Barclays increased the stock’s target price, stating the company continues to benefit from strong demand across its AI, cloud, and campus networking segments

- Arista Networks’ shares were down 12% in premarket trade despite posting growth in Q3 revenue and net income.

- The company’s revenue estimate for Q4 is higher than last year, but its gross margin forecast shows a drop.

- Retail investors recommend buying the dip.

Shares of Arista Networks Inc. (ANET) were down 12% in premarket trade on Wednesday despite posting a strong third-quarter print and getting a price target upgrade by Barclays.

Arista Networks’ third-quarter revenue and profit exceeded street expectations. The company, which makes hardware and software to connect and manage data center networks, reported a revenue of $2.31 billion, up 27.5% year-over-year. Analysts expected a revenue of $2.26 billion, according to Stocktwits.

Its adjusted earnings per share (EPS) stood at $0.75, compared to Wall Street estimates of $0.72, according to Stocktwits. Non-GAAP gross margin stood at 65.2%, roughly one percentage point above forecasts, and net income totaled $962 million, up 25%.

Q4 Outlook

The company projects fourth-quarter revenue between $2.3 billion and $2.4 billion, representing a 24% increase from $1.93 billion a year ago, at the top end of the range. It expects an operating margin of 47% to 48%, consistent with the level achieved last year. However, the non-GAAP gross margin forecast of 62% to 63% trails both the previous year’s 64.2% and the third quarter’s 65.2%.

Barclays raised the stock’s price target to $183 from $179 while maintaining an ‘Overweight’ rating after the company’s strong Q3 results. Analyst Tim Long noted that Arista continues to benefit from strong demand across its AI, cloud, and campus networking segments.

What Are Stocktwits Users Saying?

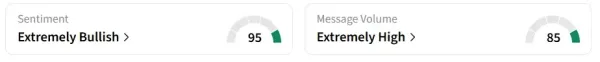

Despite the premarket decline, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a session earlier, accompanied by ‘extremely high’ message volumes. It was also among the trending stocks on the platform.

Users were bullish and were looking to “buy the dip.”

ANET stock has seen strong buying interest so far this year, with a 38% gain.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Cop accused in the Maharashtra doctor’s suicide suspended

-

Conductor pushes passenger off moving bus after fare dispute in Kolkata

-

Daily Horoscope - November 05, 2025 (For All Zodiac Signs Today)

-

Understanding Education Loan Interest Rates in India for 2025

-

Election Commission Team Visits Kolkata for Electoral Roll Revision