This Monday, the Reserve Bank of India (RBI) on Monday allowed Indian banks and their overseas branches to extend rupee-denominated loans to persons who are residing in the countries including Bhutan, Nepal, and Sri Lanka in a latest move aimed at strengthening regional trade and payment systems.

RBI Announced Cross-border Trade Transactions

As per this latest development, the Banks in India and their overseas branches have been permitted to lend in Indian Rupees to persons resident in Bhutan, Nepal, and Sri Lanka to facilitate cross-border trade transactions.

Moving ahead, the central bank of the country explained that this step was taken to facilitate cross-border trade transactions.

Further explaining that this is part of its ongoing efforts to ease external trade and payment mechanisms, as per the media report.

These amendments have been made to the Foreign Exchange Management (Borrowing and Lending) Regulations, 2018 and the Foreign Exchange Management (Foreign Currency Accounts by a Person Resident in India) Regulations, 2015 as informed by the regulatory body.

Moreover, RBI said, “AD (authorised dealer) banks in India and their overseas branches have been permitted to lend in Indian Rupees to persons resident in Bhutan, Nepal, and Sri Lanka, including banks in these jurisdictions, to facilitate cross-border trade transactions,” in a statement.

Ease In Norms For Indian Exporters Holding Foreign Currency Accounts Abroad

Besides this, RBI has also eased norms for Indian exporters holding foreign currency accounts abroad.

Prior to arrangement, exporters were required to repatriate unutilised balances in such accounts by the end of the month following the date of realisation.

Now, they have decided that “the period for repatriation shall be extended up to three months, in case of foreign currency accounts maintained with a bank in the IFSC in India,” the RBI noted.

This announcement appears to align with the policy statement made by the RBI on October 1 during the bi-monthly monetary policy review.

-

Star India cricketer set to make T20I return against South Africa, Shubman Gill…

-

Trump invokes India–Pakistan as he touts ending global wars

-

Indian man charged with criminally negligent homicide in US

-

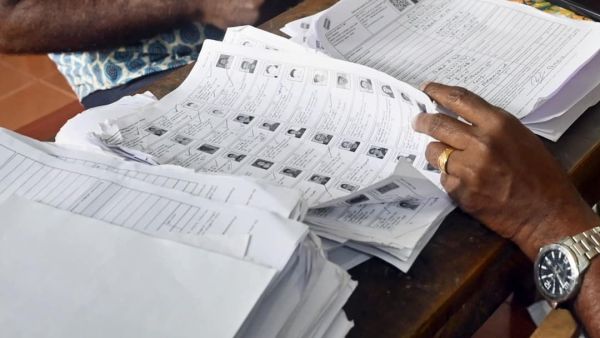

Work Pressure Row Deepens; Meerut BLO Critical After Suicide Attempt

-

'Sahi Nahi Kiya Ojha Ji', Somnath Bharti Reacted To Awadh Ojha's Resignation From Politics