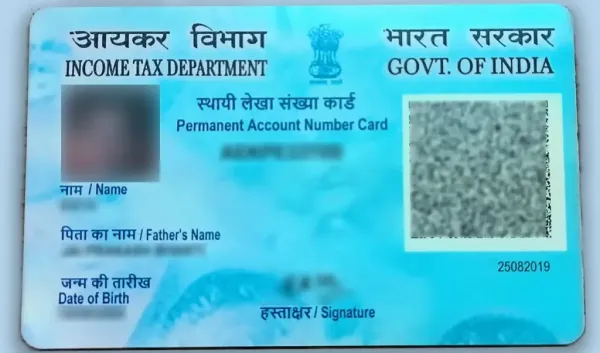

Requirement of PAN and Aadhaar linking

If you have not yet linked your PAN card with Aadhar card, do it as soon as possible. Recently the Income Tax Department has warned that if PAN is not linked to Aadhaar within the stipulated time limit, it will become inactive. The Central Board of Direct Taxes (CBDT) has said in a notice issued in April 2025 that if you do not link it, your PAN card will become inoperative. Therefore, do not forget to link your PAN card with Aadhaar by 31st December.

Effects of PAN card becoming inactive

Use of PAN card is required for opening a bank account, filing income tax return, taking loan, investing in stock market and other financial transactions. Let us know what problems can arise if PAN card becomes inactive.

Possible problems if PAN is inactive

If your PAN card becomes inoperative, you may face difficulty in using many services.

Like opening a bank or demat account, investing in stock market and mutual funds will become difficult. Additionally, you will not be able to deposit cash or fixed deposits more than Rs 50,000. There may also be problems in getting a loan, credit card or buying property. There will also be problems in availing the benefits of government schemes and subsidies. Thus, all your financial activities will come to a halt.

How to link PAN to Aadhaar online?

Follow the following steps to link PAN with Aadhaar:

– Select ‘Link Aadhaar’ option on the homepage.

– Enter your PAN and Aadhaar number.

– Click on ‘Validate’.

– If not linked, enter registered mobile number.

– Then enter OTP and click on ‘Submit’ button.

– A confirmation message will appear on the screen if linking is successful.

-

Bitcoin is rising sharply above $103K today: Why is BTC bouncing back again? Will the correction last? Latest Bitcoin price prediction is here

-

Paytm revenue rises 24%; to focus on merchants, AI, & loyalty: CEO Vijay Shekar Sharma

-

Spacewood Furnishers raises Rs 300 crore from A91 Partners to push manufacturing, retail presence

-

Black Friday 2025 kicks off early: Huge early deals live at Amazon, Walmart and Target

-

Is American Airlines shutting down? Texas-based company to cut hundreds of corporate jobs