If you want to earn fixed interest while keeping your money safe, then Fixed Deposit (FD) is still the most favorite scheme of Indian investors. But before investing money in FD, it is important to know which bank is giving how much interest. Recently many banks have changed their interest rates, and now some banks are giving great returns on one year FD. Let’s take a look at the interest rates of top banks.

HDFC Bank: Reliable and attractive returns

HDFC, the country’s largest private bank, is offering 6.25% interest to common citizens and 6.75% interest to senior citizens on one year FD. If you choose a long term FD, the interest rates can be even better. This bank is a great option for those who want a safe investment.

ICICI Bank: More profits in the long run

ICICI Bank also offers 6.25% (common citizens) and 6.75% (senior citizens) interest on one year FD. But if you choose an FD for a tenure of two years or more, you can get returns ranging from 6.60% to 7.10%. This is great for those who want to invest for a longer period of time.

Kotak Mahindra Bank: Good returns in short term

Kotak Mahindra Bank is offering 6.25% (common citizens) and 6.75% (senior citizens) interest on one year FD. The bank says that the highest interest is available on FDs of 391 days to 23 months. If you want to invest for a short period, then this bank may be right for you.

Federal Bank: Bumper interest on long FD

Federal Bank offers 6.25% (general) and 6.75% (senior citizens) interest on one year FD. But if you choose 999 days FD, you can get great returns of up to 6.70%. This is a good option for those who want to lock money for a long period of time.

State Bank of India (SBI): Government trust, excellent returns

The country’s largest government bank SBI is offering 6.25% (general) and 6.75% (senior citizens) interest on one year FD. If you choose FD of 2 to 3 years, you can get returns ranging from 6.45% to 6.95%. SBI’s trust and good interest rates make it the choice of investors.

Union Bank of India: Highest interest paying bank

Union Bank is a little ahead in this list. It gives 6.40% interest to general citizens and 6.90% interest to senior citizens on one year FD. If you choose a three-year FD, the interest rate can range from 6.60% to 7.10%. This bank is great for those who want high returns.

Canara Bank: 444 days special scheme

Canara Bank is offering 6.25% (general) and 6.75% (senior citizens) interest on one year FD. But its 444 days FD scheme is the most popular, in which you can get returns up to 6.50% and 7%. This scheme gives higher profits in a short period.

Punjab National Bank (PNB): Attractive offers

PNB offers 6.25% (general) and 6.75% (senior citizens) interest on one year FD. If you choose 390 days FD, you can get a great interest of up to 7.10%. This bank is good for those who want quick and high returns.

Interest rates of banks at a glance (one year FD)

- HDFC Bank: 6.25% (General), 6.75% (Senior)

- ICICI Bank: 6.25% (General), 6.75% (Senior)

- Kotak Mahindra Bank: 6.25% (General), 6.75% (Senior)

- Federal Bank: 6.25% (General), 6.75% (Senior)

- Union Bank of India: 6.40% (General), 6.90% (Senior)

- SBI: 6.25% (General), 6.75% (Senior)

- Canara Bank: 6.25% (General), 6.75% (Senior)

- Punjab National Bank: 6.25% (General), 6.75% (Senior)

Keep this in mind before investing in FD

Just looking at the interest rates before investing money in FD is not enough. You should also keep in mind your investment tenure, tax slab and liquidity requirement. If you are a senior citizen, most banks give you 0.50% additional interest. Also, check your past relationship with your bank or online FD options. Many banks offer up to 0.10% more interest on online FD. With the right information and smart planning, you can earn maximum profits from your investment!

-

Share Markets Continue Trading In Red, Sensex Breaches 85,500, Nifty Tests 26,100

-

Bangladesh Nationalist Party Thanks PM Modi For Support As Khaleda Zia Battles Critical Illness

-

'Joined & Resigned On Same Day': TCS Employee Forced To Quit After Refusal To Accept Change In Terms

-

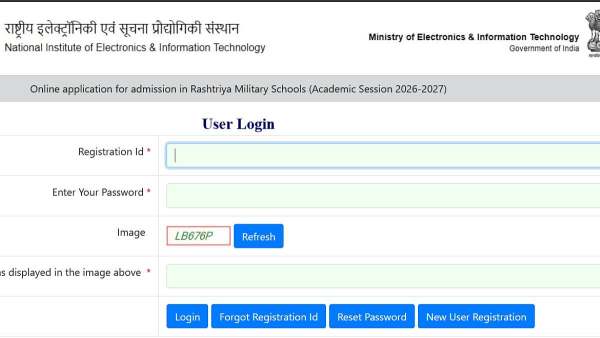

RMS CET 2025 Admit Card Out; Class 6 & 9 Entrance Exam On December 7

-

Bigg Boss 19 EXCLUSIVE: Abhishek Bajaj Spills Tea On Who's Clever, Fake, Dumb & Real Player In Bigg Boss 19