The steady uptrend in gold prices marked by scaling of new highs can take the organised gold loan (GL) market to a high of Rs 15 trillion in the current financial year, FY2025-26. If the escalation in the prices of the precious metal continues, the GL market could touch the Rs 15 trillion mark by March 2026, a year earlier than previously expected, according to rating agency ICRA.

Further on, the GL size may rise to Rs 18 trillion in FY2027, on the back of the sharper-than-envisioned expansion, and the gold loan asset under management (AUM) of NBFCs is likely to expand by 30-35 per cent in FY2026, says Senior Vice President and Co-Group Head Financial Sector Ratings, ICRA, AM Karthik.

The stage is set as gold prices have extended their rally by reaching new highs in the past few days, which has set a benchmark for the rising volatility in stock markets and geopolitical issues.

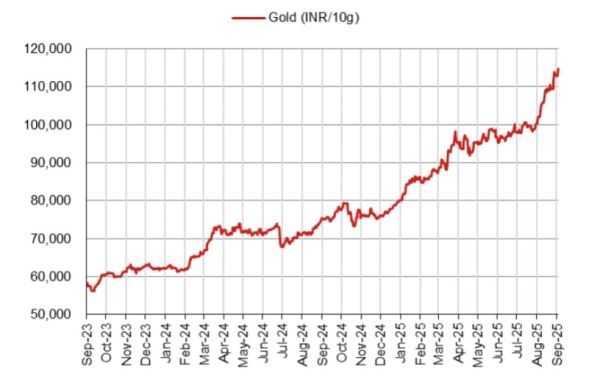

A major factor which impacts the decrease in the demand for gold jewellery is the price, which results in a notable tonnage decline and an increase in investment demand, which ultimately pushes the gold prices higher. The prices of gold in India surged from INR 55,375 to 66,532 per 10 grams (22 carat) between November 2023 to May 2024. With global prices up nearly 30 per cent in 2025 and Indian rates crossing INR100k/10g, organised gold loans may well reach the Rs 15-trillion mark by March 2026.

Triggers For Gold Price Rise

This will be fuelled, as Chintan Mehta, CEO, Abans Financial Services, agrees, by growing expectations of possible further rate cuts, the cautious and mixed stance among Federal Reserve members and the ongoing US government shutdown, which will cause delays in key economic data releases. These combined risks are weighing on the US dollar and heightening investor caution, making gold increasingly attractive as a hedge against market volatility and geopolitical unrest, says Nomura analysts Mihir P. Shah, who is of the view that gold is likely to find solid support around Rs 1,00,000, with the potential to climb toward Rs 1,20,000 if the current macroeconomic and geopolitical conditions continue.

Rising gold prices are, however, a double-edged sword, but net beneficial for organised players, according to Shah and fellow Nomura analyst Riya Patni. “Gold prices rose by 8 per cent quarter on quarter and more than 43 per cent on year." Gold price inflation seems to be putting pressure on volumes and footfall of jewellery players. Also, there is a high base effect from the customs duty cut, limiting overall growth.

While higher gold prices increase the sales value and inventory value for jewellers, leading to potential inventory gains for unorganised jewellers, they can also dampen consumer demand/volume if the price increase is sharp.

Higher gold prices also increase the working capital requirement for a jeweller who then taps gold loans, which are a secured financial product, offered by banks and nonbanking financial companies (NBFCs) in the regulated environment and local money lenders in the unregulated space. In this arrangement, customers provide their gold jewellery as collateral and, in return, the lending institution disburses the loan based on the prevailing market value of the pledged gold.

Amidst the uptick in yellow metal prices, gold loans had expanded at a compounded annual growth rate (CAGR) of about 26 per cent during FY2024-FY2025 and stood at Rs 11.8 trillion as of March 2025, with banks showing a slightly higher expansion rate vis-à-vis non-banking finance companies (NBFCs).

This growth in overall GLs was primarily fuelled by agriculture and other loans secured by gold jewellery, which were extended by banks. These two segments of loans contributed to more than 70 per cent of the overall GL as of March 2024. In the preceding years of FY2020–FY2025 (six years), banks held sway with GL asset under management growing faster at around 26 per cent relative to the 20 per cent increase recorded by NBFCs, which lost share in the overall organised GL AUM.

