New Delhi. Securities and Exchange Board of India (SEBI) has warned investors about digital gold and online products to gold. SEBI has said that many online platforms are encouraging investors to invest in digital gold or e-gold products. It is being described as an alternative to investing in physical gold. However, these products do not come under the regulatory purview of SEBI and no investor protection mechanism is applicable to them.

-

Read this also The process of unit transfer in mutual funds became easier… SEBI changed the rules

SEBI advised

The regulator clarified that such digital gold products are neither recognized as securities nor regulated as commodity derivatives. Therefore investors cannot claim any kind of SEBI protection while investing in these products. SEBI advised investors to consider legitimate options offered by SEBI-registered entities for investing in gold or gold- instruments. For example gold ETFs or mutual fund schemes should be preferred. All these come under investor protection standards and regulatory framework.

Let us tell you that on the growing trend of digital gold, Tata Group’s Caratlane and other platforms like PhonePe, Google Pay and Paytm are now providing mobile-based digital gold options. Under this, people can buy gold from their smartphones. These companies provide this service in partnership with organizations like SafeGold, MMTC-PAMP and Tanishq.

What is digital gold?

Digital gold is a way to buy gold online which is backed by physical gold stored in secure and insured vaults. However, as per the recent notification of SEBI these items are not regulated under the investor protection norms of SEBI. Investors should also be aware that Goods and Services Tax (GST), Capital Gains Tax and Short Term Benefits Tax are also applicable when purchasing digital gold products.

-

NDA conceded defeat in Bihar polls: Khera

-

Inside Nita Ambani’s 10 most expensive luxury possessions

-

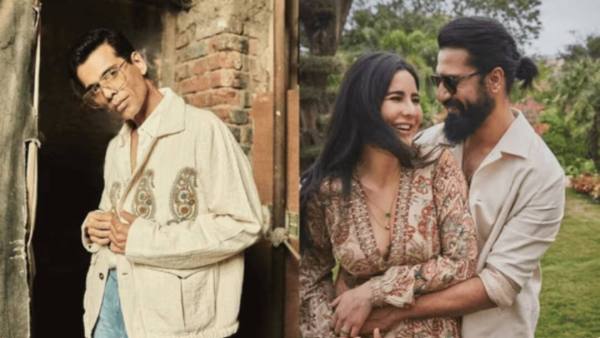

'Welcome To The Magical World Of Parenting': Karan Johar Congratulates New Parents Vicky And Katrina

-

Tej Pratap Yadav Wishes Brother Tejashwi On Birthday With Special Message

-

Arrest Made in Notorious 2009 Murder Case in Delhi After 16 Years