UPI New Rule:UPI, which has become the most trusted medium of digital payments in India, is now going to become even more convenient. NPCI has announced that a new feature will be launched from December 31, 2025, under which users will be able to access all their UPI payments and autopayments from any one app.

Whether you have set up payment through Google Pay or PhonePe, now everyone’s records can be viewed and managed from one place. This UPI New Rule will prove to be a game-changer for those who get entangled in many apps every day.

All payments will be controlled from one app

Till now, users had to go to different apps to track their autopayments, such as electricity bills, mobile recharge or OTT subscriptions. But after the new feature this process will become very easy. You will be able to control all payments and autopayments from one place, from any app of your choice, be it Google Pay, PhonePe or Paytm.

This will make it easier than ever to view payment history, cancel or transfer autopayments, and estimate expenses. This change in the UPI system will make digital payments smoother, without any hassle.

Financial planning will be more accurate

The new feature will not only make payment management easier, but will also make your financial planning accurate. For example, if the electricity bill is on autopayment through Google Pay and the Netflix payment is through PhonePe, then now you will be able to track and manage both from any one app. This will provide better control over expenses and making budget will also be easier.

This UPI New Rule of NPCI will help users to keep an eye on their digital payments, so that the money account does not get disturbed.

New authentication features for security

NPCI has said that new authentication features are being added to make the UPI system more secure. Now users will be able to verify their transactions through biometric methods like face recognition or fingerprint. This will reduce the possibility of fraud and increase the security and transparency of payments. This update is an important part of the UPI New Rule, which focuses on making digital payments fraud-proof.

There will be no pressure from any app on users

NPCI has also made it clear that no user will be forced to use any particular app. The use of this feature will completely depend on the wishes of the user. Neither any cashback offer will be given nor any app will be promoted by sending notifications. This flexible approach of UPI will ensure that autopayments management is as per your convenience.

The new rule will be applicable till 31 December 2025

NPCI has directed all UPI apps and payment service providers to implement this new feature by December 31, 2025. After this, users will be able to track and manage their autopayments, such as bill payments, loan EMIs or subscription services, from a single platform.

This update will be especially beneficial for those who use multiple apps and want to keep a complete record of their expenses in one place. The journey of digital payments will become more fun with UPI New Rule!

-

Spain: High-speed train crash leaves at least 39 dead

-

The deserted UK 'ghost village' that was 'paused in time' for 35 years

-

Gurgaon Weather LATEST Update: Dense Fog or Sunny Relief? Check Forecast Here

-

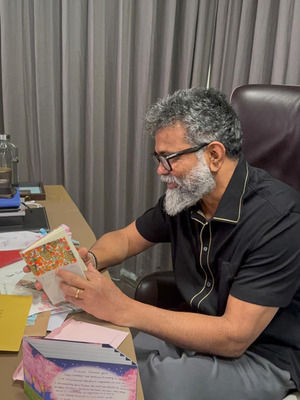

'Pushpa' director Sukumar on love from Japan: Cinema has no borders, only emotions!

-

Stop damp and mould on walls for good by wiping them with 1 natural item