This uptrend rode on the Indian jewellery market, which grew from USD 48 billion in FY18 to USD 90 billion in FY25 (a 9 per cent CAGR), and is expected to expand to an estimated USD 150 billion by FY33, according to Shah and Patni. Over FY18-25, the organised players grew 1.5x faster than the industry at a 14 per cent CAGR, with their share rising from 30 per cent in FY18 to 40 per cent in FY24, and this is expected to reach 45 per cent by FY30E.

While the continued rise in gold prices can be challenging, NBFCs have made the gold loan market competitive by offering flexible interest rates and faster turnaround times. This competition has spurred growth in the sector, with both banks and NBFCs expanding their gold loan portfolios to capitalise on the lucrative market opportunity.

Banks have seen a significant slowdown in GLs driven by this segment - agriculture and other loans secured by gold jewellery extended by them - in FY2025 as they imposed stricter eligibility criteria and reclassified some of these loans under the retail/personal category. As a result, the share of retail/personal gold loans by banks increased to 18 per cent of the overall GLs in March 2025 from 11 per cent in March 2024, and the share of agriculture and other loans secured by gold jewellery declined to 63 per cent.

Karthik expects the gold loan AUM of NBFCs to expand in FY2026, taking into consideration elevated gold prices and lower growth in the unsecured loan products. “Taking into consideration diversification by players into this space and a sizeable estimated free gold-hold in the country, offers visibility for achieving this growth in the GL AUMs of NBFCs,” says Karthik.

Based on the data of large players in the NBFC space, the GL AUM increase in the recent past has been largely driven by an uptrend in gold prices, and the current trend portends well for NBFCs. Besides, as Karthik points out, NBFCs focused on GLs are maintaining their robust lending spread, supported by improving operational efficiencies and moderate credit losses, which sustain their earnings.

An interesting trend observed in the increasing share in gold credit of NBFCs in recent years is attributed by a PwC study to their specialisation in customer reach and strategic flexibility. Over the years, NBFCs have enhanced their process efficiency, expanded their branch networks and adopted digital platforms, making loans more accessible.

Strategic initiatives, including aggressive marketing, partnerships and innovative loan products tailored to the customers’ needs, have also played a crucial role in increasing the gold credit of NBFCs. Nevertheless, competitive intensity is steadily increasing from new entrants and the ongoing expansion of banks in this segment. Banks remain the dominant player with 82 per cent market share in overall GLs, with NBFCs contributing to the rest. The overall GL AUM of NBFCs stood at about Rs 2.4 trillion as of June 2025, growing by 41 per cent on a YoY basis.

The gold loan market is poised to see moderate growth over the next two years, as gold lenders are facing increased scrutiny from regulatory authorities about the evaluation process for lending activities through FinTech start-ups. The increased regulatory scrutiny and revised guidelines have led to a dip in the share prices of leading NBFCs.

Fitch Ratings believes that the Reserve Bank of India’s (RBI) draft regulatory enhancements for gold-backed loans offer greater clarity to market participants, which should reduce regulatory uncertainty and variability in lender compliance. Some changes could raise operational complexity for lenders, but large companies with adequate resources should be able to navigate them.

(Mukherjee is a contributing writer for ABP Live English. A business journalist for more than 15 years, she has written extensively on the economy, policy, and international relations in Indian newspapers and magazines)

-

What’s Driving The Rally In NDRA Stock Today?

-

SA vs BAN, Women’s World Cup 2025: Bangladesh’s Shorna Akter’s Explosive Batting Grabs Spotlight

-

Gaza Ceasefire: PM Modi welcomed the release of Israeli hostages, said this on Trump’s peace efforts. Gaza Peace Deal PM Narendra Modi Welcomes Israeli Hostages Release Supports

-

This no-cook mithai recipe will be a hot favourite for your Diwali bash!

-

Chanakya had said, no one can defeat a person who knows these 3 things! – News Himachali News Himachali