Credit on UPI

After a long wait, now the big banks of the country HDFC Bank, Axis Bank and Kotak Mahindra Bank are preparing to rapidly increase credit payments through UPI. Till now banks were distributing RuPay credit cards to increase credit usage on UPI, but now they have also become active in providing 'Credit Line on UPI' directly. With this, UPI users will be able to make small and big payments on credit even without a card.

New movement in credit line product

National Payments Corporation of India (NPCI) launched this facility in the year 2023, but no big bank adopted it for two years. Only Karnataka Bank and Suryoday Small Finance Bank started this credit line in collaboration with Navi and Paytm.

Now for the first time, big private banks HDFC and Axis are also preparing to launch this product. According to an ET report, these banks are reportedly joining hands with fintech startups like Navi, Super.Money and SalarySe, so that customers can be easily onboarded and the first level of verification can be done through the app.

Banks' hesitation and now green signal received

The biggest concern of the banks was how interest would be charged on the credit line, whether there would be an interest-free period and what would be its rules. Due to this ambiguity, big banks lagged behind. But now it is being told that all the necessary clarity has been received from both NPCI and Reserve Bank. Therefore, banks are also now moving towards launching this facility.

How many people have taken this credit line?

According to industry estimates, so far about 3 to 4 lakh customers have taken such UPI-based credit lines. Currently, the number of transactions is less than normal UPI payments, but its pace is increasing rapidly because this facility provides instant credit to people for small expenses.

Big opportunity for banks to add new customers

Big banks are considering this facility as a way to connect new customers to the banking system through such small loans. Fintech companies say that customers who repay small credits on time become strong and reliable customers for the bank in the future. With the credit option on UPI, banks want to reach millions of users who make small everyday expenses through UPI and can become a major provider of banking services in the future.

Fear of credit bubble also exists

Some banks are also cautious about giving such a large number of small loans. He says that if the customer is not able to return the money on time, recovery will be very difficult because these loans are of very small amounts. Therefore, every bank is weighing the risks before fully investing in this product.

-

Sportvot x FPJ: 43rd Men's/Women's Mumbai Upanagar Ajinkyapad Nivad Chachani Kabaddi Spardha 2025 Delivers Exciting Action

-

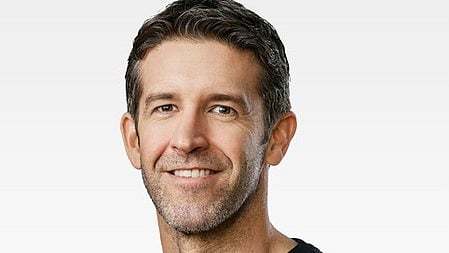

John Ternus Leads As Internal Contender For Apple CEO Position: Report

-

UPSC Civil Services Mains Result 2025: Window To Fill Updated Information Opens; Details Here

-

Puducherry: Schools, Colleges Shut Amid Heavy Rain Warning; IMD Issues Yellow Alert

-

Anupamaa Written Update, November 18: Rahi Decides To Complete Her Education As Anupama Goes To Mumbai