SBI Life Insurance Company Ltd reported a steady performance for the second quarter and first half of FY26, maintaining its leadership position in the private life insurance segment. The company continued to strengthen its premium growth, profitability, and embedded value while preserving a strong solvency position.

SBI Life retained the top spot in the private market with a 25.4% share in Individual New Business Premium and 22.6% share in Individual Rated Premium. The company’s Annualized Premium Equivalent (APE) grew 10% to ₹9,920 crore, while the Total New Business Sum Assured surged 99% to ₹7,11,740 crore, showing strong momentum in new policy issuance.

Financial Performance (H1 FY26 vs H1 FY25):

-

New Business Premium: ₹18,350 crore, up 17%

-

Renewal Premium: ₹24,550 crore, up 21%

-

Gross Written Premium: ₹42,900 crore, up 19%

-

Individual New Business Premium: ₹12,170 crore, up 6%

-

Profit After Tax (PAT): ₹1,090 crore, up 4%

-

Value of New Business (VoNB): ₹2,750 crore, up 14%

-

Indian Embedded Value (IEV): ₹76,000 crore, up 15%

-

Assets under Management (AUM): ₹4.81 lakh crore, up 10%

SBI Life reported a VoNB margin of 27.8%reflecting consistent profitability from new business, while the Operating Return on Embedded Value stood at 17.6%. The company’s net worth increased 13% to ₹18,290 crore as of September 2025.

On the operational front, the insurer maintained a robust solvency ratio of 1.94well above the regulatory requirement of 1.5. The 13th-month persistency ratio improved to 87.1%highlighting better customer retention.

SBI Life continues to benefit from its extensive distribution network of over 3.43 lakh trained insurance professionals and 1,154 offices nationwide. Bancassurance remains the key channel, contributing 57% of APEfollowed by the agency network at 29% and other channels at 14%.

Despite a slight rise in cost ratios — total cost ratio at 10.9% and operating expense ratio at 6.2% — profitability remained strong due to growth in high-value segments and a healthy mix of products.

SBI Life Insurance Company

-

Landman Season 2 Episode 4 release date, time, schedule, how to watch and Episode 3 ending explained: Global streaming timings, runtime, what to expect

-

Marty Supreme impresses with a 96% Rotten Tomatoes score; even so, Timothée Chalamet’s best-rated film is from 8 years ago

-

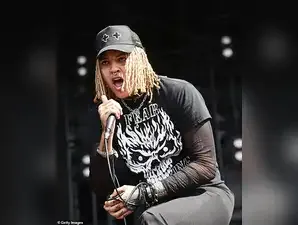

POORSTACY’s cause of death remains ‘unclear’ as 26-year-old rapper found dead after 10 days in Florida hotel

-

Who is Rapper POORSTACY and how did he die? See singer’s career, record labels, legal issues, legacy, tributes and reactions

-

Rapper POORSTACY real name, net worth and family: Here's initial death report of hotel incident, eyewitness account and timeline of events