BCL Industries Ltd a small-cap company in the breweries and distilleries sector announced its September quarter (Q2FY26) results on Wednesday. At the time of writing the companys stock was trading at Rs 38.23 down 3.22% or Rs 1.27 on the NSE at 11:01 am while on the BSE the stock was trading at Rs 38.25 down 2.97% or Rs 1.17. BCL Industries Q2 FY26 Results The companys total revenue in the September quarter was ₹720 crore a 12.4% decrease from ₹822 crore in the previous quarter (June 2025). This revenue was also 4% lower than the previous years September quarter (₹748 crore). Despite the decline in revenue the companys operating profit increased to ₹67 crore. This is significantly higher than the ₹53 crore in the previous June quarter and ₹55 crore in the same quarter last year. Due to improved profitability the companys operating margin increased to 10% from 7% in June 2025 and 8% in September 2024. Net profit was ₹32 crore slightly lower than the ₹33 crore in the June quarter but higher than the ₹30 crore in September 2024. Segment Performance and Distillery Dominance Segment-wise the Maize Oil Extraction and Refinery segment contributed less. Revenue from this segment was ₹183.31 crore significantly lower than ₹300.59 crore in June 2025 and ₹266.39 crore in September 2024. However the distillery segment remained the companys primary source of revenue. Revenue from this segment increased to ₹348.03 crore from ₹310.49 crore in the previous quarter and ₹295.98 crore in the previous year reflecting continued market demand. Real estate revenue declined slightly to ₹1.50 crore. The companys subsidiary Kharagpur-based Swaksha Distillery Limited recorded revenue of ₹243.58 crore an increase from previous quarters. Goyal Distillery Private Limited (a 100% subsidiary) had negligible revenue (₹0.016 crore). After adjusting for intersegment revenue (₹55.54 crore) net sales from operations stood at ₹720.88 crore reflecting a quarter-on-quarter decline but a broadly stable year-on-year performance. [3:03 pm 13/11/2025] Victor Dasgupta: Man Infraconstruction announces dividend along with Q2 results check share price and other details The stock of construction company Man Infraconstruction Ltd is trading in the green today. As of 1:25 pm the stock was trading at Rs 135.90 up 0.22 % or Rs 0.30 on the NSE while on the BSE it was trading at Rs 136.24 down 0.46% or Rs 0.63. The stock in focus as the company has released its September quarter (Q2 FY26) results. The company said that its consolidated net profit increased by 27.27% to ₹60.01 crore in Q2 FY26 while revenue declined by 28% to ₹148.75 crore. Profit before tax in the September 2025 quarter was ₹78.06 crore which is an increase of 23.9% on a year-on-year basis. The companys EBITDA increased by 32.61% to ₹36.6 crore. However EBITDA margin decreased from 12% to 24.6%. The company reduced total expenses by 43.74% to ₹116.93 crore in the quarter. Despite this raw material costs stood at ₹51.41 crore registering a growth of 28.27% while employee expenses stood at ₹16.61 crore up 9.42%. Segment-wise real estate revenues were ₹86.42 crore a decline of 44.15%. EPC segment revenues were ₹63.09 crore a decline of 16.89%. The company recorded collections of ₹183 crore in Q2FY26 and ₹417 crore in H1FY26. On a half-year basis net profit fell 10.1% to ₹118.33 crore while operating revenues declined 42.01% to ₹331.65 crore. Manan Shah Managing Director Man Infraconstruction said Our consolidated PAT grew 24% YoY in Q2FY26 and recorded a healthy PAT margin of 29.5%. MICL has achieved steady profitability improvement due to its focus on the bottom line. At the start of the festive season the group launched its luxury project Artek Park in BKC. We are maintaining strong sales momentum in existing projects and upcoming launches will further boost growth in the coming quarters. With a strong balance sheet and ample liquidity the company is well-positioned to capitalise on opportunities in domestic and international micro-markets. The company has announced its second interim dividend for FY26. The company stated that it will pay shareholders a dividend of 22.5% i.e. an interim dividend of ₹0.45 per equity share of face value ₹2. The company has set the record date for the interim dividend as November 18th and the payment date as December 2nd.

-

Maneka Gandhi Calls For Humane Stories On Animals: 'Every Scene Of Kindness Matters'

-

Sri Lanka Players Take U-Turn After SLC Directive? Full Squad Stays On For Revised PAK vs SL ODIs, Tri-Series

-

OnePlus 15 To Launch In India Today: How To Watch Live

-

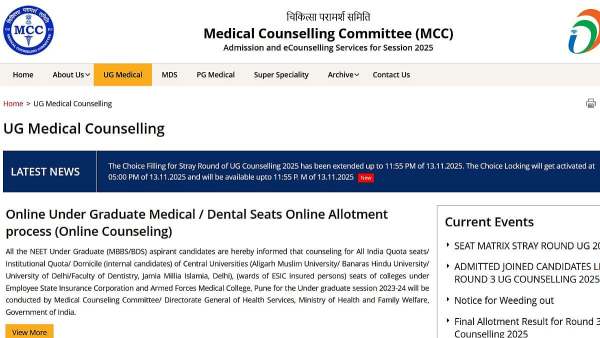

NEET UG Counselling 2025: MCC Extends Stray Round Choice Filling Till Today; Check Details

-

Anirudh Ravichander, Kavya Maran Spotted Strolling Together On New York Streets Amid Dating Rumours; Photo Goes Viral