Investing in your wife's name is considered a smart move these days. Investing in your wife's name offers tax savings, family protection, and emotional connection. However, sometimes people make mistakes with this special investment that they later regret. Poor planning can lead to missing out on the fundamental benefits of investing. So, let's learn the mistakes you should never make when investing in your wife's name.

Yes, investing in your wife's name can be a wise financial move, offering numerous benefits such as tax savings, family protection, and emotional connection. However, proper planning and avoiding some common mistakes are crucial to fully reap these benefits. It's important to understand the "clubbing rule" when investing. To avoid this, the wife should invest from her own income to receive tax benefits. So, let's explore some important things to keep in mind when investing.

1: Understand the tax benefits

Investing in the wife's name applies to clubbing rules and is added to the husband's income.

How to avoid this: Invest from the wife's own income (job, business); there is no clubbing.

Benefit: 1.5 lakh exemption under 80C, but from the wife's income.

2: Correct the nomination

The wife's name should be nominated for the investment.

How to avoid this: It is important to write the correct relationship when filling out the form, although you can change it later.

Benefit: Upon the wife's death, the money can be transferred directly to the children.

3: Match the risk profile

It is important to consider the wife's risk tolerance level.

How to avoid this: For a conservative wife, choose FD or PPF, and for an adventurous wife, mutual funds are best.

Benefit: Less stress, and the return is likely to be balanced.

4: Documents and KYC

The KYC and documentation in the wife's name must be correct.

How to avoid this?: Keep your Aadhaar, PAN, and photo updated and avoid opening a joint account.

Benefit: Doing so will make claims easier.

5: Regular Review

Monitoring your investments is an important aspect.

How to avoid this?: Check and adjust every year.

Benefit: Track your goals for the best outcome.

Before investing in your wife's name, it's important to pay attention to tax rules, nomination details, risk factors, and KYC updates. Additionally, review your investments periodically to ensure returns are secure and avoid any legal or financial hassles in the future. (Note: This article is for informational purposes only and should not be construed as investment advice. It's recommended to consult a financial advisor before making any investment decisions.)

Q1: What are the benefits of investing in your wife's name?

A: Tax savings, family protection, and emotional connection are the main benefits.

Q2: How to avoid the clubbing rule?

A: Invest from your wife's own income; avoid adding it to your husband's income.

Q3-Why is nomination necessary?

With proper nomination, the money is transferred directly to the children or nominee upon the wife's death.

Q4-Which investment option should be chosen?

A-According to the wife's risk profile: FD/PPF for conservatives, mutual funds for adventurous people.

Q5-How often should investments be reviewed?

A-Check the investment status every year and adjust if necessary.

Disclaimer: This content has been sourced and edited from Zee Business. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

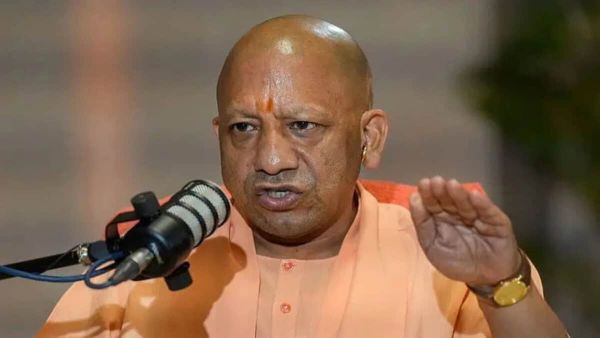

CM Yogi links Halal-certified products to terror funding, claims Rs 25K crore raised

-

Urdu journalists excluded from Delhi CM’s Diwali party; Scribes unhappy

-

RSS worker forces elderly Dalit man to lick urine near temple in UP

-

Rachel Reeves on brink as 'stubborn' inflation remains at 3.8% hitting your wallet

-

I bought this pressure washer on sale and it's a car and garden cleaning game changer