The Social Security Payment Boost 2026 has created a wave of interest across the country, especially among older Americans who rely heavily on these payments to manage daily expenses. With prices climbing in nearly every area of life, from groceries to housing, many people have been anxiously waiting to see how this adjustment will help them stay financially stable. The Social Security Payment Boost 2026 is especially important because it affects retirees, spouses, survivors, and disabled workers who depend on consistent and predictable benefits to plan their lives.

What makes this increase so impactful is the timing. Many households have been feeling the pressure of rising costs, and a boost in monthly benefits can make a real difference in the ability to budget confidently. Understanding how this increase will work, who qualifies, and how payments are calculated can help beneficiaries prepare for the months ahead.

Social Security Payment Boost 2026

The Social Security Payment Boost 2026 is built on a confirmed 2.8 percent Cost of Living Adjustment that becomes effective in January. This adjustment is intended to help benefits keep up with increases in the cost of essential items. For many Americans, Social Security is not simply supplemental income. It is the backbone of their monthly financial planning. When the cost of living rises, even a small adjustment can help keep budgets on track.

The 2026 increase reaches retirees, spouses, survivors, and disabled workers, offering a bit more breathing room as they navigate rising prices. Payments will adjust automatically, which removes extra stress and ensures that beneficiaries will not have to take additional steps to receive the new amounts.

2026 Social Security Payment Overview

| Category | Details |

| Cost of Living Adjustment for 2026 | Increase of 2.8 percent |

| Average retirement payment | Increases from two thousand eight dollars to two thousand sixty four dollars |

| Average spousal payment increase | Increase of twenty seven dollars |

| Average survivor payment increase | Increase of forty four dollars |

| Average disability payment increase | Increase of forty four dollars |

| Total number of beneficiaries | More than seventy five million people |

| Effective date of the new payments | January 2026 |

| Requirement to apply for the increase | No application needed |

| Online access to new payment details | Available in late November two thousand twenty five |

| Mail notice delivery | Sent in December 2025 |

Understanding the Social Security COLA and Its Importance

A Cost of Living Adjustment exists to protect the long term value of Social Security benefits. As the cost of everyday items changes, payments that remain the same lose spending power. The yearly adjustment is meant to reduce the impact of inflation so that beneficiaries do not fall behind economically. This is especially important for individuals living on fixed incomes, who often feel the effects of price increases more sharply.

It is surprising how many beneficiaries do not understand how COLA works. Many mistakenly believe that benefits remain flat year after year. Understanding these adjustments can make a major difference in planning for medical expenses, home costs, and long term finances. The two thousand twenty six adjustment continues a historical pattern of helping benefits remain fair and aligned with changes in wage data and living costs.

Impact on Retirees, Spouses, and Survivors

The increase for two thousand twenty six brings meaningful changes across several groups. Retirees will see an average increase of fifty six dollars per month. This added amount may help with prescription costs, food bills, or utility payments. For many households, even a small increase can create more room to breathe financially.

Spousal and survivor benefits will also see increases. Spouses will receive around twenty seven dollars more per month, while survivor benefits increase by forty four dollars. These payments often support households that have experienced major life changes, so added support can help them maintain day to day stability. Disabled workers will also see an increase of forty four dollars, reinforcing Social Security’s role in providing financial support for individuals who are unable to work at full capacity.

Working While Receiving Social Security Benefits

Many people choose to continue working after they begin receiving Social Security, either because they enjoy staying active or because they want to increase their financial stability. For those who have not yet reached full retirement age, there are annual earnings limits to consider. In two thousand twenty six, the lower limit is twenty four thousand four hundred eighty dollars and the upper limit is sixty five thousand one hundred sixty dollars. When earnings exceed these limits, a portion of benefits may be temporarily withheld.

The important word here is temporary. Once a beneficiary reaches full retirement age, any withheld amount is recalculated and returned over time. Understanding these rules can prevent surprises and help workers manage their yearly income with greater confidence.

How Beneficiaries Will Receive Updated Payment Information

Beneficiaries will not need to take any action to receive their updated amounts. Instead, they will receive information automatically. Those who use the my Social Security online portal will be able to view their updated benefit details by late November. This includes new payment amounts, deduction summaries, and adjustment dates.

For individuals who prefer mail, printed notices will arrive in December. These notices are written in a simple and clear format to help beneficiaries understand what to expect. Medicare enrollees will also receive updated premium information through the online Message Center. Even if a notice is delayed, the updated payment will still be applied automatically in January.

Planning Ahead With Social Security Changes

Planning ahead becomes much easier when beneficiaries know what to expect from upcoming payments. The two thousand twenty six increase may seem modest at first glance, but it can significantly improve financial stability for individuals who rely heavily on fixed monthly income. Understanding how these updates work helps households prepare for medical bills, daily expenses, or even small savings goals.

By reviewing updated payment details and staying informed about changes to Social Security rules, beneficiaries can make better decisions about budgeting, healthcare, and long term planning. The purpose of the adjustment is to keep payments aligned with real world inflation so that beneficiaries can maintain a reasonable quality of life.

FAQs: Social Security Payment Boost 2026

The increase will begin with January 2026.

No. All increases are applied automatically.

The average retiree will receive two thousand sixty four dollars per month.

Yes. Medicare premiums are deducted from benefits, and updated information will appear in the online Message Center.

Online notices appear in late November, and mailed notices are sent in December.

The post Social Security Payment Boost 2026: New Monthly Amounts for Retirees, Spouses, and Survivors appeared first on unitedrow.org.

-

Chagee billionaire orphan founder Zhang Junjie to hold wedding celebration with Trina Solar heiress this month

-

Karachi manhole claims child’s life, stars demand accountability

-

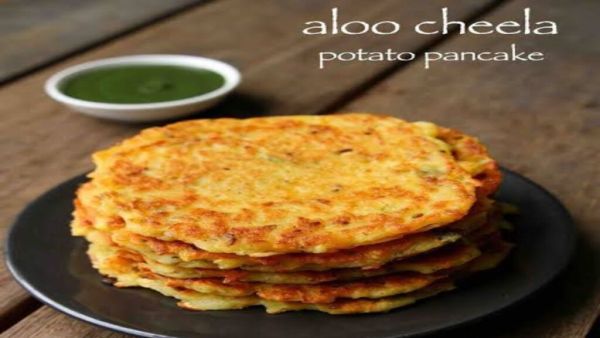

Aloo Cheela Recipe: Make delicious potato cheela for breakfast, see the recipe here…

-

Woman Shares How She Lives Off $50 A Month Budget

-

6 Chinese Zodiac Signs Attract Beautiful Luck & Love On December 3, 2025