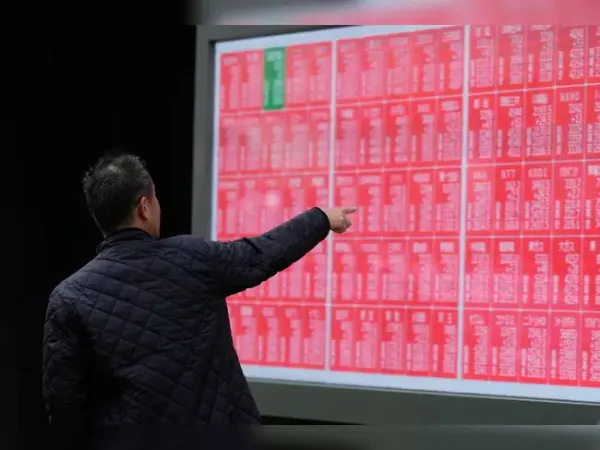

Tech shares were back under pressure Friday, leading major indices lower as President Donald Trump dismissed worries about an artificial intelligence stock bubble.

"No, I love AI. I think it's going to be very helpful," Trump said in response to an AFP reporter about whether there is an AI bubble.

"It's truly going to be the future, and we're leading the world."

But shares of Amazon, Google-parent Alphabet and AI chip giant Nvidia were among those in the red Friday, a dynamic that weighed especially heavily on the tech-rich Nasdaq Composite Index, which was down 1.1 percent at 22,794.81 around 1900 GMT.

The Dow Jones Industrial Average dipped 0.4 percent to 46,728.74, while the broad-based S&P 500 fell 0.6 percent to 6,677.97.

Tech giants such as ChatGPT-maker OpenAI have announced multiple massive projects throughout 2025, also spurring significant building plans for new electricity generation to bolster processing capacity.

But after multiple stock market records throughout the year, equity markets have hit resistance in recent days amid persistent concerns of overvaluation.

In a note Friday, Briefing.com analyst Patrick O'Hare pointed to the retreat in Palantir shares after the company reported strong earnings earlier this week as a sign of growing anxiety.

Unclear is whether "this loss of momentum is a simple profit-taking consolidation or the start of a larger valuation-driven correction," O'Hare said.

jmb/des

"No, I love AI. I think it's going to be very helpful," Trump said in response to an AFP reporter about whether there is an AI bubble.

"It's truly going to be the future, and we're leading the world."

But shares of Amazon, Google-parent Alphabet and AI chip giant Nvidia were among those in the red Friday, a dynamic that weighed especially heavily on the tech-rich Nasdaq Composite Index, which was down 1.1 percent at 22,794.81 around 1900 GMT.

The Dow Jones Industrial Average dipped 0.4 percent to 46,728.74, while the broad-based S&P 500 fell 0.6 percent to 6,677.97.

Tech giants such as ChatGPT-maker OpenAI have announced multiple massive projects throughout 2025, also spurring significant building plans for new electricity generation to bolster processing capacity.

But after multiple stock market records throughout the year, equity markets have hit resistance in recent days amid persistent concerns of overvaluation.

In a note Friday, Briefing.com analyst Patrick O'Hare pointed to the retreat in Palantir shares after the company reported strong earnings earlier this week as a sign of growing anxiety.

Unclear is whether "this loss of momentum is a simple profit-taking consolidation or the start of a larger valuation-driven correction," O'Hare said.

jmb/des