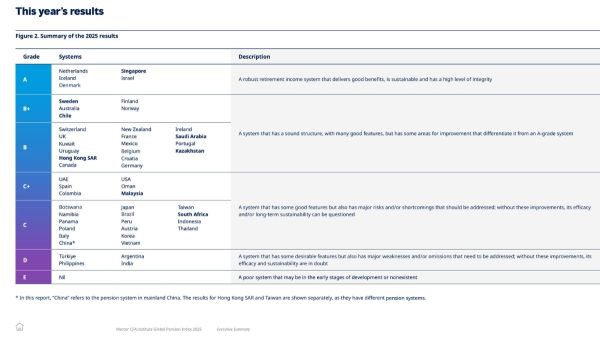

India's pension framework has been ranked among the worst globally, according to the 2025 Mercer CFA Institute Global Pension Index. The Index, now in its 17th year, evaluates retirement systems across 52 countries, representing 65 per cent of the world's population.

What the Index Measures

The Mercer CFA Institute Global Pension Index assesses retirement systems based on three core pillars: adequacy, sustainability, and integrity. These pillars carry respective weights of 40 per cent, 35 per cent, and 25 per cent.

Adequacy examines whether individuals can expect sufficient retirement income for a dignified post-work life. Sustainability measures whether systems can endure demographic and economic pressures while continuing to deliver benefits. Integrity assesses the robustness of regulatory frameworks that underpin long-term trust and reliability.

Where Does India's Pension System Stand?

With an overall score of 43.8, India remains in the D-grade category, highlighting serious concerns about the adequacy, sustainability, and integrity of its pension system.

The sub-index scores further reveal significant gaps: adequacy at 34.7, sustainability at 43.8, and integrity at 58.4. While regulatory stability and system governance show relative strength, the capacity to provide meaningful retirement income and long-term financial security remains a critical challenge.

India's Pension Structure And Why It Scored Last

India's retirement income system comprises an earnings-related employee pension scheme, the defined contribution (DC) Employee Provident Fund Organisation (EPFO), and supplementary employer-managed DC schemes, the report explained.

Government initiatives under the universal social security programme aim to cover the unorganised sector, but coverage remains limited, the analysis highlighted. The combination of these schemes has not yet produced a robust or inclusive system, contributing to India's low ranking, it added.

The Index highlights that India's overall score decreased slightly from 44.0 in 2024 to 43.8 in 2025, largely due to the addition of a new question in the sustainability sub-index.

Key factors impacting the score include limited coverage for unorganised workers, inadequate support for the poorest elderly, and insufficient mechanisms to preserve benefits exclusively for retirement purposes. Despite relative regulatory stability, these systemic gaps hinder adequacy and sustainability.

What Can India Do To Improve?

The report provides clear recommendations to enhance India’s pension system. Experts suggest:

- Introducing a minimum level of support for the poorest aged individuals.

- Expanding coverage for the unorganised workforce to increase accumulated retirement assets.

- Implementing a minimum access age to ensure benefits serve their intended purpose.

- Strengthening regulatory requirements for private pension schemes to enhance long-term reliability.

Netherlands Tops The Index

In comparison, the Netherlands leads with an A-grade score of 85.4, reflecting a highly structured, sustainable, and inclusive pension system. India’s low ranking underscores the urgent need for comprehensive reforms to provide economic security for its ageing population.

Pension reform is a complex balancing act, requiring governments, employers, and pension providers to align interests across generations and income levels.

For India, immediate focus on coverage, adequacy, and sustainability could gradually transform a fragmented system into one capable of delivering reliable and equitable retirement outcomes.

-

Google Drive’s special storage offer on Diwali

-

The child turned 10 years old? Don’t delay now, teach these skills that will make life easier.

-

DA of employees increased by more than 14%, Holi-Diwali of lakhs of families together!

-

Leave the cafes-malls in Delhi, celebrate a memorable date at these 5 places, your partner will be happy

-

28-year-younger wife of Hong Kong’s 5th-richest billionaire Joseph Lau flaunts self-made knitwear paired with luxury brands