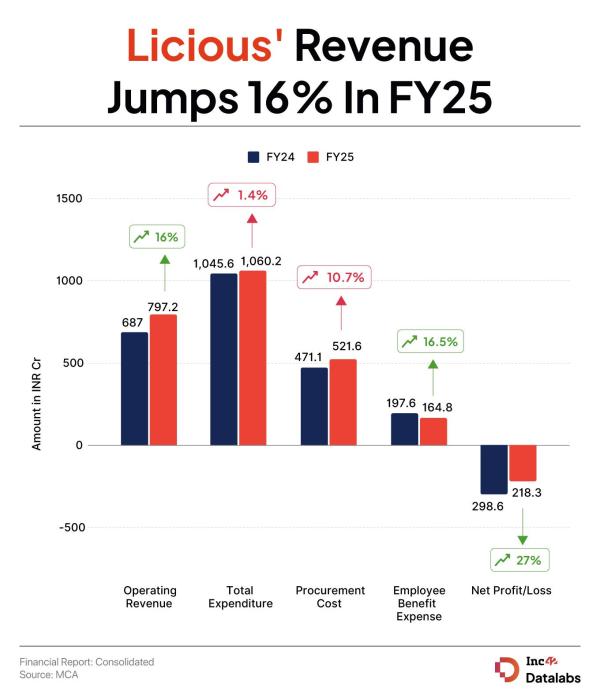

Bengaluru-based meat delivery unicorn Licious’ consolidated net loss narrowed 27% to INR 218.3 Cr in FY25 from INR 298.6 Cr in the previous fiscal year, on the back of robust revenue growth and flat expenses.

The startup, which started as a D2C platform before becoming an omnichannel brand, saw its operating revenue jump 16% to INR 797.2 Cr during the year under review from INR 686.9 Cr in FY24.

Including other income of INR 47.4 Cr, total income stood at INR 844.6 Cr in FY25.

In a statement last month, Licious said it has tightened its cost structure and its EBITDA loss fell 45% to INR 163 Cr in FY25 from INR 296 Cr in the previous fiscal year.

Founded in 2015 by Vivek Gupta and Abhay Hanjura, Licious has a farm-to-fork model, meaning it owns the entire back-end supply chain. It sells meat, seafood, cold-cuts, and ready-to-eat meat items through its website, quick commerce platforms, and offline stores.

It has raised a funding of over $550 Mn to date from the likes of Temasek, 3one4 Capital, IIFL, among others. It joined the unicorn club in 2021.

Currently, Licious has over 15 brand stores across Delhi NCR and Bengaluru. The startup is doubling down on its omnichannel strategy, with quick commerce and offline retail emerging as key growth pillars. It also plans to expand its online presence to 50 cities.

Where Did Licious Spend?Despite the 16% revenue growth, the meat delivery startup’s expenses remained almost flat during the year under review. Total expenses rose 1.4% to INR 1,060.2 Cr from INR 1,045.6 Cr in FY24.

Procurement Cost: This was the biggest expense for the unicorn, rising 10.7% to INR 521.6 Cr from INR 471.1 Cr in FY24.

Employee Benefit Expenses: Licious managed to cut its spending on employee benefits, which include salaries, PF contributions, gratuity, among others, by 16.5% to INR 164.8 Cr from INR 197.6 Cr in FY24.

Advertising Expenses: The unicorn also cut its advertising expenses by 24% to INR 77.6 Cr in FY25 from INR 102.2 Cr in the previous year.

As it prepares for its public listing, Licious has been phasing out offerings that have struggled to scale. Inc42 exclusively reported in September that the startup shut its plant-based meat platform UnCrave.

Licious decided to discontinue the offering amid its focus on achieving profitability before its IPO plans in 2026.

Licious competes against the likes of ITC-owned Meatigo, Zepto’s Relish, Zappfresh, FreshToHome, Tendercuts, among others.

The post Licious Trims FY25 Loss By 27% To INR 218.3 Cr appeared first on Inc42 Media.

-

NATO Defences Shoot Down Iranian Ballistic Missile Heading Toward Turkish Airspace

-

MEA Fact Checks False Claim That US Navy Is Using Indian Ports Amid Iran Tensions

-

‘We’re Doing Our Work Regardless’: Shivakumar On Budget

-

Morne Morkel Highlights Importance Of Key Performances, Pitch & Dew Ahead Of Semifinal Clash

-

Defending Champions India Take On 2022 Winners England In High-Stakes ICC T20 World Cup Semifinal At Wankhede Stadium