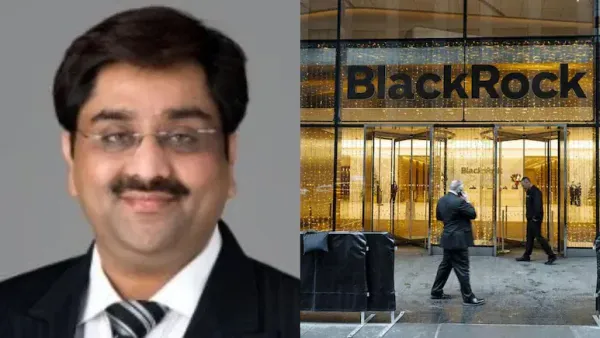

BlackRock Loan Fraud: America BlackRock loan scam has been in the news for the last few days. The accused in this scam is Bankim Brahmbhatt of Indian origin. He has been accused of a scam of more than Rs 4300 crore in America. The private-credit investing branch of American multinational investment company BlackRock and other lenders are trying to recover this amount. At the same time, Bankim Brahmbhatt has termed the allegations against him as false. Lenders have accused him of manipulating accounts receivable, which were to be used as loan collateral. In America this scam is being called unbelievable. According to a report in the Wall Street Journal, lenders have accused him of falsifying the accounts, which were to be used as loans.

Who is Bankim Brahmbhatt?

Bankim Brahmbhatt is an Indian-origin entrepreneur who is the Chairman and CEO of ‘Bankai Group’, a group of telecom-services and financing companies in America. He is the owner of Broadband Telecom and Bridgevoice, two lesser-known companies in the global telecommunications services sector. Both companies are lesser-known companies in the global telecom-services sector. There is not much information available about Bankim Brahmbhatt on the internet. His profile on LinkedIn has been deleted.

Bankim Brahmbhatt has committed fraud and fraud of more than $500 million in America with the world’s largest asset management company BlackRock. Talking about Brahmbhatt’s companies, both the companies belong to Bankai Group, which in an ex-post in July had named Bankim Brahmbhatt as the President and CEO.

Bankai Group’s X Bio describes it as a globally recognized leader in the telecommunications industry, maintaining its place in the telecom technology and carrier business with telcos, operators and other companies.

Connectivity Solution gives Bhat’s companies

Bankim Brahmbhatt’s business provides infrastructure and connectivity solutions to other telecom operators around the world. According to the report of Wall Street General, till a few days ago Brahmbhatt was in his office in Garden City, New York.

hps To BlackRock bought it

According to the lenders, they created a network of financing vehicles, which include Carioux Capital and BB Capital SPV. It borrowed millions of dollars from private-credit investors led by BlackRock’s HPS Investment Partners. HPS Investment Partners is a private-credit company, which was recently purchased by BlackRock.

Accused of using fake receivables

Lenders have accused him of forging customer invoices and using those fake receivables as collateral for loans of more than $500 million. Brahmbhatt’s lawyer has termed these allegations as false.

India and Mauritius In property transfer

According to lenders, he transferred his assets to India and Mauritius, while his companies and he himself have filed for bankruptcy. His lawyer has denied the allegations of fraud.

Where is Bankim Brahmbhatt now?

According to the report of WSJ, experts of Brahmabhatta say that Brahmabhatta is currently in India. A person working at HPS reportedly visited the Garden City offices of Brahmbhatt’s companies in July and found them closed. A neighboring tenant said that he had not seen anyone coming into the place recently.

The report said that at a house listed as Brahmbhatt’s residence, several luxury cars including two BMWs, a Porsche, a Tesla and an Audi were parked in the driveway near a dust-covered packet. The lender claims that their investigation revealed that every customer email sent over the past two years was fraudulent. There were also fake customer contracts from 2018.

Had applied for bankruptcy in August

Brahmbhatt’s telecom companies had filed for bankruptcy in August. Last week, Carioux Capital II and BB Capital SPV also joined. Brahmbhatt himself filed for personal bankruptcy on August 12, the same day his companies entered Chapter 11.

Why is this matter important?

This scam has made it clear how widespread the risks can be in the private-credit market. Especially when the collateral is not checked properly. This teaches us how important audit-check, customer verification and transparency are. It also highlights the complexities between an Indian-origin entrepreneur and large American investment firms, exposing the shortcomings of the global finance network.

-

CEC Gyanesh Kumar highlights global recognition as India set to chair International IDEA for first time

-

Raquel Escalante dead: Beloved TV presenter dies aged 28 after tragic cancer battle

-

Ben Stokes accused of being 'disrespectful' as England icon calls his side 'embarrassing'

-

X Factor star looks unrecognisable after ditching fame for life as spiritual healer

-

Frontline British troops get mobile brain scans in major medical breakthrough