26 per cent over the past 13 years several other listed companies have witnessed exponential growth. How Reliance TCS Moved Ahead Of ONGC? Reliance has seen its valuation soar from Rs 2.43 lakh crore in July 2012 to Rs 18.7 lakh crore at Fridays close. Tata Consultancy Services (TCS) which jostled with ONGC for the top slot in the past saw its market capitalisation jump from Rs 2.42 lakh crore in July 2012 to Rs 10.95 lakh crore now. Market capitalisation of a listed company corresponds to the cumulative market price of all its shares. Reliance leads the pack followed by HDFC Bank (Rs 15.07 lakh crore) Bharti Airtel (Rs 11.05 lakh crore) and TCS. ONGC holds a 71.63 per cent stake in MRPL which is worth over Rs 18000 crore. Its 54.9 per cent stake in refiner Hindustan Petroleum Corporation Ltd (HPCL) is worth about Rs 52770 crore. Besides ONGC has a minority stake in Indian Oil Corporation - 14.20 per cent worth Rs 31000 crore - and gas utility GAIL (India) Ltd - 5 per cent valued at about Rs 5900 crore. The combined value of its stake in subsidiaries MRPL and HPCL and minority investments in other listed companies comes to over Rs 1.07 lakh crore - more than a third of its current mcap. Is ONGC Undervalued? Oil Minister Hardeep Singh Puri last month rued that state-owned oil public sector undertakings (PSUs) are significantly undervalued by the market. He emphasised that despite their profitability and essential role in the economy investors display a perception bias that unfairly suppresses their market value. Puri noted that in the last six years the three major oil marketing companies (OMCs) - Indian Oil Bharat Petroleum and Hindustan Petroleum - had a collective profit of Rs 2.5 lakh crore. Apart from them ONGC reported a standalone net profit of Rs 1.16 lakh crore in the last three financial years. It paid a total dividend of Rs 12.25 for every share of Rs 5. In comparison Eternal had a net profit of just Rs 527 crore in FY25. Swiggy which has an mcap of Rs 1.08 lakh crore reported a consolidated loss of Rs 3116.8 crore for FY25. (With Inputs From PTI)

-

100-year-old ex-model reveals the one exercise that helps her feel better. Her workout goes viral

-

Employee questions manager's WhatsApp during office hours. Simply run away, say netizens

-

Family-of-five cheat death as orcas sink Portugal tourist boat in horror attack after SOS call

-

Buying gold every year on Diwali is like an SIP: Don’t overinvest and stick to asset allocation

-

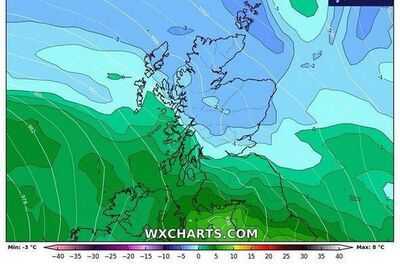

UK snow: Exact date four inches to cover parts of UK as weather maps turn white