FIIs make a strong comeback, buying Indian stocks worth ₹3,000cr

16 Oct 2025

Foreign institutional investors (FIIs) have returned to the Indian equity market with a bang.

After months of selling, they have bought over ₹3,000 crore worth of stocks in the secondary market between October 7 and October 14.

The buying spree comes as a surprise to many market watchers and has coincided with a steady uptrend in benchmark indices such as Sensex and Nifty.

FIIs also invest in primary market

Market activity

FIIs have also shown strong participation in the primary market, investing over ₹7,600 crore.

Provisional data from the National Stock Exchange (NSE) shows that FIIs bought another ₹162 crore on October 15.

The renewed buying has come as Sensex and Nifty have gained some 3% each since early October.

The BSE MidCap index has jumped 3.4% while SmallCap index has gained 1.7%.

Short-term rebound or sustainable inflow?

Investor outlook

The sudden change in foreign flows has surprised many. Some see it as a short-term rebound while others credit it to improving corporate earnings prospects and stabilizing macroeconomic conditions.

Sunny Agrawal of SBI Securities said, "Investors are hopeful of a positive outcome on the India-US trade agreement within the next 30-60 days, which could remove a key overhang."

However, he added that whether these inflows sustain or turn volatile remains to be seen.

Caution remains despite positive sentiment

Market volatility

Despite the positive sentiment, some analysts remain cautious. They warn that similar buying patterns in the past have often been followed by renewed selling.

Vinayak Magotra from Centricity WealthTech said, "Valuations have become more competitive compared to other emerging markets, and government stimulus, along with encouraging Q2 results, have reignited interest."

However, he cautioned that heavy short positions in derivatives and instances of fresh selling suggest lingering caution.

-

Rajkummar Rao Dedicates Filmfare Best Actor Critics Award To Soon-to-Be-Born Baby

-

China calls on Pakistan, Afghanistan to reach lasting truce

-

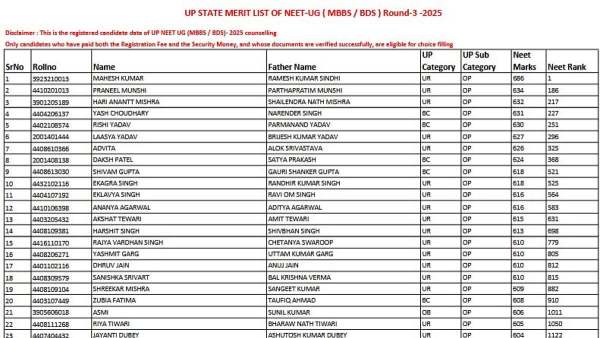

UP NEET 2025 Round 3: Revised State Merit List Out, 34,511 Students Eligible For Counselling; Choice Filling From October 17

-

Future of Cricket? Test Twenty format backed by de Villiers, Hayden, Harbhajan and Lloyd

-

This actress worked with Salman Khan, Hrithik Roshan, never gave single hit in Bollywood, still became top actress, her name is…