On Monday, the rupee reached a one-month high against the dollar.

India's rupee is wreaking havoc in the currency market. The continuous rise in the rupee for the past few days has brought the dollar back to its level. Due to which the rupee has reached a one month high. According to experts, the rupee is continuously strengthening due to the fall in crude oil prices and foreign investors. If experts are to be believed, the rupee may strengthen at the level of Rs 86 in the coming days. On the other hand, a decline in the dollar is also being seen in the international market. Whereas crude oil prices are trading at $61. Foreign investors have invested around Rs 6500 crore so far in the current month. The effect of which is visible in rupees. Let us also tell you at what level the rupee is trading in the currency market.

Rupee at one month high

Talking about the data, due to foreign capital inflows and low crude oil prices, the rupee rose by 14 paise to a one-month high of 87.88 against the US dollar in early trade on Monday. Sharp gains in the domestic stock market also strengthened the sentiment of the rupee. In the Interbank Foreign Currency Market, the rupee opened strongly at 87.94 and remained in a limited range due to limited business. In early trade, the rupee reached a low of 87.95 and a high of 87.88. Later, the local currency was trading at 87.88 against the US dollar, which is 14 paise higher than the previous closing price. On Friday, the rupee had closed at 88.02 against the US dollar. Stock and currency markets will remain open on Monday. According to information from BSE and NSE, the stock markets will organize a special Muhurat trading session on Tuesday from 1.45 pm to 2.45 pm for Lakshmi Puja.

Rise in stock market and fall in crude oil

Meanwhile, the dollar index, indicating the strength of the dollar against six currencies, rose by 0.02 percent to 98.45. Global oil benchmark Brent crude fell 0.31 percent to $ 61.10 per barrel in futures trade. In the domestic stock market, Sensex rose 668.88 points or 0.83 per cent to 84,621.07 in early trade on Monday, while Nifty rose 202.25 points or 0.79 per cent to 25,912.50. Analysts said that the capital market is being affected by the news of continuous buying by domestic institutional investors (DII), modest buying by foreign institutional investors (FII) and strong sales of automobiles and household items during the festive season.

What are the experts doing?

VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd, said, "There has been a slight change in FII activity in recent times. FIIs have significantly reduced their selling and in some days have even turned into buyers. As of October 17, FII selling has declined drastically to only Rs 4,114 crore. The main reason for this change in FII strategy is the mismatch between India and other markets." There is a reduction in the valuation gap. India's weak performance in the last one year has opened up possibilities for better performance in the future.

-

Gold Silver Price: What is the price of gold after Diwali, what is the price of 24 carat gold in your city?

-

PM Kisan Yojana: Didn't receive installments until Diwali, how long will we have to wait? See new updates..

-

South Africa vs Pakistan: Live Streaming, TV Broadcast Details For Women's World Cup Clash

-

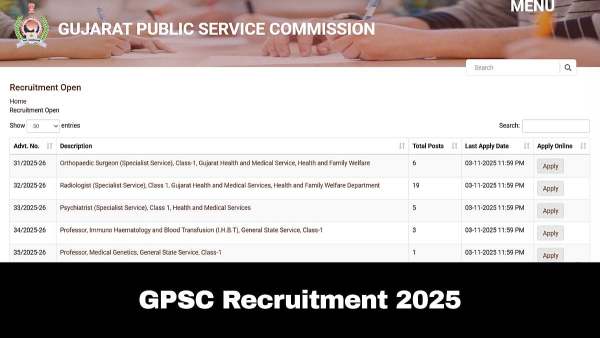

GPSC Recruitment 2025: Registration Process For 44 Posts Underway; Details Here

-

9-Year-Old Student Beaten With PVC Pipe By Principal At Bengaluru School; Police Launch Probe