The company noted that it plans to shift its portfolio to higher-growth, higher-margin businesses with an eye on long-term profits.

Shares of Hewlett-Packard Enterprise Co. (HPE) fell sharply in Wednesday’s extended trading after the company issued a downbeat near-term forecast.

In a press release published after the HPE Securities Analyst Meeting held on Wednesday, the Houston, Texas-based company stated that on a pro forma basis, it expects compounded annual revenue growth of 5%-7% for the fiscal years 2025 through 2028. It guided adjusted operating profit growth of 11%-17%, driving adjusted earnings per share (EPS) of at least $3 by fiscal year 2028.

For the fiscal year 2026, the company expects year-over-year (YoY) revenue growth of 5%-10% on a pro forma basis and adjusted operating profit growth of 10%-18%. It also guided to adjusted EPS of $2.20-$2.40 for the year. According to Fiscal.ai, the consensus revenue growth estimate and the adjusted EPS estimates for the year are at 16.7% and $2.42.

For the year-to-date period, HPE stock has gained about 20%. Retail traders, however, shrugged off the near-term softness. On Stocktwits, retail sentiment toward the stock turned to ‘extremely bullish’ by late Wednesday, from ‘bullish’ the day before. Retail buzz also perked up to ‘high’ levels, with the message volume rising 1,450% over the 24 hours leading up to late Wednesday.

HPE, however, stated that it intends to capture explosive artificial intelligence (AI) infrastructure growth with a focus on enterprise and sovereign customer segments. The company also noted that it plans to shift its portfolio to higher-growth, higher-margin businesses with an eye on long-term profits. Speaking at the meeting, CEO Antonio Neri said, “By aligning our investments and innovation to address the IT industry’s most promising opportunities in networking, cloud, and AI, we’re poised to gain share in the markets that matter most to our customers.”

Citing confidence in its outlook, HPE announced a 10% increase to its annual dividend for the fiscal year 2026. Its board authorized an additional $3 billion in stock repurchases. Among the focus areas outlined by the company are networking, the AI infrastructure market, high-margin GreenLake software and services growth, the unstructured data market, and next-generation server platforms.

In an 8-K filing with the SEC, HPE said, beginning in the first quarter of the fiscal year 2026, it plans to implement an organizational restructuring:

- Merger of the Server, Hybrid Cloud, and Financial Services business segments into a new segment named Cloud & AI’

- Transfer of the Telco and Instant On businesses to Corporate Investments and Other from Networking

The new reporting segments would be Cloud & AI, Networking and Corporate Investments & Other.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Greaves, Seales script rare 10th-wicket stand against India in Delhi

-

Virat Kohli Transfers Gurugram Property Power of Attorney To Brother Vikas At Tehsil Office Ahead of Australia Tour: Report

-

Apple's AI Search Chief Ke Yang Set To Exit Company To Join Meta Escalating Talent War

-

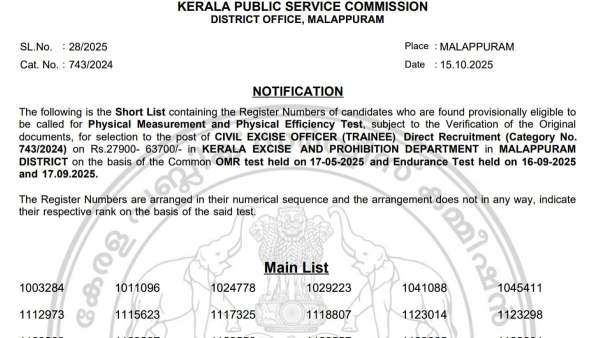

Kerala PSC CEO Recruitment 2025: Provisional Merit List Out; Here's How To Check

-

HSNC University Honours India’s Courageous Heroes