Bihar election results are going to come on 14th November

Bihar assembly elections results: The excitement seen in the stock market as soon as the exit polls of Bihar Assembly elections came out, has once again started the old debate as to what is the relationship between politics and the market. Sensex jumped 750 points and Nifty jumped 230 points amid claims of a big victory for NDA in the exit polls. But, along with this, a report is also scaring that if the results on November 14 do not come as expected and NDA is defeated, then there may be an 'outcry' in the market.

This is the fear of every investor who has invested his money in the market during the election season. Election results day is not like any ordinary business day; It is a mixed cocktail of hope and panic. The question is whether there is real earning on the election day or is the money lost?

What is the relationship between elections and market?

Does the course of Dalal Street change with the change of state government? If we look at the history of the last few elections in Bihar, the answer is both 'yes' and 'no'.

In 2010, when NDA registered a massive victory under the leadership of Nitish Kumar, it did not have any significant impact on the market. At that time, the country was trying to recover from the global recession of 2008 and investors were more focused on the recovery of 'Wall Street' (US market) than on domestic reforms. The market gave a clear message that it is more concerned about Delhi and the world than the politics of the state.

But the story of 2015 was different. Narendra Modi was in power at the center and this election was being seen as a test of his popularity. When the results came and the grand alliance (Nitish-Lalu) defeated BJP, the market panicked the very next day. Sensex fell by 391 points. Investors feared that this defeat might stall the Centre's major reforms (like GST). However, this fear lasted only for a few moments. Which analysts call a 'knee-jerk reaction'. Within a few days, the market stabilized as investors understood that there was no threat to the stability of the Center due to the results of Bihar.

The 2020 election was even different. The country was fighting Covid-19. NDA definitely won, but the market's focus was on the vaccine trial and the economy recovering from the lockdown. Bihar results were no big news for the market.

When exit polls 'failed'

The impact of state elections may be limited, but when it comes to Lok Sabha i.e. general elections, the market holds its breath. The market hates 'uncertainty' the most. The biggest example of this is the general elections of 2024.

Last year, exit polls were claiming a strong government, but when the results came, BJP fell short of majority. This was a shock to the market. The panic among investors about a weak coalition government spread so much that the Nifty fell by 10% in a single day. This decline shows that the market is not afraid of 'leadership' but of 'instability'. When doubts arise about government policies (especially defence, infra and PSUs), investors start withdrawing their money.

However, it is not necessary that this happens every time. Even in 2004, the results were completely opposite to the exit polls. But that day (13 May 2004) the market remained almost 'flat'. Sensex gained marginally by only 41 points (0.77%).

Celebrate with 'stable government'

When the market gets what it wants, i.e. 'stability', it celebrates. The biggest example of this is the 2009 elections. The world was in the grip of recession. Manmohan Singh's policies were being praised. When the results came (Saturday, May 16), the stable UPA government came back. When the market opened on Monday (May 18), it broke all records. Sensex took a historic jump of 17.34% and climbed 2,110 points. Even when the 'Modi era' started in 2014, the market welcomed it. On May 16, the day of results, the Sensex closed 1.11% higher.

But the result of 2019 was the most interesting. Modi government came back stronger. On May 23, the day of results, the market celebrated, Sensex crossed 40,000 and Nifty crossed 12,000. But this celebration lasted only till the day's business. By evening the market closed in 'red' mark. Sensex fell by 298 points. This is called 'profit booking'. Meaning, investors already knew that victory was certain, they had already made purchases and as soon as the news was confirmed, they pocketed their profits.

What should an investor do?

Understand that the stock market does not love any particular party, but loves 'stable and decisive' leadership. If the results are clear and show a picture of a strong government, the market salutes. If the results point to a 'hung' or 'weak alliance', the market gets nervous.

The impact of state elections often lasts for a few days, but general elections can decide the direction of the market for a long time. The lesson for a common investor is that instead of getting worried about the volatility on the day of results, one should focus on the economic policies of the country and the performance of the companies.

-

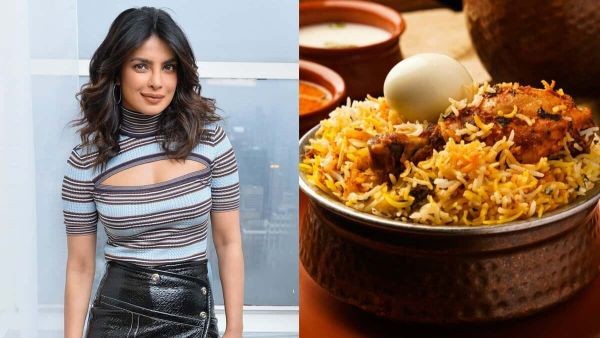

‘Biryani is the best in the world in Hyderabad’: Priyanka Chopra

-

Dharmendra Health Update: Video Of Ailing Veteran Actor Goes Viral; Netizens Slam Instagram User For Sharing It, 'Shame On You'

-

ECGC PO Recruitment 2025: PO recruitment for graduates in government companies, salary will be more than 88000..

-

How to Raise a Baby on a Budget: Practical Tips for New Parents

-

How many eggs are 'safe to eat' per day?