- Whirlpool’s shares decline 2.4% in the extended session, following the quarterly report.

- Revenue rose 1%, while adjusted EPS declined by over 37%.

- Whirlpool says its results were impacted by Asian competitors' inventory loading.

Whirlpool Corp.’s shares declined 2.4% in the after-hours session on Monday, but retail sentiment improved as the appliances maker issued upbeat quarterly results and issued a better-than-expected forecast. Investors seemed to be holding off for more details on the company’s analyst call scheduled for 8 am ET on Tuesday.

Whirlpool has been struggling for years due to high inflation, which has dented sales, and competition from overseas appliance makers such as Samsung and LG Electronics. Last month, the company complained to the U.S. government that some of its competitors were underreporting the value of goods imported to the U.S. to evade tariff costs.

Beats All Around

Whirlpool said it expects 2025 adjusted earnings of around $7 on revenue of $15.80 billion. Analysts expect EPS of $6.41 on revenue of $15.49 billion.

For the third quarter, the company’s adjusted profit fell to $2.09 per share, down from $3.43 a year ago. Analysts were expecting $1.39. Revenue rose 1% to $4.03 billion, also beating analysts’ expectations of $3.93 billion.

"Our third quarter results continued to be impacted by the inventory loading from Asian competitors,” CFO Jim Peters said in a statement. “Meanwhile, we continued to focus on what is within our control and delivered cost take out in line with expectations, putting us on track to achieve approximately $200M of cost take out in 2025."

What is Retail Investors’ View?

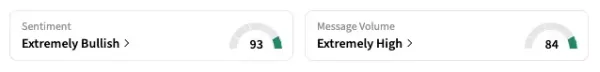

On Stocktwits, retail sentiment shifted to ‘extremely bullish’ as of early Tuesday, up from ‘bullish’ the previous day, with several users viewing the earnings report positively.

“$WHR starting position after E/R to bottom fish on solid results and positive outlook,” said one user.

“$WHR earnings better than the whisper and no one takes notice. Abandoned by longs. Maybe time to nibble. Will see if dividend is safe,” said another user.

As of the last close, Whirlpool’s shares are down 35.6%. They currently trade near an over five-year low.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Chiranjeevi files police complaint over AI-generated deepfake

-

Canva, PUBG, Snapchat down in major AWS outage; were Indian users affected?- The Week

-

Cat Adventure Game Stray Reportedly Coming to PS Plus Essential in November

-

What Does ‘Open Source’ Actually Mean, And How Did It Start?

-

Beau Webster admits Ashes selection uncertainty but remains confident of contributing to Australia