LIC Housing gets profit of ₹1349 crore

LIC Housing Q2 Results: LIC Housing Finance, one of the country's largest housing finance companies, has released its quarterly results. The figures for the second quarter (Q2) ending in September present a mixed picture. The company has registered a slight increase in profits and there has also been a jump in interest income (NII). But, despite these positive figures, investor confidence in the stock market seems to be shaken. The question is, when the company is earning, why are its shares disappointing investors?

Interest income provided support

According to data released by LIC Housing Finance, the company has earned a net profit of ₹ 1,349 crore in the quarter from July to September 2024. If we compare this with the same period last year, it is a very nominal increase of 1.6%. In the same quarter last year, the company had made a profit of ₹ 1,328 crore. This slow growth in profits shows that the company is stable, but is not able to gain momentum.

The main support for the company's performance comes from its interest income (Net Interest Income – NII). This is the money that the company earns from the difference between the interest earned on loan and the interest paid on deposits. NII grew by 3.3% to ₹2,048 crore in the quarter, compared to ₹1,981 crore last year. The company says that the demand for home loans in the market has remained stable, which has benefited them. The number of loan takers has been good especially for affordable and middle-income group homes, which is the main market of LIC Housing.

last quarter was better

If we look at the performance of the first quarter of the current financial year (April-June 2024), the picture was more or less the same, in fact a little better. In the June quarter, the company's net profit increased by 4.4% to ₹ 1,364 crore. During that period, the company's revenue increased by 7% to ₹7,233 crore and NII also increased by 4% to ₹2,076 crore. That is, the performance of the current quarter (Q2) has been a bit weak compared to the previous quarter.

Now let us talk about loan disbursements, which is a major measure of the health of any finance company. According to June quarter data, the company disbursed total loans of ₹13,116 crore, which was more than ₹12,915 crore last year. The good thing in this is that 'Individual Home Loans' given to common people to buy houses saw an annual growth of 3% and stood at ₹ 11,247 crore.

But, a major cause for concern was seen in the 'Project Loan' segment. This is the loan that the company gives to builders or big real estate projects. The company has taken utmost care on this front. Project loan disbursement dropped by more than 70% from ₹521 crore to just ₹156 crore. This sharp decline shows that the company is either hesitant in giving loans to big projects or the demand in this sector has weakened.

'Tortoise move' of LIC Housing Shares

The company's profit and income figures may not be in the red, but they have not completely met market expectations. The market does not consider annual profit growth of 1.6% as 'great'. This is the reason why investors are not showing enthusiasm in the company's shares. On Wednesday, just ahead of the results announcement, the stock closed at ₹593.90 with a marginal gain of 1.37%.

But if we take a long-term view, the picture is disappointing. This stock has given a negative return (loss) of 2.13% to its investors in the last six months. At the same time, investors who had invested money in it a year ago are facing a loss of 6.83% today.

Disclaimer: This article is for information only and should not be considered as investment advice in any way. TV9 Bharatvarsha advises its readers and viewers to consult their financial advisors before taking any money-related decisions.

-

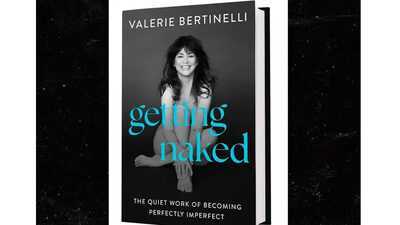

Valerie Bertinelli Opens Up About a Dark Past: Abused at Just 11 Years Old

-

Gujarat records 4,890 emergency cases on Holi-Dhuleti, 22 pc higher than normal

-

"Today, we were good all the way through": Santner hails NZ's win over SA in T20WC semifinal

-

Sky Sports commentator gives health update after taking break for mystery condition

-

Premier League: Joao Pedro hat-trick helps Chelsea sink Aston Villa