Passenger vehicle sales in India hit a record for the month of September as carmakers raced to accelerate factory dispatches, anticipating a rush of buyers at showrooms to benefit from the tax cuts that rolled in towards the end of the month.

Consumers had deferred purchases, while automakers postponed dispatches in the first 21 days of the month, ahead of implementation of reduced goods and services tax (GST) rates from September 22.

The subsequent nine days of the month saw an unprecedented sales surge as potential buyers jostled at showrooms while companies cut prices, and in several cases, offered additional price incentives to exploit the boom.

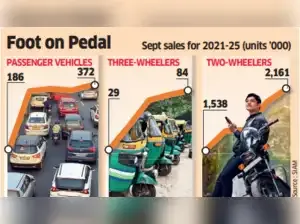

As many as 372,458 cars, SUVs and vans were sold in the previous month, a 4.4% increase from a year earlier, showed data issued by industry body Society of Indian Automobile Manufacturers (SIAM).

It was the highest ever for the month, exceeding the 362,000 vehicles sold in September 2023.

September sales of two-wheelers grew 6.7% to a record 2.16 million units. Three-wheeler sales also posted their best-ever performance for the month, with 84,077 units sold, a 5.5% rise from a year earlier.

The government cut the GST on scooters and motorcycles less than 350 cc, and non-electric three-wheelers to 18% from 28%.

Automakers in India mostly report wholesale dispatches from factories to dealerships and not retail sales.

“In spite of the new GST rates coming into effect from 22nd of September, that is, only for nine days of the month, passenger vehicles, two-wheelers and three-wheelers have already posted their highest ever sales of September,” said Shailesh Chandra, president of Siam. “The festive season, which started with Navratri also on September 22, helped boost retail sales across categories.”

He said retail sales of passenger vehicles and two-wheelers rose by 5.8% and 6.51%, respectively, last month, citing Federation of Automobile Dealers Associations (Fada) data.

The continued impact of GST 2.0 reforms, which has improved affordability and lifted consumer sentiment, coupled with lower interest rates and income tax slab revisions in the budget earlier this year, is expected to sustain buying interest across vehicle segments, according to industry experts.

“Vehicle makers have seen a surge in bookings in the last 45 days. Some of this demand is yet unserved because dispatches were on hold in the first three weeks of September and on account of logistical challenges subsequently,” said Chandra. “In addition to this, GST 2.0 has helped generate demand among a newer set of customers, for whom affordability has improved and who are now thinking of buying a vehicle. We are optimistic this momentum will sustain in the coming months.”

He said that while urban markets were stable during the month, rural areas are starting to show signs of “strong growth off late.”

The kharif crop harvest is broadly expected to be healthy, supported by above normal monsoons. Despite flood disruptions, farm output and rural sentiments remain stable. This, together with the upcoming marriage season, will support rural consumption and demand for mobility in the second half of the fiscal, said Chandra.

Consumers had deferred purchases, while automakers postponed dispatches in the first 21 days of the month, ahead of implementation of reduced goods and services tax (GST) rates from September 22.

The subsequent nine days of the month saw an unprecedented sales surge as potential buyers jostled at showrooms while companies cut prices, and in several cases, offered additional price incentives to exploit the boom.

As many as 372,458 cars, SUVs and vans were sold in the previous month, a 4.4% increase from a year earlier, showed data issued by industry body Society of Indian Automobile Manufacturers (SIAM).

It was the highest ever for the month, exceeding the 362,000 vehicles sold in September 2023.

September sales of two-wheelers grew 6.7% to a record 2.16 million units. Three-wheeler sales also posted their best-ever performance for the month, with 84,077 units sold, a 5.5% rise from a year earlier.

The government cut the GST on scooters and motorcycles less than 350 cc, and non-electric three-wheelers to 18% from 28%.

Automakers in India mostly report wholesale dispatches from factories to dealerships and not retail sales.

“In spite of the new GST rates coming into effect from 22nd of September, that is, only for nine days of the month, passenger vehicles, two-wheelers and three-wheelers have already posted their highest ever sales of September,” said Shailesh Chandra, president of Siam. “The festive season, which started with Navratri also on September 22, helped boost retail sales across categories.”

He said retail sales of passenger vehicles and two-wheelers rose by 5.8% and 6.51%, respectively, last month, citing Federation of Automobile Dealers Associations (Fada) data.

The continued impact of GST 2.0 reforms, which has improved affordability and lifted consumer sentiment, coupled with lower interest rates and income tax slab revisions in the budget earlier this year, is expected to sustain buying interest across vehicle segments, according to industry experts.

“Vehicle makers have seen a surge in bookings in the last 45 days. Some of this demand is yet unserved because dispatches were on hold in the first three weeks of September and on account of logistical challenges subsequently,” said Chandra. “In addition to this, GST 2.0 has helped generate demand among a newer set of customers, for whom affordability has improved and who are now thinking of buying a vehicle. We are optimistic this momentum will sustain in the coming months.”

He said that while urban markets were stable during the month, rural areas are starting to show signs of “strong growth off late.”

The kharif crop harvest is broadly expected to be healthy, supported by above normal monsoons. Despite flood disruptions, farm output and rural sentiments remain stable. This, together with the upcoming marriage season, will support rural consumption and demand for mobility in the second half of the fiscal, said Chandra.

(This story has not been edited by economictimes.com and is auto–generated from a syndicated feed we subscribe to.)

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!