There's a whiff of change somewhere in the world of money changers. A small slice of funds remitted by Indians working abroad is taking a different route.

For about two months, this money has been coming in in the form of stablecoin - a type of cryptocurrency - instead of the customary transfers through high-street banks.

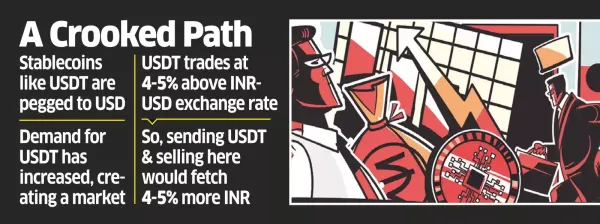

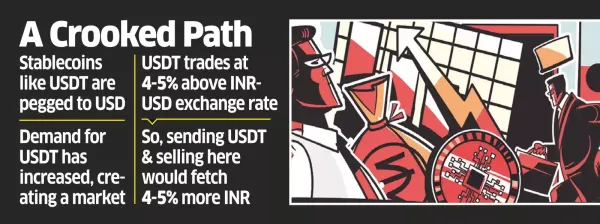

Since USDT, or stablecoin, trades at 4-5% premium in India, a crypto remittance fetches more than bank transfers. Pegged to the US dollar, stablecoins are issued by Tether, the company which manages the coin. While USDT is a proxy for the dollar, its price hovers around ₹93 in India compared with the current INR-USD exchange rate of ₹88.6 a dollar.

So, $1,000 sent by a worker from UAE or US through regular banking channels will convert into ₹88,600; but USDT bought in Dubai or New Jersey and sold in India would fetch ₹93,150 based on Saturday's USDT price of ₹93.15 a coin.

(Join our ETNRI WhatsApp channel for all the latest updates)

An NRI worker walking into a money changer's office is probably oblivious of the arbitrage opportunity. But instead of transferring the money to a bank, the man behind the counter buys USDT and moves them the wallet of his counterpart in India.

The latter may sell the coins in a peer-to-peer deal-with crypto buyers and sellers connecting on Telegram or unregulated platforms - escaping the 1% tax deducted at source; or, he may sell it on a local exchange, pay TDS and still be left with extra money which is split with customers.

Money changers earn a little more while their customers send a little more money to their folks. Besides, the transactions are quicker and cheaper than banks, though not kosher. A few money transfer firms have informally discussed the matter with some officials of the Reserve Bank of India. Market estimates are that about 3-4% of the remittances has moved from banks to stablecoins.

"Money transmitters in a few jurisdictions are now allowed to handle remittance in fiat currency as well as in cryptos, including stablecoins. For example, a company having a Money Transmission License in the US can accept USD, convert it into stablecoin and send it to the digital wallet of the beneficiary in India," said Purushottam Anand, advocate and founder of Crypto Legal.

These are early days and the flows are not big enough to worry banks. What may have triggered this is the rise in demand for USDT in India, said a crypto industry person.

Use of USDT to hedge against crypto volatility - with traders selling other cryptos and using the proceeds to buy stablecoins - and betting on real money games on offshore platforms have increased stablecoin demand. This has sustained the premium, creating a market for USDT coming from abroad.

NOT ALL KOSHER

All this may not go down well with the regulator. While recently RBI, for the first time, met a few members of the crypto community - perhaps to share inputs with the government - its position is unlikely to have changed .

RBI is backing the central bank digital currency (CBDC) - a centralised coin as against the decentralised cryptos like Bitcoin - for cross-border fund transfers. Unlike USDT or USDC (from another company Circle) issued by private entities, CBDCs are issued by central banks. For instance, the UAE has a plan to launch Dirham-based CBDC. So, RBI and the UAE central bank would have to put in place conversion and settlement mechanisms before Indians in UAE can send funds using CBDCs.

Meanwhile, sensing the arbitrage window and huge remittance market, private operators and cryptos players are testing the waters. Last week, a Bengaluru firm announced a plan for INR stable coin. If such a coin is listed overseas, members of the Indian diaspora or a foreign importer can buy stablecoins and transfer to anyone here. Sources said payments for some service exports, which are not reported in the central EDPMS portal for monitoring transactions, are also happening in stablecoins.

For about two months, this money has been coming in in the form of stablecoin - a type of cryptocurrency - instead of the customary transfers through high-street banks.

Since USDT, or stablecoin, trades at 4-5% premium in India, a crypto remittance fetches more than bank transfers. Pegged to the US dollar, stablecoins are issued by Tether, the company which manages the coin. While USDT is a proxy for the dollar, its price hovers around ₹93 in India compared with the current INR-USD exchange rate of ₹88.6 a dollar.

So, $1,000 sent by a worker from UAE or US through regular banking channels will convert into ₹88,600; but USDT bought in Dubai or New Jersey and sold in India would fetch ₹93,150 based on Saturday's USDT price of ₹93.15 a coin.

(Join our ETNRI WhatsApp channel for all the latest updates)

An NRI worker walking into a money changer's office is probably oblivious of the arbitrage opportunity. But instead of transferring the money to a bank, the man behind the counter buys USDT and moves them the wallet of his counterpart in India.

The latter may sell the coins in a peer-to-peer deal-with crypto buyers and sellers connecting on Telegram or unregulated platforms - escaping the 1% tax deducted at source; or, he may sell it on a local exchange, pay TDS and still be left with extra money which is split with customers.

Money changers earn a little more while their customers send a little more money to their folks. Besides, the transactions are quicker and cheaper than banks, though not kosher. A few money transfer firms have informally discussed the matter with some officials of the Reserve Bank of India. Market estimates are that about 3-4% of the remittances has moved from banks to stablecoins.

"Money transmitters in a few jurisdictions are now allowed to handle remittance in fiat currency as well as in cryptos, including stablecoins. For example, a company having a Money Transmission License in the US can accept USD, convert it into stablecoin and send it to the digital wallet of the beneficiary in India," said Purushottam Anand, advocate and founder of Crypto Legal.

These are early days and the flows are not big enough to worry banks. What may have triggered this is the rise in demand for USDT in India, said a crypto industry person.

Use of USDT to hedge against crypto volatility - with traders selling other cryptos and using the proceeds to buy stablecoins - and betting on real money games on offshore platforms have increased stablecoin demand. This has sustained the premium, creating a market for USDT coming from abroad.

NOT ALL KOSHER

All this may not go down well with the regulator. While recently RBI, for the first time, met a few members of the crypto community - perhaps to share inputs with the government - its position is unlikely to have changed .

RBI is backing the central bank digital currency (CBDC) - a centralised coin as against the decentralised cryptos like Bitcoin - for cross-border fund transfers. Unlike USDT or USDC (from another company Circle) issued by private entities, CBDCs are issued by central banks. For instance, the UAE has a plan to launch Dirham-based CBDC. So, RBI and the UAE central bank would have to put in place conversion and settlement mechanisms before Indians in UAE can send funds using CBDCs.

Meanwhile, sensing the arbitrage window and huge remittance market, private operators and cryptos players are testing the waters. Last week, a Bengaluru firm announced a plan for INR stable coin. If such a coin is listed overseas, members of the Indian diaspora or a foreign importer can buy stablecoins and transfer to anyone here. Sources said payments for some service exports, which are not reported in the central EDPMS portal for monitoring transactions, are also happening in stablecoins.